Federal Funds: Evaluating Costs Associated with Federal Funding in Selected State Agencies

Introduction

Representative Ron Highland requested this audit, which was authorized by the Legislative Post Audit Committee at its April 25, 2018 meeting.

Objectives, Scope & Methodology

Our audit objective was to answer the following questions:

- How much federal funding did the Department of Labor, Department of Transportation, and the Department of Agriculture spend in fiscal year 2018 and how were those funds used?

- What are the state costs and obligations associated with federal funds in the Departments of Labor, Transportation, and Agriculture?

The scope of our work covered the major costs and obligations of receiving federal funds in a sample of six programs administered by the Departments of Labor, Transportation, and Agriculture. To keep the audit within the original timeframe estimated, we focused on fiscal year 2018. We only reviewed obligations tied directly to the receipt of each program’s federal funds. Our method included collecting and analyzing expenditure data from the three departments, conducting legal research, and interviewing agency officials.

More specific details about the scope of our work and the methods we used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

The Kansas Departments of Labor, Transportation, and Agriculture spent about $568 million in federal funds to provide benefits like unemployment insurance, to fund highway projects, and to conduct food inspections in fiscal year 2018.

Fiscal Year 2018 Federal Spending

The $568 million in federal funding made up between 25% and 86% of the three agencies’ total expenditures in fiscal year 2018.

- To determine the agencies’ federal expenditures, we reviewed data they reported to the Division of Budget. We reviewed the Governor’s Budget Report for fiscal year 2020 to determine their total expenditures.

- The Department of Labor’s (Labor) federal expenditures for fiscal year 2018 were about $177 million. Federal expenditures were 86% of about $206 million in total department expenditures. Labor used federal funds to operate unemployment insurance, perform workplace safety consultations, and provide and maintain statistical data.

- The Department of Transportation’s (Transportation) federal expenditures for fiscal year 2018 were about $380 million. Federal expenditures were 29% of about $1.3 billion in total department expenditures. Transportation used federal funds for highway safety projects, public transportation, public airports, and highway construction projects.

- The Department of Agriculture’s (Agriculture) federal expenditures for fiscal year 2018 were about $11 million. Federal expenditures were 25% of about $45 million in total department expenditures. Agriculture used federal funds for programs that protect Kansas natural resources and livestock, inspect food and food-related products, manage water resources, and prepare for natural disasters.

We reviewed six programs that each spent between about $710,000 to $20 million in federal funds to provide important services to Kansas residents.

- We selected six programs to review, so the results of our work are not projectable to other federally funded programs. We selected programs with moderate to large federal spending, requirements we thought could be a cost to the state, and that had not been previously audited. For example, we did not review federal expenditures for Transportation’s largest program (Highway Planning and Construction) because we audited it in our 2015 federal funds audit.

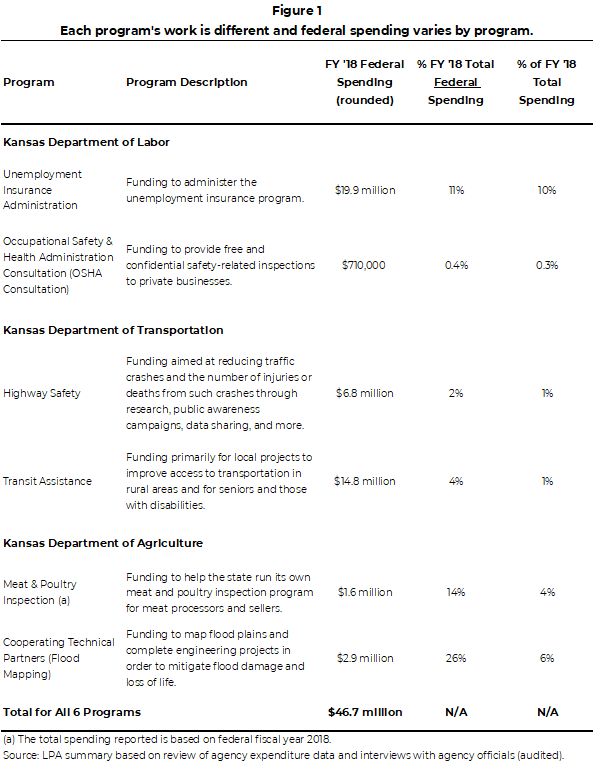

- Figure 1 lists the six programs we selected and their federal spending in fiscal year 2018. As the figure shows, the six programs spent a wide range of federal funds on a variety of programs intended to provide important services to Kansans. For example, Labor spent about $20 million in federal funds to operate the Unemployment Insurance program, which provides temporary financial support to workers who have lost their jobs.

- Figure 1 also shows the percentage of total federal money and total agency budget these programs represent. As the figure shows, the six programs we evaluated represent between 0.4% and 26% of federal expenditures in their respective agencies, and between 0.3% to 10% of the total spending in their respective agencies.

- None of the programs are federally required, but officials told us they provide important benefits to the state.

Depending on their purpose, the six programs we reviewed spent most of their federal funds on either state employee salaries and wages, assistance to other state agencies and local governments, or for contractual services.

- To determine how agencies spent federal funds in our sample programs, we requested federal expenditure data from each agency. Each agency tracked federal spending versus state spending at some level. We also compared agency totals to totals reported in the Statewide Single Audit. All amounts presented in this report are approximate or rounded.

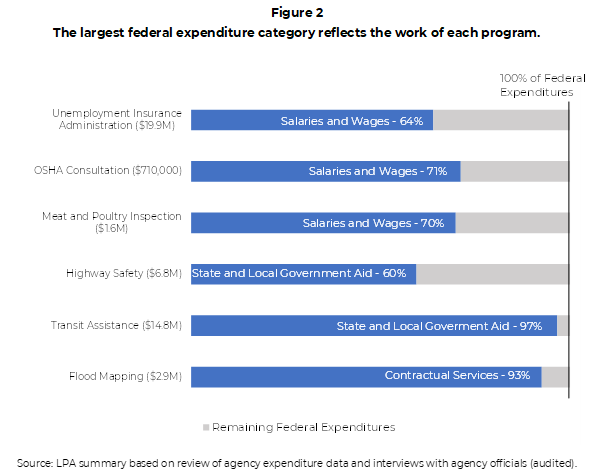

- Figure 2 shows the largest category of spending for each program in our sample. We created categories based on expenditure codes found in agency data. We did not verify that all expenditure codes were correctly entered by the agencies.

- As the figure shows, three programs in our sample spent most of their federal funds on salaries, wages, and benefits for the state employees working in those programs. For example, Labor spent about $13 million (64%) of its federal funds on the salaries, wages, and benefits of the state employees who process unemployment insurance claims, help with the appeals process for denied claims, and work on fraud prevention.

- Two sample programs passed most federal funds on to other state, local, and non-profit agencies to carry out the work of the program. For example, Transportation passed 97% of its Transit Assistance funds to these other entities.

- One program spent most of its federal funds on contractual services. For example, Agriculture spent more than 90% of its Flood Mapping funds on contracts with multiple engineering firms to provide technical and engineering services.

- These sample programs also spent federal funds on commodities, capital outlay, and indirect costs. Commodities and capital outlay expenditures include things like software, computer equipment, and office supplies. Indirect costs are the programs’ portion of costs for things like administration, payroll, etc. that cannot be directly attributed to the program but come from support services that benefit various areas of the agency.

The federal funds for these programs create state funding obligations and have several requirements and conditions that can be paid for with either state matching or federal funds.

Mandatory Federal Legal Requirements

State agencies must follow certain federal laws regardless of whether they accept federal funds.

- Often optional programs have requirements tied to the receipt of funding. Other times, states must adhere to federal requirements even without receiving funding, as described below.

- The Clean Air Act, the Civil Rights Act, Americans with Disabilities Act, and the Age Discrimination in Employment Act are examples of federal laws that all state agencies must follow. These laws have many requirements, which apply to state agencies whether or not they accept federal funding.

- We did not review the costs or obligations created by federal laws that must be followed regardless of funding. That is because it would be very difficult to identify these programs (e.g., would require a comprehensive review of all federal laws and regulations), the costs would often be difficult to measure, and because the state has no ability to avoid or reduce any associated costs or obligations.

Federal Funding Requirements and State Costs for Optional Programs

Half of the programs we reviewed had funding requirements that require some state spending.

- Federal law does not require the state to operate any of the six programs we reviewed.

- For each program in our sample, we reviewed federal laws and regulations, cooperative or grant agreements between the state and federal agencies, and state compliance documents. We also interviewed agency officials to identify major program requirements which we grouped into three main categories: funding, administrative, and policy requirements.

- Funding requirements require state agencies to spend a specific amount of money on the program. The two types include:

- Requirements that require state or local recipients to match a specific percentage of federal funding. These are intended to make sure the state shares the cost of providing services that benefit Kansas residents. For the six programs we reviewed, three had state match requirements that ranged from 10% to 50%. For example, the OSHA Consultation program requires a 10% state match. This means that for each dollar spent on the program, the state pays 10¢ and the federal government pays 90¢.

- Maintenance of effort (MOE) requirements require the state to spend at least as much in state funds as it did in a previous time period. This ensures that federal funds are not replacing state funds.There were several safety grants within Highway Safety (i.e., occupant protection grants and alcohol impaired driving grants) that had an MOE requirement for total state expenditures to remain at or above fiscal year 2014 and 2015 expenditures. The other five programs in our sample did not have MOE requirements.

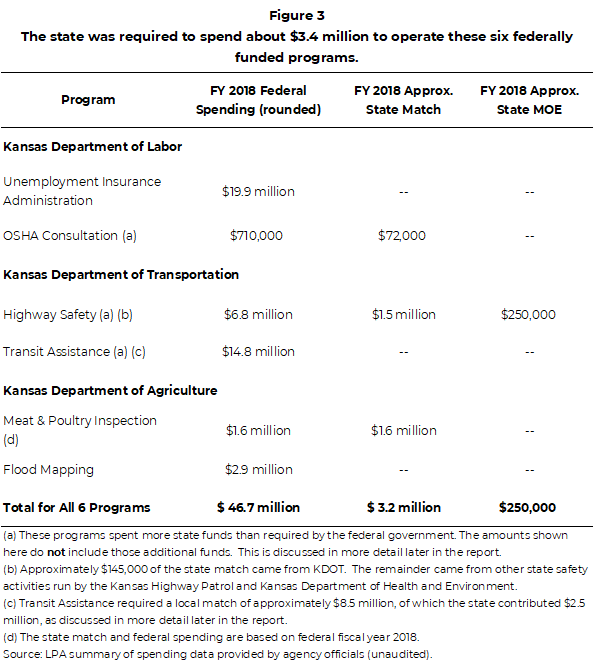

- Figure 3 shows the state matching and MOE spending for the six programs we reviewed. As the figure shows, the state spent about $3 million in fiscal year 2018 to meet the state funding requirements for the six programs we reviewed. That state spending was required to draw down $47 million in federal funds the programs received and spent in the same fiscal year.

The Unemployment Insurance Administration, Flood Mapping, and Transit Assistance programs did not require state matching or MOE funds as shown in Figure 3. There were local matching requirements for Transit Assistance, which is discussed in more detail later in the report.

All six programs we reviewed also had to meet administrative and policy requirements.

- Administrative requirements are tasks state agencies must complete to ensure funds are properly tracked, and that performance measures and other standards are met. Typical administrative requirements include completing periodic reports, monitoring program performance, and developing program guidelines and statewide plans. All six programs we reviewed had administrative requirements.

- For example, Transportation is required to prepare a comprehensive annual safety plan for the federal government for its Highway Safety program. In this plan, Transportation shows what work they will complete the next year to meet program objectives, such as implementing child safety seat programs or improving their safety databases.

- Similarly, the Flood Mapping program requires Agriculture to submit quarterly reports to the federal government on its performance and expenditures.

- Policy requirements are principles or guidelines state agencies must follow to conduct the program’s work. Typical policy requirements impose a certain standard on the program like which training must be provided to employees, what laboratory methods must be used for inspections, or what penalty should be imposed for fraudulent unemployment claims. All six programs we reviewed had policy requirements.

- For example, the Meat and Poultry Inspection program requires Agriculture to operate a state program that is “at least equal to” the federal government’s policies in areas such as inspection, investigation, enforcement, and the humane handling of animals. Agriculture complies with this requirement by aligning Kansas statutes to these federal requirements.

- Some policy requirements are not program specific and apply to all agencies that receive federal funds. For example, all programs receiving federal funds should have drug-free workplace policies and should work with construction contractors that pay their employees a wage appropriate to the local area for certain projects.

Further, the six programs we reviewed included limitations and conditions on how state agencies could spend federal funds.

- The federal government sometimes limits how state agencies can spend federal funds. Limitations are specific to each program and vary between the programs. Most of the programs in our sample were not allowed to spend federal funds on specifically listed items or categories.

- For example, the Meat and Poultry Inspection program prohibits Agriculture from spending federal funds on certain types of meat inspections and on staff overtime for plant inspections.

- Similarly, the Flood Mapping program restricts Agriculture from spending federal funds for certain equipment, international travel, overtime, and construction or renovation costs.

- Additionally, the federal government may place conditions on the percentage of federal funds that can be spent on certain activities. Some of the programs in our sample had additional conditions on federal spending.

- For example, some programs capped the amount of federal funds that could be spent on certain management, administrative, and planning costs. The Flood Mapping program capped the amount of federal spending that Agriculture could apply to these types of costs at 4%, the Transit Assistance program included a 10% cap, and the Highway Safety program included a 13% cap.

- Conversely, the Highway Safety program required Transportation to spend at least 40% of federal funds on local aid, and Transit Assistance required Transportation to spend at least 15% of federal funds on intercity bus service.

Officials told us the costs and obligations related to federal funds could all be paid for with state matching or federal funds for all six programs we reviewed.

- We compiled a list of the requirements tied to each of the programs in our sample after reviewing federal regulations for each grant and any specific written agreements between the agency and federal authority. We interviewed agencies officials and reviewed this list of requirements with them to determine how they covered the cost to comply with the requirements in fiscal year 2018.

- Labor, Transportation, and Agriculture staff told us they use federal funds and state matching funds to cover all the funding, administrative, and policy requirements associated with the federal program. They also confirmed that the costs to meet the limitations and conditions we identified were covered by state matching funds or federal funds in fiscal year 2018.

- We did not determine if local governments or non-profits had any costs associated with meeting federal requirements as a result of receiving federal funds provided from state agencies because it was outside the scope of the audit. We also did not audit agencies’ expenditures to determine if they complied with federal regulations on how federal funds may be used or if they complied with limitations and conditions previously described.

In a few cases, Transportation and Labor officials opted to contribute more in state funds or resources than required to increase program services.

- The state match and MOE requirements are minimum federal requirements. State agencies can voluntarily contribute more state funding or resources than the federal government requires.

- Transportation officials chose to cover the indirect costs related to the sample programs with state funds so they could maximize the amount of federal funds available for program projects. For example, the department uses state dollars for legal review of contracts or to pay for the finance departments’ time to process invoices for the sample programs. Transportation officials told us they could pay for indirect costs with federal funds, but they would have less money to spend on program projects. We did not estimate the amount of state dollars spent on indirect costs because federal funds could have been used and Transportation does not track these costs by federal program. Also, officials told us this is their policy for all federal programs.

- Transportation officials also chose to spend state funds to help local organizations meet local matching requirements for its Transit Assistance program. Transit Assistance requires local organizations to match 50% of operating costs. However, Transportation elected to pay 20% of the match in support of local transit services, because officials said local services led to enhanced and more sustainable services statewide. In fiscal year 2018, this resulted in Transportation distributing $2.5 million more in state funds than required.

- Labor officials chose to spend state funds to increase the amount of services they could provide to private businesses through its OSHA Consultation program. OSHA Consultation requires Labor to match 10% of program costs, but Labor officials told us they chose to match approximately 34% of program costs so they would not have to reduce the number of inspections they complete. In fiscal year 2018, this resulted in Labor voluntarily spending about $170,000 more in state funds than required.

Although all six programs we reviewed are optional, agency officials told us they provide very important benefits to Kansans.

- Federal law does not require the state to operate any of the six programs we reviewed.

- However, agency officials told us there were important benefits to each of the programs. For example:

- Agriculture officials told us the Flood Mapping program is critical for Kansas communities’ eligibility for the National Flood Insurance Program. About 490 communities in Kansas participate in the National Flood Insurance Program.

- Similarly, the Unemployment Insurance Administration program covers the entire cost of running unemployment insurance in Kansas. If Kansas were to keep unemployment insurance without these funds, it would have to pay for the administration of the program with state funds and employers would have to pay a higher federal unemployment tax.

- If the state wanted to continue providing the same services without federal funding, it likely would have to rely entirely on state funds.

- Conversely, the state could rely solely on federal programs to provide services in some areas and provide no state funding. For example, Kansas could end its state-operated Meat and Poultry inspection program and instead have the USDA conduct all meat and poultry inspections at no cost to the state. However, Agriculture officials told us that would negatively affect small meat processors and sellers. Although sanitation standards are the same for both the Kansas and USDA programs, Agriculture officials said other USDA standards (i.e., rules on overtime, higher wage requirements, etc.) would make it too expensive for small meat processors and sellers to pass USDA inspections.

Conclusion

Although federally funded programs create a variety of obligations for the Department of Labor, Department of Transportation, and Department of Agriculture, not all obligations result in state costs. The federally funded programs we reviewed are not federally required, but they help address important activities such as unemployment insurance, highway safety initiatives, public transit assistance, and food safety inspections. The state must meet a number of requirements when it accepts these federal funds. Funding requirements, like matching or maintenance-of-effort requirements, are a cost to the state. Conversely, administrative and policy requirements require time, effort, and resources, but those costs can be paid with federal funds. It is ultimately up to state policymakers to determine whether the benefits of federally funded programs outweigh the obligations they impose on state agencies.

Recommendations

We did not make any recommendations for this audit.

Agency Response

On June 17, 2019 we provided a copy of the draft audit report to the Departments of Agriculture, Labor, and Transportation. We did not have recommendations for these agencies, so their response was optional. Although optional, the Department of Agriculture submitted a formal response to our audit. In its formal response, agency officials acknowledged receipt of our draft and discussed the importance of the sample programs. Its response is below.

Appendix A – Cited References

This appendix includes a list of the major reports, articles, publications, or studies that we relied on for information in this report.

- Federal Funds: Evaluating State Spending Required by Federally Funded Programs (December, 2015). Legislative Post Audit.

- K-12 Federal Education Funds: Evaluating the Costs and Benefits Associated with K-12 Federal Education Funding (December, 2016). Legislative Post Audit.

- 2 CFR Part 200, Appendix XI, Compliance Supplement (April, 2018). Executive Office of the President Office of Management and Budget.

- 2 CFR 200, Appendix XI, Compliance Supplement (April, 2017). Executive Office of the President Office of Management and Budget.

- State of Kansas Single Audit Report (June, 2018). CliftonLarsonAllen, LLP.

- Code of Federal Regulations, Title 2, Grants and Agreements (January 2018). Office of Federal Register national Archives and Records Administration.