Kansas Department of Agriculture: Evaluating the Economic Impact of Hemp Production in Kansas

Introduction

Representative Willie Dove requested this audit, which was authorized by the Legislative Post Audit Committee at its April 30, 2019 meeting.

Objectives, Scope, & Methodology

Our audit objective was to answer the following question:

- What would be the economic impact of commercial hemp production in Kansas?

To answer this question, we evaluated the potential financial returns (profits or losses) on hemp grown in Kansas in 2019. We also reviewed whether Kansas has a suitable climate to grow hemp. Finally, we spoke to several stakeholders to understand risks and challenges associated with growing the crop.

We used a consultant to determine the estimated financial returns on hemp grown in Kansas in 2019. Our consultant, Dr. Tyler Mark, is an agricultural economist from the University of Kentucky with relevant research experience and publications. Dr. Mark relied on Kansas Department of Agriculture data from Kansas’ 2019 hemp season for his analysis. He also used regional, national, and proprietary cost and sales data. When necessary, he made assumptions about hemp growing practices, production, sale prices, and costs based on his experience in the field. We think these assumptions are reasonable, but they significantly influence the results of the analysis. Our estimates do not represent the actual economic impact of hemp grown in the state.

More details about the scope of our work and the methods we used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

Audit standards require us to report limitations on the reliability or validity of our evidence. Hemp production data is limited to a single year (2019) and was self-reported by growers. We discuss the effects of this on our results later in the report.

Hemp could become an economically successful crop in Kansas, but its success will depend on future harvest yields and market factors that are not yet known.

Background on Hemp Production

Hemp was grown as a crop for many years in the United States before being banned in 1970 as part of the Controlled Substances Act.

- Although derived from the same plant as marijuana (Cannabis Sativa L.), hemp contains little to none of the intoxicating compound, delta-9 tetrahydrocannabinol (THC).

- As shown in Figure 1, the hemp plant typically is grown for one of the following three purposes:

- Hemp fiber comes from the stalk of the hemp plant. Hemp fiber has been used to make rope, canvas, and other textiles. It can also be used as a more sustainable source for several paper products.

- Hemp grain is the seed that comes from the hemp flower. Hemp grain can be used to make several products including flour and cooking oil. Hemp seed oil can also be used in some cosmetic goods.

- Floral hemp is the common term given to the female hemp flower. Floral hemp is grown for the chemical compound cannabidiol (CBD) which is extracted from the flower. The U.S. Food and Drug Administration (FDA) has approved one pharmaceutical drug containing CBD for its ability to help treat seizures. CBD may have other health benefits such as reducing anxiety, depression, and pain relief. However, those benefits have not been confirmed. Further, as an active ingredient in a regulated drug, the FDA currently prohibits CBD from being added to any consumable good sold through interstate commerce.

- The 1970 Controlled Substances Act prohibited growing hemp in the United States because of its classification as marijuana. Prior to this, hemp cultivation in the United States had already declined significantly due to high taxes imposed under the Marijuana Tax Act of 1937. During this time, hemp continued to be produced in other parts of the world.

- Prior to 1970, hemp was cultivated for its fiber and grain. Hemp has seen a recent resurgence in popularity, mostly due to floral hemp for CBD.

Recent changes to federal and state law made it legal to grow and distribute hemp in Kansas.

- The U.S. Congress passed the Agricultural Act of 2014, which allowed states to create programs to research hemp cultivation. Under the Act, hemp is defined as a Cannabis Sativa L. plant that contains no more than 0.3% THC. Generally, anything more is considered marijuana and must be destroyed.

- In 2018 the U.S. Congress passed the Agricultural Improvement Act. Among other things, this Act allowed commercial hemp production and distribution in all states. The Act included several regulations but also allowed states to create their own.

- Kansas did not allow any hemp production until 2018. That year, the Kansas Legislature passed the Alternative Crop Research Act. That act allowed Kansas to participate in the federal research program. 2019 was the state’s first year of growing hemp as a crop.

- In 2019 the Kansas Legislature amended state law to develop its own regulatory framework for commercial hemp production. The U.S. Department of Agriculture approved the state’s plan in Spring 2020. The Kansas Department of Agriculture (KDA) is responsible for monitoring and regulating the state’s hemp production. KDA officials told us they are working to implement the new commercial regulations, which should go into effect in the next few growing seasons.

Most of the state has a suitable climate for growing hemp, but some irrigation may be required.

- Hemp is grown in a variety of ways depending on its end use. For example, specific growing techniques (spacing, seeding rate, etc.) are better suited to grow floral hemp than hemp fiber or grain.

- Growers may also choose to grow hemp transplants, typically in an indoor greenhouse. Transplants are young hemp seedlings grown to be sold and planted directly in the field. Because they already sprouted, transplants have a higher success rate in the field than hemp seeds.

- Conditions in most of the state are favorable to grow hemp, but irrigation may be necessary in western Kansas. We reviewed average temperatures and rain in Kansas from May to September. These months reflect a typical hemp growing season. Average temperatures in the state from May to September were within hemp’s desired range of 60 to 80 degrees Fahrenheit. The average rainfall in Kansas during the growing season ranges from 13 inches in Western Kansas, to 17-23 in central and eastern Kansas. Because hemp requires 25-30 inches per growing season, farmers may need to irrigate the crop in drier parts of the state.

- We did not evaluate soil conditions (e.g., pH levels, nitrogen levels, etc.) or which hemp strains are best suited to grow in various parts of Kansas. More data and research are needed to know which soil conditions and strains are best suited for Kansas.

2019 Financial Returns on Growing Hemp in Kansas

We used a consultant to estimate the potential financial returns on hemp grown in Kansas.

- Our work reflects the estimated financial returns on hemp grown in Kansas, not its actual economic impact. As a new crop, there was limited data on hemp grown in Kansas or nationally. So, we couldn’t calculate the economic impact of hemp grown in the state in terms of state and local revenues generated, jobs created, etc. Instead, our consultant estimated what money growers could have made or lost had they sold all their hemp crop in 2019. However, it was unknown how much of the 2019 hemp crop was sold. Selling hemp generally requires a contract with a hemp processor. Some stakeholders told us finding a processor to buy hemp crops could be difficult to find.

- The estimated returns we present in this report depend on three pieces of information: hemp costs, sales prices, and information about Kansas’ 2019 growing season (e.g., acres of hemp harvested, pounds of hemp harvested, etc.).

- Kansas does not yet have statewide data on hemp costs or sales prices. As a result, our consultant used regional, national, and proprietary data. He also made several assumptions about hemp planting practices, production, sales prices, and costs. He made these assumptions based on his experience as an agricultural economist and his prior hemp research. Appendix B contains more information about these key assumptions.

- Our analysis was based on a single year (2019) of self-reported hemp harvest data. Growers are required to submit information on their hemp harvests to KDA. To date, Kansas has completed just one hemp growing season (2019). As such, our analysis is based on a single year of hemp harvest results. It is possible future harvest results could look much different than 2019.

- Harvest data is also self-reported to KDA officials, creating some risk that there were errors or inconsistencies in the data. For example, some growers separated crops grown for fiber from floral while others reported a single mixed-crop harvest. In other cases, growers used estimation techniques to weigh their crops instead of a scale. However, these inconsistencies were not significant enough to prevent us from completing our analysis. KDA staff also followed-up with licensed growers to ensure they submitted 2019 harvest data.

The state’s 2019 hemp crop had limited financial returns, likely due to a lack of knowledge on how best to grow hemp in Kansas.

- Overall, the state’s 2019 hemp crop had an estimated net positive return of about $4 million. In other words, our contractor estimated Kansas growers could have sold their hemp crops for $4 million more than it cost them to grow it.

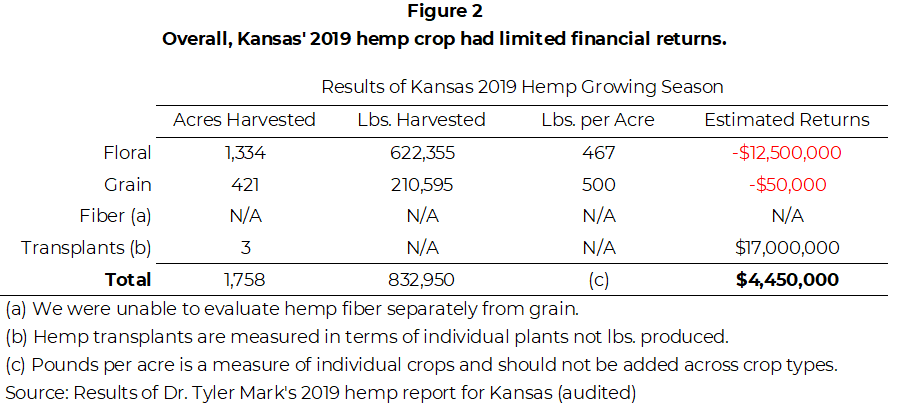

- As Figure 2 shows, floral and grain hemp had a combined estimated negative return of nearly $13 million. As a reminder, floral hemp is used to produce the chemical compound CBD. Hemp grain can be used to make flour or cooking oil.

- As the figure also shows, hemp transplants had an estimated positive return of about $17 million. Hemp transplants are seedlings that growers sell to other growers to be planted in the field.

- We were unable to evaluate hemp fiber separate from hemp grain because data was not separately tracked and available for analysis.

- Kansas’ 2019 harvest yields, usually reported in pounds harvested per acre, were very low, causing the negative returns for floral and grain hemp. According to our consultant, successful yields would be closer to 1,200 pounds per acre for hemp grain and about 3,300 pounds per acre for floral hemp. As Figure 2 shows, Kansas’ average 2019 yields were much lower than this.

- A lack of knowledge on how best to grow hemp in Kansas likely contributed to the low yields. As a new crop to the state, little is known on the growing conditions (e.g., soil conditions, fertilizer, etc.) or strains of hemp that are best suited for Kansas. According to our consultant, this may have resulted in growers using planting practices or hemp strains that were not well suited for this region. Growing conditions (e.g., rainfall) in 2019 could have also had some effect on crop yields that year, but it is unclear from one year’s worth of data.

- High prices for hemp transplants resulted in the estimated positive returns for the crop, but key assumptions drove this estimate. In working with KDA officials, our consultant assumed that hemp reported as grown indoors was grown as a transplant. Based on this assumption, he used the total square feet of indoor growing for Kansas’ 2019 season to estimate the number of transplants that could have been grown that year (about 9 million). Based on national trends, he assumed each transplant was valued at about $3, resulting in the high returns. Although a reasonable assumption, we do not know how many transplants were actually grown in Kansas in 2019, whether farmers sold all transplants, and for what price.

Future Financial Returns on Hemp Grown in Kansas

If harvest yields improve, hemp has the potential to become a more profitable crop in Kansas in the next several years.

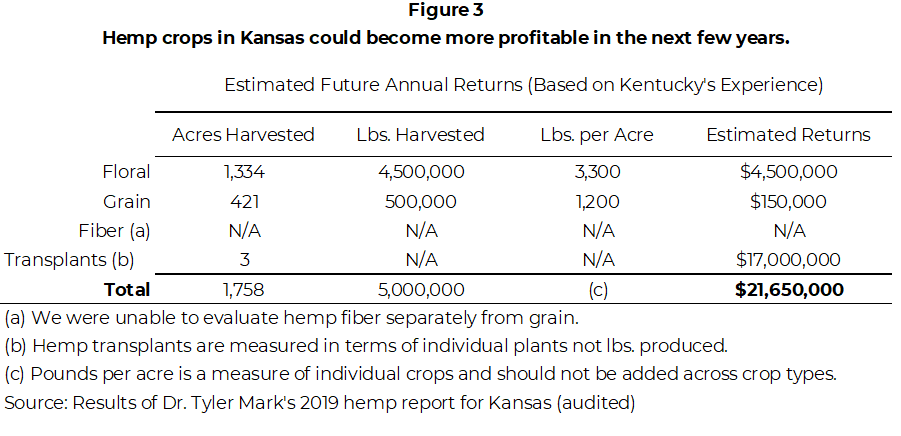

- Harvest yields (i.e., pounds of crop harvested per acre) for floral and grain were low for Kansas’ 2019 season. Based on his experience, our consultant estimated how, with more knowledge and experience, improved yields could affect Kansas’ future returns in the next several years. His hypothetical estimates are based on floral and grain hemp yields similar to Kentucky. Kentucky was chosen because of its experience growing hemp since 2014.

- Kansas’ future hemp crops could generate about $22 million in annual returns over the next several years. This estimate assumes crop yields achieved by experienced growers. As Figure 3 shows, improved harvest yields could create positive returns for both floral and grain hemp grown in the state. However, these estimates assume Kansas growers can implement best practices for hemp production from states like Kentucky.

Future hemp production has the potential to be financially successful compared to other crops, but its success depends on several factors.

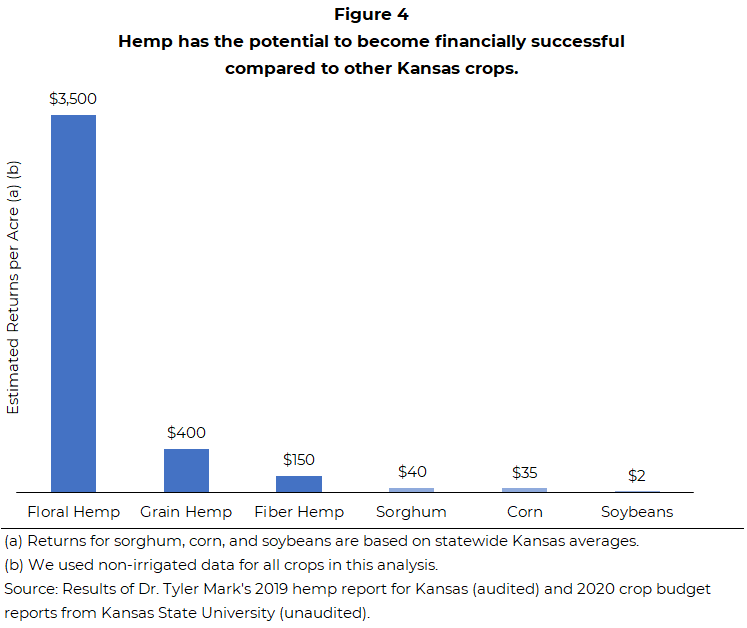

- We compared the estimated future returns (per acre) for hemp to three well-established Kansas crops: corn, sorghum, and soybeans. We included hemp fiber in this analysis because it is a hypothetical estimate of possible returns per acre. Hemp transplants are an indoor crop and were therefore not comparable. These estimates are primarily based on Kentucky’s recent growing experience. As with the previous estimates, it also assumes Kansas follows a similar learning curve and has similar harvest results as Kentucky.

- On a per acre basis, it appears future hemp returns could be higher than several other Kansas crops. As Figure 4 shows, projected returns for floral hemp could be as high as about $3,500 per acre in the next several years. This was much higher than the other crops we compared it to. This is largely due to the high sales price for floral hemp (about $4 per pound) compared to other crops like sorghum (about $0.06 per pound).

- However, the financial success of hemp depends on several factors. First, hemp yields need to improve over the next several years. It is currently uncertain whether or how quickly that will occur. Additionally, hemp growers will need to be able to sell their hemp crops once harvested. Their ability to do so will depend on future demand for hemp and availability of hemp processors, neither of which is currently known. Market issues surrounding hemp is discussed more in the next section.

- Although hemp has the potential to be financially successful, it is also more expensive to grow compared to other crops. For example, it costs about $11,500 per acre to grow floral hemp compared to about $400 for corn and $330 for sorghum. Floral hemp’s high costs are mostly due to the cost of transplants and harvest labor. Hemp’s high costs could create financial risk for growers if they have trouble growing or selling their crops. Growers may choose to grow hemp on a smaller scale to reduce this risk, especially for floral.

The future financial returns on hemp in Kansas will largely depend on the future demand for CBD products.

- Estimating future market conditions for hemp is difficult without additional time and data. Given that uncertainty, we did not attempt to estimate future market conditions for hemp. Instead, we reviewed the types of market factors that could affect floral hemp’s financial returns in Kansas.

- Demand for CBD products has grown in recent years. This likely drove the increased floral hemp production (used to create CBD) across the country. It is possible that nationally, growers are beginning to overproduce floral hemp. Overproduction could saturate the floral markets and decrease the price for floral hemp. This would reduce the financial returns of floral hemp nationwide and in Kansas.

- It also is unclear whether the current popularity and demand for CBD products will persist, decrease, or increase over the next several years. Any change in consumer behavior also will affect the demand, prices, and financial returns on floral hemp in the state.

Other market changes and innovations could also affect hemp’s future financial returns in Kansas.

- New uses and markets for hemp grain could be created in the coming years. For example, if hemp grain were to be approved by the FDA to be used in animal feed it could positively affect the financial returns on hemp grain in the state.

- There is already an established international supply of hemp fiber that Kansas growers may find difficult to compete with. However, Kansas and other states may be able to produce specific types of hemp fiber needed for new hemp-based products (carbon fiber, electronic components, etc.). Should those markets exist one day, it could positively affect the financial returns on hemp fiber in the state.

Risks and Challenges for Hemp Production

Stakeholders identified several risks and challenges related to growing and regulating hemp in Kansas.

- We spoke to several stakeholder groups to get their opinions on the risks of growing hemp. This included agricultural officials from Colorado, Kentucky, Montana, Oregon, and Vermont. These states all had older, more established hemp programs than Kansas. We also spoke to nine individuals licensed under Kansas’ 2019 hemp program and agricultural researchers at Kansas State University.

- Stakeholders mentioned a few risks and challenges related to legal factors surrounding hemp. KDA staff must test a sample of all hemp grown in the state to ensure the crop contains no more than 0.3% THC. When the crop tests above that limit, growers can pay to have their crop re-tested once. However, if the crop fails the test again, it must be destroyed. Stakeholders also told us banks have been hesitant to lend to hemp growers because of uncertainty surrounding the crop. Lastly, the FDA currently prohibits CBD from being added to consumable goods sold through interstate commerce, which could affect whether and how it can be sold commercially.

- Stakeholders mentioned a few risks and challenges related to environmental factors surrounding hemp. Stakeholders told us a lack of approved pesticides and herbicides for hemp has been an issue. Without these, hemp is susceptible to pests, weeds, and diseases that could result in crop loss. A few pesticides and herbicides were approved for 2020 but it is too early to know how well they work. Stakeholders also mentioned cross-pollination between hemp plants as an issue. This usually occurs when feral cannabis plants that grow naturally in Kansas pollinate floral hemp grown for CBD. Cross-pollination may reduce a plant’s CBD content, potentially lowering its value.

- The state may face some challenges in regulating hemp. For example, one stakeholder from another state told us testing hemp can be labor intensive, sometimes requiring staff overtime or seasonal employees. Stakeholders told us they use past testing data to rate hemp strains as high to low risk of being a “hot crop” (i.e., exceeding 0.3% THC). This can help them focus testing on high-risk crops. They also said it can be difficult for law enforcement to know whether someone is transporting legal hemp or illegal marijuana. It is important for the state to work with law enforcement to reduce this risk.

Conclusion

It’s too early to know with certainty how successful hemp production will be in Kansas. Growers are still figuring out how best to grow it and there aren’t established industry standards because it’s so new. For example, growers are learning when it’s best to plant, what type of hemp they want to produce, and where to buy high quality seeds. The market also is very volatile. Sales prices and growing costs are subject to wide swings as large numbers of growers enter the market (supply) and consumers learn about new hemp products (demand).

Because of all these uncertainties, we estimate Kansas’ hemp growers about broke even financially their first year. As growing practices become clearer and the market stabilizes, it appears hemp may become a profitable crop for Kansas growers. Floral hemp can be an expensive crop to grow but also has the potential to generate much larger revenues than other traditional Kansas crops. More time and data are needed to know the extent of hemp’s economic potential for Kansas beyond the individual profits for growers.

Recommendations

We did not make any recommendations for this audit.

Agency Response

On August 11, 2020 we provided the draft audit report to the Kansas Department of Agriculture. Its response is below.

Appendix A – Cited References

This appendix lists the major publications we relied on for this report.

- 2020 Corn Cost-Return Budget (October, 2019). Kansas State University, Department of Agricultural Economics.

- 2020 Grain Sorghum Cost-Return Budgets (October, 2019). Kansas State University, Department of Agricultural Economics.

- 2020 Soybeans Cost-Return Budget (October, 2019). Kansas State University, Department of Agricultural Economics.

Appendix B – Major Assumptions

This appendix includes the major assumptions our consultant made to estimate the financial returns on hemp produced in Kansas in 2019.

- In working with officials from the Kansas Department of Agriculture, our consultant assumed all hemp reported as grown indoors in 2019 was grown as transplants. He also assumed 124 transplants could be grown per square foot. It is unknown how many transplants were actually grown in Kansas in 2019.

- Our consultant assumed sale prices of $0.07 per pound for fiber, $0.70 per pound for grain, $4.49 per pound for floral, and $3.12 per hemp transplant. These assumptions were based on proprietary information available to our consultant and national and regional sale prices.

- Our consultant assumed improved hemp yields in Kansas could be as high as 1,200 pounds per acre for hemp grain and 3,300 pounds per acre for floral hemp. These yields assume Kansas will follow a similar learning curve and have similar harvest results as Kentucky in the next few years.

- Our consultant assumed a CBD content of 7% for floral hemp grown in Kansas in 2019. This was a conservative CBD concentration, aimed to reflect Kansas’ first year growing floral hemp.

- We used non-irrigated crop data for all analyses in this report. Our consultant assumed Kansas growers did not rely on irrigation for the 2019 hemp season. As such, we used non-irrigated crop data for corn, sorghum, and soybeans to compare to hemp.

- Kansas corn, sorghum, and soybean financial returns were averages across six agricultural regions. For example, the average return for soybeans was about $1.60 per acre, but actual returns ranged from about negative $60 to positive $50 per acre across the state.

- Some Kansas growers reported growing mixed hemp crops in 2019 (e.g., hemp grown for fiber, grain, and floral). Because mixed crop data could not be separated into unique categories, our consultant assumed all mixed crops were grown for grain. This is based on the assumption that mixed hemp crops likely resulted in poor floral harvests. No growers reported growing hemp strictly for fiber in 2019.

- This audit occurred during the early parts of the COVID-19 pandemic. The economic effect of the pandemic could influence future hemp markets, prices, costs, and other variables that we could not evaluate as part of this audit.