Evaluating the Kansas Department of Labor’s Response to COVID-19 Unemployment Claims (Part 1)

Introduction

The Legislative Post Audit Committee requested this audit and authorized it at its September 2, 2020 committee meeting.

Objectives, Scope, & Methodology

The audit request included three questions. For reporting purposes, we divided those three questions into two separate audit reports. This audit report answers the following question:

- What types of unemployment claims fraud schemes is the Kansas Department of Labor aware of and how are they being addressed?

To answer this question we spoke to officials with the Kansas Department of Labor (KDOL), the U.S. Department of Labor’s Inspector General, the Federal Bureau of Investigation, and the National Association of State Workforce Agencies to understand the types of fraud schemes that occurred nationally and in Kansas in 2020. We also interviewed KDOL officials and surveyed KDOL fraud staff to understand their process to detect fraudulent unemployment claims. We reviewed KDOL weekly reports and information they provided on fraudulent claims identified in Kansas to estimate how much unemployment fraud occurred in Kansas in 2020.

There was very limited information on the amount of fraud that occurred both in Kansas and nationally in 2020. That’s because states and the federal government were still assessing the extent of fraud that occurred in 2020. We worked with KDOL officials to estimate how much fraud occurred in Kansas in 2020. However, our estimate is only intended to provide a general scale of the fraud that likely occurred in Kansas.

Several members of this audit team were either victims of unemployment fraud or knew someone that was a victim. We concluded these events did not constitute an actual impairment to the team’s independence or ability to objectively complete this audit.

More specific details about the scope of our work and the methods we used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

The Kansas Department of Labor’s fraud detection process was not designed to detect the large-scale, nationwide fraud campaign that occurred during the COVID-19 pandemic.

Unemployment Insurance Program Background

The Regular Unemployment Insurance program is administered by the Kansas Department of Labor (KDOL) and gives financial aid to unemployed individuals.

- The Regular Unemployment Insurance program is a joint program between federal and state governments. Although there are broad federal guidelines over the program, states establish their own criteria for who is eligible for Regular Unemployment insurance. States also decide the amount and duration of Regular Unemployment benefits.

- In Kansas, individuals must meet several criteria to qualify for Regular Unemployment benefits. For example, individuals must have met a minimum duration of employment and left work through no fault of their own (e.g., medical emergency, hostile workplace, layoffs, etc.).

- Generally, Regular Unemployment Insurance benefits are funded entirely by employer contributions in each state. Kansas employers contribute to the state’s unemployment insurance trust fund, which is used to pay weekly benefits to unemployed individuals for 16 to 26 weeks depending on the state’s unemployment rates. Based on state law, employers fall into two general categories:

- A contributing entity is a private company or public employer that pays KDOL a quarterly unemployment tax before claims are made. This tax helps fund Kansas’ unemployment trust fund. Contributing entities receive an annual statement summarizing their past year’s charges. Charges occur when a company’s former employee receives Regular Unemployment benefits. A company’s future tax rate is based in part on their past charges. For example, a company with high prior-year charges could also see higher future taxes rates.

- A reimbursing entity is a public employer, not-for-profit, or tribal entity that pays KDOL after claims are paid. They do this instead of paying a quarterly tax. Reimbursing entities are charged quarterly for any unemployment funds used. Typically, these entities are responsible for paying 100% of funds used. However, under the CARES Act, half of these employers’ unemployment costs are reimbursed with federal funding. This is a temporary arrangement under the CARES Act, set to expire March 14, 2021.

- Kansas employees do not contribute any money to the trust fund.

In 2020, the federal government created three temporary unemployment insurance programs to help individuals who lost their jobs due to COVID-19.

- The COVID-19 pandemic significantly increased the unemployment rate nationally and in Kansas. Before the pandemic, the national unemployment rate was about 4% in January 2020 (about 3% in Kansas). By April 2020, the national unemployment rate rose to about 15% (about 12% in Kansas).

- In March 2020, Congress passed the CARES Act to help individuals negatively affected by the pandemic. The act included funding for three new unemployment insurance programs.

- The new programs differed from Regular Unemployment Insurance in a few ways. For example, the new programs were funded entirely with federal funds. Additionally, all the new programs were temporary and have either expired or are scheduled to expire in 2021.

- The new programs expanded unemployment benefits to include more people who lost their jobs due to COVID-19. For example, the Pandemic Unemployment Assistance program extended benefits to several new classes of workers. This included the self-employed (e.g., independent contractors) and gig workers (e.g., Uber drivers). Under this program, individuals not eligible for Regular Unemployment Insurance could receive up to about $500 per week for 39 weeks (a maximum of about $19,500) under the terms of the original CARES Act in 2020. The Federal Pandemic Unemployment Compensation (FPUC) program also gave an extra $600 per week to anyone already receiving unemployment benefits for a period from late March through late July 2020. FPUC was renewed at a level of $300 per week in late December 2020 and will now run through mid-March 2021.

- Benefits paid out for the temporary federal unemployment programs are paid with federal money and do not come from the state’s unemployment trust fund.

There were two main types of unemployment fraud alleged nationally and in Kansas during the pandemic.

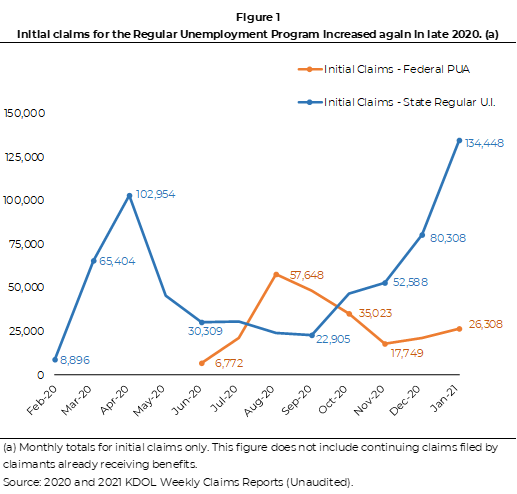

- We reviewed claims reports from KDOL for both the state’s Regular Unemployment program and the federal Pandemic Unemployment Assistance (PUA) program. That’s because these programs have been specifically targeted by fraudsters during the past year. Figure 1 shows claims filed from February 2020 through January 2021.

- COVID-19 created a massive spike in PUA claims in the summer 2020. As Figure 1 shows, PUA claims spiked during the summer of 2020 but have steadily decreased since September 2020. It is possible the federal program saw an initial spike as individuals who needed PUA benefits applied for them for the first time. The PUA program has also been the focus of unemployment fraud nationally and in Kansas. It is likely some portion of these claims reflect that fraud. PUA fraud is discussed in more detail in the following section.

- COVID-19 also created a massive spike in Regular Unemployment initial claims during the spring of 2020. As the Figure 1 shows, claims for the state’s Regular Unemployment program increased from about 8,900 initial claims in February 2020 to about 103,000 initial claims at the end of March. That’s roughly a 1,060% increase.

- Regular Unemployment claims have spiked again in January 2021. KDOL officials told us that’s because fraudsters began targeting the state’ Regular Unemployment program in late 2020. Regular Unemployment fraud is discussed in more detail later in the report. It is possible that legitimate seasonal unemployment claims also contributed to this increase.

Federal Unemployment Program Fraud

Nationally, fraudsters targeted the new Pandemic Unemployment Assistance (PUA) program because of weaknesses in its application process.

- We spoke to officials with KDOL, the Federal Bureau of Investigation, the U.S. Department of Labor’s Office of Inspector General, and the National Association of State Workforce Agencies. We spoke to these officials to understand what fraud schemes occurred nationally and in Kansas during the COVID-19 pandemic. According to those officials, fraudsters used a large-scale identity theft campaign to target the Pandemic Unemployment Assistance (PUA) program specifically.

- Because of how it was set up federally, fraudsters could easily falsify claims to get approved for PUA. Individuals must file a claim with KDOL to apply for and potentially receive unemployment benefits.

- Fraudsters recognized they could apply for PUA benefits as “self-employed.” Self-employed individuals were eligible for benefits under the new PUA program. Because there is no employer, states are limited in what they can do to verify the claim. This created an incentive for fraudsters to apply for PUA benefits.

- Fraudsters could apply for PUA benefits without submitting supporting documents. To apply for PUA benefits, individuals must self-report their personal information and prior earned income. Generally, the PUA application process did not require applicants submit proof of prior income (e.g., pay stub, W2, invoices, etc.) to receive benefits. Because no documents were required, it was easy for fraudsters to file as self-employed.

- Fraudsters relied on large-scale identify theft to exploit weaknesses in PUA’s application process. Fraudsters likely obtained stolen personal information from past large-scale data breaches. This could include the 2014 eBay data breach and the 2017 Equifax data breach, for example. In both cases, criminals stole the identities of over one hundred million people (e.g., names, addresses, social security numbers, etc.). Using this data fraudsters could apply for PUA benefits in other peoples’ names, usually in mass quantities.

- Unemployment funds are typically disbursed on debit cards or sent via direct deposit, making them easy to convert into cash. Like other unemployment programs, PUA benefits could be loaded on debit cards or deposited through direct deposit. Fraudsters could use stolen names and social security numbers to apply but have the debit cards mailed to an address they specified. They could also have the funds deposited directly to an account of their choosing. Once they had access to the benefits it became difficult for government agencies to track or recover those funds.

- Once eligible for PUA, fraudsters could also receive additional benefits under the Federal Pandemic Unemployment Compensation program or the Lost Wages Assistance program.

Many of KDOL’s existing processes were not effective to identify PUA fraud because of how the program was structured by the federal government.

- Before the pandemic, KDOL’s fraud detection process was focused on the Regular Unemployment Insurance program. That program is used by employees who have an employer (e.g., not self-employed individuals). KDOL largely relied on a visual review of claims data and public assistance to identify fraud. Prior to benefits being paid, KDOL officials told us they reviewed state and federal wage reports to confirm claimants were recently employed. Claim notices were also sent to former employers, giving them a chance to contest the claim as potentially fraudulent. KDOL told us they also reviewed claims data for trends that might indicate fraud, including suspicious log-in credentials and duplicated fields. Claims were approved for payment if no red flags were raised during this process.

- Because of how the program was federally structured, the PUA program made it possible for fraudsters to circumvent KDOL’s existing process for verifying potentially fraudulent claims with employers.

- Moreover, many of KDOL’s other fraud detection methods were manual and not effective against the high number of claims filed during the pandemic. Unemployment claims for both Regular Unemployment and PUA increased dramatically during the pandemic in 2020. KDOL officials told us their fraud staff at the time were overwhelmed and did not have time to do a detailed review (e.g., comparing claims to wage reports or new-hire reports) on all claims during this time.

- During the pandemic, KDOL implemented two anti-fraud measures in addition to their existing processes.

- In July 2020, KDOL put a 72-hour hold on all PUA claims before benefits could be paid out. They told us that KDOL staff reviewed PUA claims data during this time to identify suspicious information that could indicate fraud. KDOL staff put holds on any suspicious PUA claims, preventing payment.

- KDOL also started a public campaign in August 2020 to ask individuals to report cases of identity theft and unemployment fraud. KDOL staff could then stop payment associated with those claims.

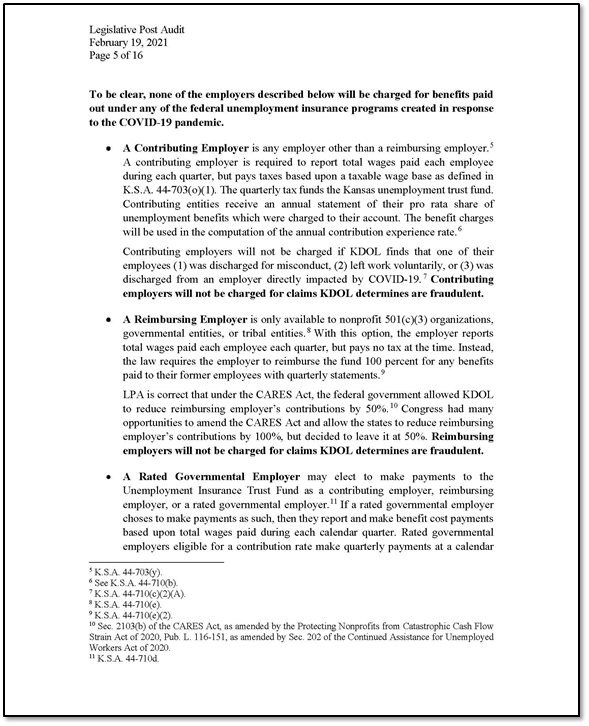

- KDOL officials told us that as of December 2020, about 157,000 claims were identified or reported as fraudulent. That’s about 24% of the roughly 650,000 claims filed during that time. It wasn’t clear to KDOL at the time of the audit how many of the fraudulent claims were related to the Regular Unemployment program and how many were related to the temporary federal unemployment programs.

KDOL officials told us they are in the process of upgrading their fraud detection process to better identify PUA and other unemployment fraud.

- In December 2020, KDOL officials told us they partnered with a private company to improve its data analytic capabilities. KDOL officials hope this arrangement will give them access to new automated tools. These include programs that automatically flag claims data as suspicious, machine learning to identify new fraud trends, and a consistent way to score a claim’s risk for fraud. These new automated tools could help make KDOL’s fraud detection process more effective and efficient. KDOL officials hope to have these tools in place by early 2021.

- In January 2021, KDOL implemented an identity verification system that could help combat cases of identity theft and unemployment fraud. Under the new system, all claimants are sent to a third-party site and asked to answer a series of questions to help verify their identify. The system uses a claimant’s credit history to generate questions that only they should know. The claimant must successfully answer the questions to apply for benefits. This system could help reduce identify theft and fraudulent claims in Kansas.

- KDOL officials hope staff will have broader access to multi-state checks by February 2021. During the pandemic KDOL gained access to a data integrity hub that allows states to cross-check their unemployment claims data to better identify suspicious claims. However, IT limitations prevented all KDOL staff from having access to these tools in 2020.

- KDOL officials plan to document these and other new fraud detection procedures in the near future. Prior to the pandemic KDOL officials did not have a documented policy for their fraud detection process. A lack of a documented process could lead to inconsistencies in how KDOL staff look for fraud. KDOL officials understand the need to document their process and told us they plan to do so after they finish upgrading their process.

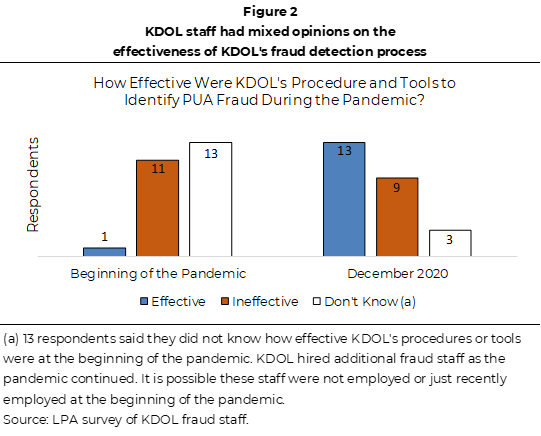

- KDOL fraud staff reported mixed reviews of KDOL’s fraud detection measures. We surveyed all 36 KDOL fraud staff for their opinion on issues related to KDOL’s fraud detection process. Figure 2 shows the results of the survey. As the figure shows, of the 25 staff that responded (69% response rate) only one respondent said KDOL’s process was effective to identify PUA fraud at the beginning of the pandemic. 13 respondents said KDOL’s process to detect PUA fraud was effective as of December 2020. However, 9 staff still said the fraud detection process was ineffective in December 2020.

State Unemployment Fraud

Fraudsters targeted the state’s Regular Unemployment program beginning in late 2020.

- According to KDOL officials, around November 2020 there was a rise in reported fraud cases targeting the state’ Regular Unemployment program.

- KDOL officials could not tell us how many of the Regular Unemployment claims filed during this time were fraudulent, or how this fraud occurred. They speculate that fraudsters filed for Regular Unemployment in mass quantities to try and overwhelm the state’s system. It is unclear at this time to what extent Regular Unemployment systems in other states were also targeted.

- KDOL officials told us they were still looking into how exactly fraudsters penetrated the state’s Regular Unemployment system. KDOL officials speculated fraudsters attempts to overload the unemployment system could have impeded employers’ ability to report fraudulent notices. Employers have 10 days to contest a claim from the time they receive a claim notice. Claims are processed for payment if not contested by an employer within 10 days. We were unable to determine whether these claims were sent timely as part of this audit.

- Additionally, KDOL’s fraud detection process was fairly manual. It is possible overloading the system with claims made it difficult for KDOL staff to review claims for fraud.

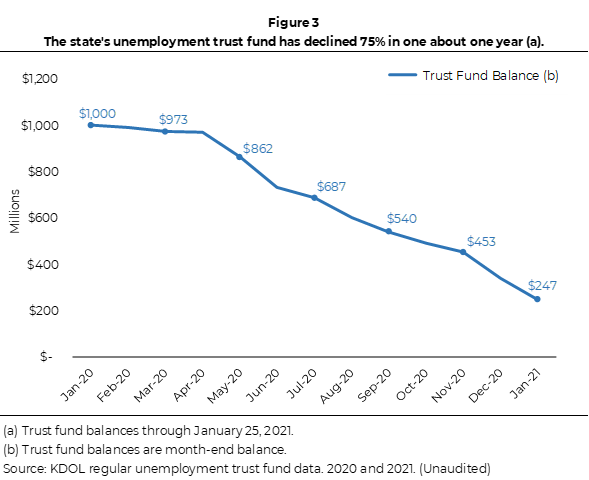

The state’s unemployment trust fund balance has declined 75% in one year.

- The state’s unemployment trust fund is used to pay Regular Unemployment claims. Most companies and public organizations pay KDOL a quarterly unemployment payroll tax to support the fund. Other public entities reimburse the trust fund for unemployment funds used to pay claims for their employees. Benefits paid out for the temporary federal unemployment programs do not come from the state’s unemployment trust fund.

- Figure 3 summarizes the monthly balance of the state’s unemployment trust fund. As the figure shows, the balance of the state’s unemployment trust fund dropped from about $1 billion in January 2020 to about $247 million as of January 25, 2021. That’s about a 75% decrease. This is largely because January 2020 was the last month the fund had a positive net contribution. This means unemployment benefits paid out of the fund have exceeded tax contributions into the fund since February 2020.

- It was unclear at the time of this audit how much of this decrease was related to fraudulent claims. Both legitimate and fraudulent unemployment claims could be depleting the state’s unemployment trust fund. As Figure 1 showed, there were a significant number of claims filed for the Regular Unemployment program, both early in the pandemic and beginning again in November 2020. Both legitimate and fraudulent benefits would negatively affect the balance of the state’s trust fund.

- Employer tax rates were adjusted to help replenish the state’s unemployment trust fund. According to KDOL officials, employer tax rates are based in part on the state’s unemployment trust fund balance. Historically, employers’ tax rates were discounted up to 0.5% when the fund was in a surplus. This discount effectively reduced some companies’ contribution rates to zero. However, KDOL officials told us they had to remove this discount per state law as the trust fund diminished last year. It is possible that alternative funding solutions may be needed to help replenish the state’s trust fund.

Estimated Unemployment Fraud

Of the roughly $2.6 billion in state and federal unemployment benefits paid in Kansas in 2020, we estimated about $600 million (24%) could have been fraudulent.

- There was little information on how much fraud occurred in Kansas in 2020. Each year the U.S. Department of Labor reviews a sample of unemployment claims in each state to determine an estimated fraud rate. However, the U.S. Department of Labor did not have a complete 2020 fraud rate available at the time of this audit. KDOL officials reported about 157,000 potentially fraudulent claims were reported or identified from March 2020 (when the pandemic began) through the end of November 2020. However, KDOL officials had not yet assigned a dollar value to those claims at the time of this audit.

- As a result, we developed a preliminary estimate of how much fraud could have occurred in Kansas in 2020. We determined the 157,000 potentially fraudulent claims were about 24% of the roughly 650,000 initial claims filed from March through November 2020. We applied this estimated fraud rate to the total state and federal benefits paid out in 2020. This is meant to be a preliminary estimate only. We will use KDOL claims data to provide a more precise fraud estimate in part two of this audit.

- We estimated about $600 million in state and federal funds paid out in Kansas in 2020 could have been fraudulent. In total, KDOL reported expending about $2.6 billion on state and federal unemployment funds. That’s comprised of about $970 million in state funds and $1.6 billion in federal funds. Applying our 24% fraud rate, we estimated

- about $200 million in fraud in state funds

- about $400 million in fraud in federal funds

- In its response, KDOL estimated about $300 million in unemployment benefits were paid on claims they identified as potentially fraudulent in 2020. Our analysis in part two of this audit will include a similar analysis. In addition, we also hope to use KDOL claims data to estimate how much in unemployment benefits were paid that KDOL did not identify as potentially fraudulent. For that reason, our estimate will likely exceed KDOL’s initial estimate of $300 million.

Our fraud estimate is subject to some key assumptions and limitations.

- We included unemployment funds expended through Kansas’ and the federal unemployment programs in 2020. Although it appeared PUA, and federal programs tied to PUA, were targeted during the pandemic, it is likely the state’s Regular Unemployment program was also attacked to some degree in 2020. During our fieldwork, KDOL could not estimate how many of the 157,000 fraudulent claims it identified were related to the state’s unemployment program versus the federal unemployment programs. Given this uncertainty, we applied our 24% fraud rate evenly between state and federal funds expended in 2020.

- Our estimate was based on the 157,000 total claims KDOL identified as potentially fraudulent. It is likely that more fraudulent claims occurred that KDOL did not catch. This would understate our estimate. For that reason, it is possible the actual amount of fraud that occurred in Kansas in 2020 was much higher.

- Not all of the 157,000 cases KDOL identified as potential fraud will be fraudulent. These claims were flagged and stopped by KDOL staff as suspicious but need to be investigated by KDOL law enforcement to determine fraud. It is likely not all 157,000 cases will end up being fraud. This would overstate our estimate.

- Our estimate included some Regular Unemployment benefits that were paid in January and February 2020, which could be considered pre-pandemic. However, given the relatively low number of claims filed during this time it is unlikely to significantly affect our estimate.

Impacts on Kansas Employees and Employers

If not reported to or stopped by KDOL, Kansas employees could owe taxes on benefits they never filed or received because of fraudulent claims.

- According to KDOL, benefits received under both the state’s Regular Unemployment program and the temporary federal programs are considered taxable income. Claimants that received benefits in tax year 2020 will receive a 1099-G form from KDOL showing taxable benefits. Claimants need to include those benefits when filing their income taxes, which will likely increase their tax liability.

- Victims of unemployment fraud may receive 1099-G forms for unemployment benefits they never received. KDOL officials told us they attempted to flag, amend, and prevent 1099-G forms tied to known fraud cases from ever being mailed out. However, individuals still received 1099-G’s for unemployment benefits they did not file or receive.

- KDOL officials were not able to provide the number of 1099-G forms that were sent in error. KDOL officials told us some forms were sent before the claim was identified as fraud. In other cases, the form may be tied to a fraudulent claim that KDOL never identified.

- KDOL officials told us anyone who received a 1099-G in error should contact them to amend it. If the individual does not report the fraud to KDOL, those individuals could be responsible for paying taxes on the fraudulent benefits. Individuals need to file an unsworn statement with KDOL attesting the form was sent in error. This should eliminate any taxes owed related to fraud. KDOL officials urge anyone who received a 1099-G form in error to contact the department’s Tax Call Center at 785-575-1461 or by calling toll-free at 1-888-499-0063 to fill out this form. Individuals can also complete the form online by visiting www.UIAssistance.GetKansasBenefits.gov. There is no deadline for protesting a fraudulent 1099-G.

If not appealed or stopped by KDOL, private and public employers could be financially responsible for fraudulent claims filed under the state’s Regular Unemployment program.

- Generally, an employer either pays for unemployment funds as a contributing entity or a reimbursing entity. Employers either contribute payroll taxes to the fund before claims are made (contributing) or pay no tax upfront but reimburse the fund after claims are made (reimbursing). Employer tax rates are based on a number of things including how long the employer has been in business, the employer’s industry type, and their past payment experience.

- If not appealed in time, contributing and reimbursing entities could be financially responsible for fraudulent claims tied to the state’s Regular Unemployment program.

- Because contributing entities’ tax rates are based on past charges, fraudulent charges against their account could increase their future tax rates.

- Because reimbursing entities are responsible for paying KDOL back for benefits paid out, these organizations could be responsible for paying KDOL back for fraudulent claims. However, under the CARES Act, the federal government repays reimbursing entities half of their unemployment costs. This could help reduce the employer costs associated with fraudulent claims by 50%. This provision of the CARES Act is set to expire March 14, 2021.

- Contributing entities receive “charge statements” annually and reimbursing entities receive them quarterly. These statements could alert them to fraudulent behavior. KDOL officials told us any private or public organization needs to contact KDOL to protest fraudulent charges. Depending on the circumstance, KDOL told us employers have 15 to 20 days to protest a statement once mailed. Otherwise, they could be responsible for the financial impact of the fraud. It is important to note that annual charge statements for contributing agencies are based on fiscal years. As such, fraud that occurred between July 1, 2020 and June 30, 2021 won’t be reflected until 2021’s statements. Those statements won’t be mailed until October 2021.

- KDOL officials were unable to determine how much private and public organizations were charged due to fraud. KDOL officials told us they attempted to stop statements associated with claims flagged as fraud. However, it is possible some statements went out before the claim was flagged. Other statements might be associated with fraudulent claims KDOL never identified. For these reasons, KDOL officials told us they could not determine how much organizations were charged due to fraud.

- It is important to note this issue only applies to fraud within the state’s Regular Unemployment program. Public and private employers would not be affected by fraud within the temporary federal unemployment programs, such as PUA.

KDOL reported potentially fraudulent cases to federal agencies for investigation but focused its investigative resources on stopping fraudulent claims during the pandemic.

- KDOL’s special investigations unit is responsible for the criminal investigation of potentially fraudulent claims. At the time of this audit, the unit consisted of five licensed law enforcement officers and one special investigator.

- KDOL officials told us they prioritized stopping fraudulent claims over pursuing criminal charges. Officials told us the special investigations unit was reassigned during the pandemic to help identify and stop potentially fraudulent claims.

- KDOL officials told us they are in the process of working with federal agencies to investigate potentially fraudulent claims. These agencies include the Federal Bureau of Investigation and the U.S. Department of Labor’s Office of Inspector General for investigation. It is possible that out-of-state or out-of-country cases could be turned over to those offices for investigation.

Conclusion

The COVID-19 pandemic created a unique opportunity for fraudsters across the nation. It resulted in a massive spike in unemployment claims that would challenge even the most adept unemployment systems. It also resulted in a new federal Pandemic Unemployment Assistance program with far fewer verification requirements than the state’s program. Kansas was clearly not well prepared to address either situation. The combined effect has been significant fraud within the federal program and some fraud almost certain to affect the state’s program.

Recent trends suggest that the state’s unemployment system is now being targeted by fraudsters. This could have significant consequences for some Kansas employers, especially nonprofits, government entities, and tribal organizations that chose to reimburse the state instead of making unemployment contributions. That is because these employers are currently responsible for covering the costs of these claims unless they can successfully appeal them. Moreover, Kansas taxpayers are hurt by fraud at both the federal and state level. Not only because their identities have been stolen, but because they may face a tax liability if they don’t report fraudulent benefits they never received.

Recommendations

We did not have any recommendations for part 1 of this audit but will be considering recommendations for part 2.

Agency Response

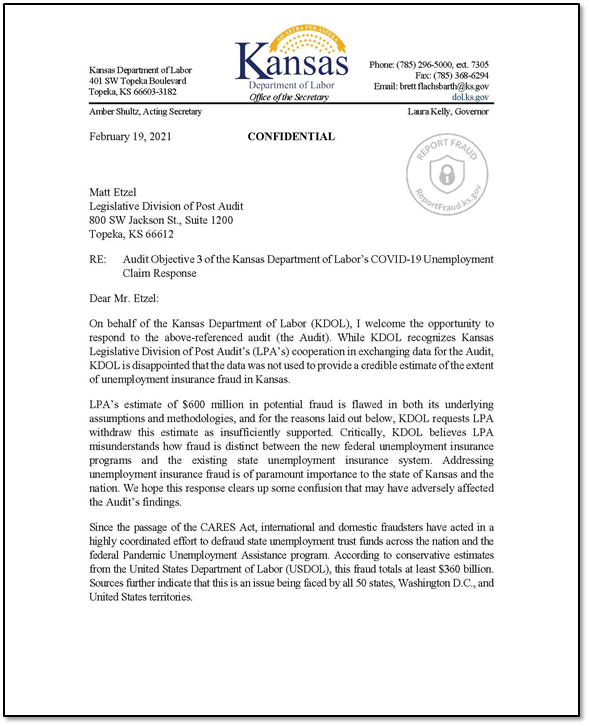

On February 16, 2021 we provided the draft audit report to the Kansas Department of Labor. The Department raised a number of concerns with the report findings and our fraud estimate. The agency’s full response is below. We carefully reviewed the information agency officials provided, but ended up only making minor changes to our findings.

Appendix A – Cited References

This appendix lists the major publications we relied on for this report.

- Kansas Department of Labor Weekly Unemployment Claims Reports (December, 2020). Kansas Department of Labor.

- COVID-19: States Cite Vulnerabilities in Detecting Fraud While Complying with the CARES ACT UI Program Self-Certification Requirement (October 2020.). The U.S. Department of Labor Office of the Inspector General.