Reviewing Connectivity Emergency Response Grants (CERG) for Broadband Development

Introduction

Senator Richard Hilderbrand and Representative Susan Concannon requested this limited-scope audit, which was authorized by the Legislative Post Audit Committee at its March 2, 2022 meeting.

Objectives, Scope, & Methodology

Our audit objective was to answer the following question:

- What entities received Connectivity Emergency Response Grants and where were they located?

The scope of our work included interviewing Kansas Department of Commerce (Commerce) officials about the Connectivity Emergency Response Grant (CERG) program, reviewing CERG program data, and reviewing CERG applications. Commerce collected CERG applications and program data from about August 2020 through December 31, 2021. We reviewed this information to determine how many entities received CERG funding, how much CERG funding was distributed to applicants, and where CERG funding went in Kansas.

We also selected and reviewed 6 of the 82 CERG applications and scoring sheets for reasonableness. We did not re-score the applications nor reevaluate the information contained in the submitted documents. Our conclusions about the reasonableness of application scores are not projectable to the CERG applicant population. We also did not evaluate the outcomes of CERG funded projects.

More specific details about the scope of our work and the methods we used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

39 entities received 66 Connectivity Emergency Response Grants (CERG) to expand connectivity across Kansas.

Background

In 2020, the federal government allocated about $1 billion to Kansas in discretionary CARES Act funds which the state distributed to counties and state agencies.

- The federal Coronavirus Aid, Relief, and Economic Security Act (or CARES Act) provided Kansas with $1.25 billion in March 2020.The state received $1.03 billion to address COVID-19 related needs. Johnson and Sedgwick counties received the rest for direct relief.

- In May 2020, the Governor established the Office of Recovery within the Office of the Governor. The purpose of the office is to help manage the state’s economic recovery from pandemic and related closures.

- Also in May 2020, the Governor established the Strengthening People and Revitalizing Kansas (SPARK) task force. The purpose of the task force was to distribute the $1 billion in CARES Act discretionary funds the state received from the federal government. SPARK made recommendations about spending to the Governor.

- The SPARK task force included a 5-member executive committee and a 15-member steering committee. The governor appointed members of the business community, economic development community, and the Legislature to the task force.

- The State Finance Council granted final approval of SPARK recommendations.

SPARK allocated $50 million of CARES Act funds to the Connectivity Emergency Response Grant (CERG) program to address COVID-19 related connectivity needs.

- SPARK allocated $50 million to CERG in July 2020. These grants provided internet service providers and Kansas cities, counties, non-profit organizations, and non-governmental entities with funds to improve internet connectivity to unserved and underserved locations of Kansas. CERG was also meant to address the needs of telework, telehealth, distance learning, and other remote business services related to COVID-19 effects.

- The Governor established the Kansas Office of Broadband Development within Commerce to help improve residents’ access to quality, affordable and reliable broadband. The office distributed and oversaw CERG funding.

- The broadband development office also administers or has administered other programs since its creation in 2020. These include the Broadband Partnership Adoption Grant program, the Broadband Acceleration Grant program, the Capital Project Fund, and Broadband Equity, Access, and Deployment program. We did not review these other programs as part of this audit.

Commerce worked with the Office of Recovery and SPARK task force to develop the framework for CERG.

- Guidance from the federal government about how states could spend CARES Act funds was very broad. That guidance had 2 stipulations.

- Federal funds could cover necessary expenditures states incurred due to COVID-19, and that were not accounted for in the state budget as of March 27, 2020.

- Federal funds could cover expenditures states made between March 1, 2020, and December 31, 2021.

- As a result, Kansas could tailor COVID-19 recovery programs like CERG to address its unique needs. The SPARK task force identified the grant’s broad priorities when it created CERG and allocated money to it. For example, SPARK determined the money should be used to increase connectivity in unserved and underserved Kansas communities. Commerce then developed an application process and requirements that fit within SPARK’s framework. These main requirements were that applicants:

- be an internet service provider or a Kansas city, county, non-profit organization, or non-governmental entity.

- had the ability to complete their proposed projects by the initial CARES Act deadline of December 30, 2020. This means they had about 90 days after their applications received approval in October 2020.

- would provide a 20% match for the total project cost. Applicants could also receive in-kind matches of up to 50% of the required match.

- would provide services to Kansas communities that had internet service with less than 25 megabits/second download speeds and less than 3 megabits/second upload speeds. This is the Federal Communication Commission’s (FCC) definition of underserved.

- Commerce officials told us CERG applicants also could submit internet speed tests and letters from community stakeholders to demonstrate the area was unserved or underserved.

CERG Applications and Awards

Commerce awarded about $48.5 million in CERG funding through 66 grants.

- CERG funding went to 3 types of broadband infrastructure projects. 37 grants (about 56%) went to projects proposing fiber to premises or fiber to the curb. 22 grants (about 33%) went to projects proposing fixed or mobile wireless. 7 grants (about 11%) went to hybrid projects proposing a combination of fiber to premises, fiber to the curb, or wireless.

- Fiber to premise is a fiber infrastructure project. It builds a fiber optic line from a central office or edge office to the boundary of a residence, business, or other premise.

- Fiber to curb is also a fiber infrastructure project. It builds a fiber optic line from a central office or edge office to the curb or driveway location of a residence, business, or other premise.

- Fixed wireless is a type of internet service. It uses broadcast towers to send and receive signals in the form of radio waves. These transmitters attach to stationary objects—like poles, buildings, or towers—which creates a wireless network.

- Individual grant awards varied in funding. About 79% of CERG awards were under $1 million. The smallest CERG award was $12,000 and the largest CERG award was about $6.2 million. The median CERG award was about $412,000.

- Commerce awarded about $48.5 million in connectivity grants out of the $50 million allocation (about 97%). Commerce officials told us they also spent about $280,000 for administration and contracting. The remaining $1.2 million in CERG funding was not distributed. Commerce officials demonstrated they returned unspent CERG funds and other unspent relief funds to the state Coronavirus Relief Fund account.

Commerce awarded CERG funding to all seven regions in Kansas with the largest amounts going to South Central, Southwest, and Northeast Kansas.

- Figure 1 shows the number of CERG applications and amount of CERG funding requested and received by region. As the figure shows, 66 CERG applications (about 80%) received final approval from Commerce and the Office of Recovery out of 82 total applications.

- South Central Kansas received the most CERG funding which was about $14 million (about 29%). Southwest Kansas received about $11 million (about 23%) and Northeast Kansas received about $9 million (about 18%). These 3 regions accounted for 47 (about 57%) of CERG applications and 62% of all requested grant funds.

- One project received about $3 million (about 6%) to expand telehealth services to more than 1 region. In Figure 1, we referred to this as “Statewide.”

- The Southeast and East Central regions received just over $5 million each. The North Central and Northwest regions received around $550,000 or less. The North Central and Northwest regions also requested the least in CERG funding.

- Because Commerce awarded CERG funding to most entities that applied for funding, we did not identify any meaningful differences in the demographics between applicants and award recipients. For example, Northwest Kansas accounted for the smallest percentage of funding requests (1%) and awards (1%).

- The 66 grants Commerce approved went to 39 different entities. That’s because 11 entities received more than 1 grant. Appendix B lists the 39 CERG grantees.

Commerce denied some CERG applications through its review process.

- Commerce officials told us that CERG applications were digital. They accepted CERG applications in August 2020. Those applications requested technical and non-technical information from the applicant about the proposed project.

- Technical information included service location maps, network architecture, financial capacity, project timeline, infrastructure speed and type (e.g., fiber to premise, fixed wireless), and consumer affordability.

- Non-technical information included explanations about how the project addressed the level of community need, letters of community support, and COVID-19 impact benefits.

- Commerce officials explained Commerce staff and a technical consulting firm processed CERG applications. Commerce staff evaluated the non-technical aspects of the applications. The consulting firm evaluated the technical aspects of the applications. They said applications received approval around October 2020.

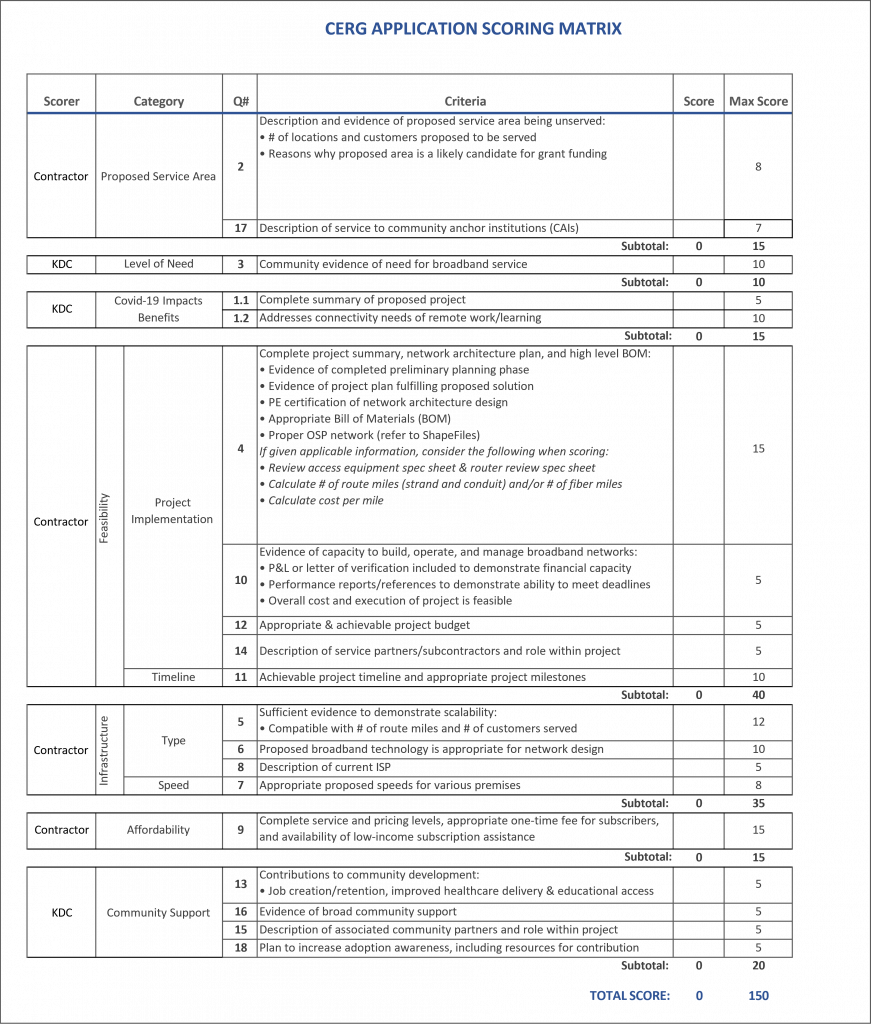

- To evaluate applications, Commerce and its consultant created a scoring matrix, which is included in Appendix C. Applications could receive a maximum score of 150 points (105 technical and 45 non-technical). This means the technical aspects of projects carried more weight than the non-technical aspects.

- However, an applicant’s score didn’t appear to determine whether they received CERG funding. That’s because almost every entity that submitted a complete application was approved. For example, Commerce did not require applications to meet a minimum score to receive funding. Applications that received funding ranged from 30 points to 144 points.

- Commerce officials told us they considered other factors such as the health needs of home-bound patients too. For example, they approved a project that proposed telehealth connectivity through fixed kiosks and mobile clinics linked to telehealth networks and another that proposed equipping in-home care providers and medical practitioners with mobile devices.

- Commerce denied 16 applications (about 20%) for the following reasons.

- 7 because applicants requested funds for ineligible purposes such as for equipment for private business.

- 3 because they were incomplete and didn’t respond to requests for more information.

- 2 because of a higher-scoring competing project.

- 2 because the projects expected to exceed the initial CARES Act deadline of December 30, 2020.

- 1 because of financial concerns related to the applicant’s ability to complete and maintain the project.

- 1 project received consideration for alternative funding (not CERG).

- Commerce officials also explained there were several processes in place that protected CERG funds. For example, Commerce told us there was weekly monitoring of projects behind schedule, and monthly reporting requirements for grantees. But due to the limited scope of this audit, we were not able to verify Commerce’s claims.

We reviewed a few of the scores Commerce and its contractor assigned during the application process, and they seemed reasonable.

- We reviewed a judgmental selection of 12 scores for 4 approved and 2 denied applications (out of 82 total CERG applications). For each application, we selected one high score and one low score to review from the scoring matrix. Commerce evaluated one of the reviewed scores and the consultant evaluated the other in most cases. We selected scores that covered the categories concerned with level of need, COVID-19 impact benefits, community support, project implementation, and affordability. Our conclusions are not projectable to the CERG application population because we reviewed only a small, judgmental selection.

- We did not re-score the applications nor reevaluate the information contained in the submitted documentation. We only checked to see if a selection of the scores on each of the 6 scoring sheets made sense base on Commerce’s review process.

- 11 of the scores we reviewed appeared reasonable based on Commerce’s review process. We thought one of the low scores could have warranted a higher score based on the information provided by the applicant. However, the effect was negligible because the project still received funding.

- Commerce officials told us they sent applications approved by Commerce and its contractor to an inter-agency review committee after scoring them. Members from Commerce representing economic development and legislative interests; other state agencies such as Transportation, Agriculture, and Education; and the executive branch Chief Information Technology Officer composed this committee. Grant recommendations were then sent to the Office of Recovery for review before final approval.

Recommendations

We did not make any recommendations for this audit.

Potential Issues for Further Consideration

We did not identify any issues for further consideration.

Agency Response

On August 10, 2022 we provided the draft audit report to Commerce. Its response is below. Agency officials generally agreed with our findings and conclusions.

Commerce Response

Dear Legislative Post Audit:

Commerce concurs with the LPA regarding the data points and conclusions made in the report. Understanding the limited scope and question posed to LPA regarding Connectivity Emergency Response Grant (CERG) Program, we would like to highlight the accomplishments of this unique, one-time funding.

The CERG program prioritized projects that were focused on providing broadband access in support of remote education, healthcare and quality of life implications caused by the COVID-19 pandemic. Not only did this program incorporate a compressed construction timeframe of roughly 90 days from award to completion for large scale construction projects during the winter in Kansas, but grantees were also working to complete projects amidst unprecedented supply chain constraints, labor shortages and employee health concerns related to working through the COVID-19.

Overall, the CERG program enabled:

- Nearly 55,000 new connections to homes, businesses and community institutions

- Construction of more than 600 miles of fiber infrastructure

- 200 towers for fixed and mobile wireless services in 175 cities and 75 counties across the state

These connections, miles of fiber infrastructure and services to cities and counties across the state provided broadband access during a time when it was needed the most.

Thank you for the opportunity to respond to the audit and share the impact of this funding.

Sincerely,

David C. Toland

Secretary

Appendix A – Cited References

We did not rely on any major publications for this report.

Appendix B – CERG Grantees

This appendix lists the 39 CERG grantees, their total CERG funding awards, and their proposed service locations.

| CERG Grantee | Funding | Proposed Service Location | ||

| 1 | Atchison Area Economic Development Corporation | $390,665 | Atchison (City) | |

| 2 | Blackdragon Networks, LLC | $386,272 | Cities of Jetmore & Hanston. | |

| 3 | City of Chanute | $1,600,000 | Chanute (City) | |

| 4 | City of Garden City | $526,544 | Garden (City) | |

| 5 | City of Marion | $143,540 | Marion (City) | |

| 6 | Cox Communications | $1,381,285 | Cities of Derby, Kechi, Topeka, Dodge City/Dodge Township. | |

| 7 | Finney County | $1,823,261 | Garden (City) | |

| 8 | Giant Communications, Inc. | $206,997 | Cities of Nortonville, Effingham, Lancaster, Valley Falls, Denison, Ozawkie, and Oskaloosa. | |

| 9 | Golden Belt Telephone Association Inc. DBA GBT Communications Inc. | $532,536 | Cities of Hudson, Macksville, Radium, St. John, Seward, and Stafford. | |

| 10 | Haviland Telephone Co., dba Haviland Broadband | $464,887 | Rural towns of Argonia, Conway Springs, Riverdale, Norwich, Cullison, Haviland, Mullinville, Greensburg, Nashville, Sawyer, Coats, and Isabel. | |

| 11 | Home Communications, Inc | $487,084 | McPherson (County) | |

| 12 | IdeaTek Telcom, LLC1 | $14,141,299 | Cities of Kismet, Plains, Meade, Fowler, Minneola, Bloom, Kingdown, Ford, Florence, Cedar Point, Elmdale, Strong City, Cottonwood Falls, Langdon, Arlington, Abbyville, Willowbrook, Pretty Prairie, Offerle, Kinsley, Lewis, Belpre, Macksville, St. John, Stafford, Hudson, Cullison, Haviland, Greensburg, Mullinville, Bucklin, and Garfield. | |

| 13 | JBN Telephone Company, Inc. | $80,563 | Cities of Hiawatha, Sabetha, Fairview, Morrill, and Powhattan. | |

| 14 | Jefferson County | $605,000 | Cities of Grantville,

McLouth, Meriden, Nortonville, Oskaloosa, Ozawkie, Perry, Valley Falls,

Williamstown, and Winchester. Districts of Lakeshore Estates, Lakeside Village, and Lakewood Hills. |

|

| 15 | KanOkla Networks1 | $981,820 | Cities of Caldwell, South

Haven, Argonia, Corbin, Perth, Wellington, and Oxford. Rural west of Wellington & Rural west of Arkansas City. |

|

| 16 | Kansas Fiber Network, LLC1 | $2,323,226 | Cities of: Osawatomie, Paola, Spring Hill, Olathe, Basehor, Garnett, Eudora, Parsons, Independence, and Wellsville. | |

| 17 | LaHarpe Communications, Inc dba Newwave Broadband1 | $245,326 | Cities of: Mildred, Moran, Kincaid, Lone Elm & Bayard (Rural town), Geneva (Rural town), and Neosho Falls (Rural town). | |

| 18 | LR Communications, Inc. | $494,444 | Raymond (City) | |

| 19 | Memorial Health System | $26,420 | Cities of Abilene, Carlton, Chapman, Enterprise, Herington, Hope, Manchester, Solomon, and Woodbine. | |

| 20 | Mercury Wireless Kansas, LLC. | $528,960 | Cities of Atchison, Cummings, Easton, Effingham, Fariview, Fort Leavenworth, Hiawatha, Highland, Horton, Lancaster, Leavenworth, Morrill, Netawaka, Nortonville, Powhattan, Sabetha, Troy, Valley Falls, Wathena, Wetmore, and Winchester. | |

| 21 | Mokan Dial Inc. | $545,903 | Hillsdale/Paola (Rural town) | |

| 22 | Moundridge Telephone Company, Inc.1 | $395,521 | Pine Village in Moundridge (Rural town), Moundridge (Rural town). | |

| 23 | Nex-Tech, LLC1 | $706,887 | Rural towns of Cedar Bluffs, Speed, Stuttgart, Codell, and Sequin, Great Bend (City), Plainville (City), Republic (County), and Norton County (Rural area). |

|

| 24 | Nextlink Internet, in partnership with Black & Veatch and Microsoft. The responding team is referred to as “Connect & Advance Kansas”. | $1,361,000 | Cities of Burrton, Brookville, Lindsborg, Larned, Great Bend, Hoisington, Newton, Solomon, Gypsum, Bennington, and Winfield. | |

| 25 | North Central Kansas Community Network1 | $76,755 | Jewell County. Norway and Talmo (rural towns) and area in Republic County. Hwy9 and Noble Rd (rural areas) and area in Cloud County. Carr Creek and Carr Creek East (rural areas) and area in Mitchell County. |

|

| 26 | One Point Technologies, Inc. | $298,046 | Blue Rapids (City) | |

| 27 | RAINBOW COMMUNICATIONS1 | $2,022,162 | Rural towns of Effingham and Lancaster. | |

| 28 | RG Fiber1 | $2,255,181 | Cities of Baldwin, Wellsville, Edgerton, Gardner, De Soto, Spring Hill. | |

| 29 | S&A Telephone Company | $106,947 | Americus (City) | |

| 30 | South Central Wireless, Inc. dba/SCTELCOM1 | $2,031,950 | Medicine Lodge

(City). Pratt (City) and area directly east on Hwy 54 and rural Byers/Hopewell. Harper (City) and area east and northeast of Harper. | |

| 31 | Spectrum Mid-America, LLC (managed by Charter Communications, Inc., “Spectrum” or “Charter”) | $12,000 | Lansing (City) | |

| 32 | TC Wireless | $1,695,197 | Alta Vista (City) | |

| 33 | THE BUTLER RURAL ELECTRIC COOPERATIVE ASSN INC | $1,198,299 | Rural towns of Eureka, Severy, and Piedmont. | |

| 34 | The University of Kansas Health Authority, d/b/a The University of Kansas Health System | $3,015,000 | The University of Kansas Health System | |

| 35 | Twin Valley Communications1 | $1,302,300 | Cities of Chapman, Abilene,

and Solomon. Junction (City) including Grandview Plaza. Keats (City) and surrounding area. Minneapolis (City) and the surrounding rural areas. |

|

| 36 | Unified Government of Wyandotte County | $2,823,164 | Cities of Bonner Springs, Edwardsville, and Kansas City | |

| 37 | Wabaunsee County | $452,400 | Cities of Alma, Alta Vista, Eskridge, Harveyville, Lake Wabaunsee, and Willard. | |

| 38 | Wave Wireless LLC | $362,920 | Portion of Labette, Montgomery, and Neosho (Rural towns). | |

| 39 | WTC Communications, Inc. | $477,593 | McFarland (City) | |

| Total | $48,509,354 | |||

| 1Indicates grantee received more than 1 CERG award. | ||||

| Source: LPA analysis of CERG data from Kansas Department of Commerce and the Office of Recovery. | ||||

| Kansas Legislative Division of Post Audit | ||||

Appendix C – CERG Scoring Matrix

This appendix includes the CERG application scoring matrix. That matrix included instructions to evaluators. These instructions told evaluators the location of supporting documents. They also told evaluators how to score the materials. For example, applicants had to submit descriptions and evidence of underservice. Applications received 1-3 points on this question if there was an incomplete description of the proposed location. They received 4-6 points on this question if they partially described the proposed location. Applications received 7-8 points on this question if they fully described proposed location. This included a general description, evidence to identify location as unserved, list of service locations, credible method for determining service locations, and explanation of why the area is unlikely to be served without grant funding.

Commerce officials explained the scoring matrix and weights used to evaluate CERG applications were developed with input from many sources. This included the Office of Recovery, the consulting team for the SPARK committee, the CERG technical consulting firm, and representatives from the Departments of Administration, Agriculture, Education, Health and Environment, and Transportation.

Commerce officials explained the scoring matrix and weights used to evaluate CERG applications were developed with input from many sources. This included the Office of Recovery, the consulting team for the SPARK committee, the CERG technical consulting firm, and representatives from the Departments of Administration, Agriculture, Education, Health and Environment, and Transportation.