Private Activity Bonds: Comparing How the Structure and Use of These Bonds in Kansas Compares to Other States

Introduction

Representative Tom Burroughs requested this audit, which was authorized by the Legislative Post Audit Committee at its April 30, 2019 meeting.

Objectives, Scope, & Methodology

Our audit objective was to answer the following questions:

- How does Kansas’ use of private activity bonds compare to other states?

- What are the benefits and drawbacks of administering the Kansas Housing Assistance Program at a state level versus a county level?

Our work examined how Kansas and other states used private activity bonds in calendar years 2016 through 2018. We also interviewed officials in Kansas and four other states to compare homebuyer program models. We only reviewed private activity bonds subject to the state’s private activity bond limit. There are other bonds not subject to a limit, but agencies do not track those.

More specific details about the scope of our work and the methods we used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

Audit standards require us to report limitations on the reliability or validity of our evidence. In this audit, we used data from the Council of Development Finance Agencies (CDFA) and other states to determine how states used private activity bonds from 2016 to 2018. However, the data was not always correct. For example, the CDFA misreported Kansas’ use of private activity bonds. The CDFA data also did not always match what we received from four other states. We used correct data for Kansas. We did not change what the CDFA reported for the four other states because the errors did not substantively affect the national comparison. We think the CDFA data gives an adequate sense for how other states use private activity bonds.

Audit standards require us to report our work on internal controls relevant to our audit objectives. They also require us to report deficiencies we identified through this work. In this audit, we reviewed the Department of Commerce’s processes for maintaining accurate data and complying with several key state laws about private activity bonds. We noticed two minor issues with the Department of Commerce’s data management and timeliness. We communicated those issues to agency officials in a separate management letter. They are not included in this audit report.

From 2016 to 2018, Kansas used fewer private activity bonds and for different purposes than most other states.

State and local governments can use tax-exempt private activity bonds to help private entities fund qualifying projects.

- Private activity bonds are a specific type of bond. State and local governments issue these bonds to finance projects or activities. Private investors (businesses or individuals) buy the bonds in exchange for future principal and interest payments. Then, the state or local government gives the proceeds of the bond sale to a private entity to use for a project. The private entity is responsible for repaying the investors.

- Qualified private activity bonds are tax-exempt private activity bonds. This means the interest investors earn is exempt from federal income tax. Governments issue these bonds to attract private investment for projects that have some public benefit. There are six categories of these bonds.

- Exempt facility bonds fund projects like airports, sewage facilities, or residential rental properties for low-income individuals.

- Qualified mortgage bonds finance mortgages for first-time homebuyers and veterans. Homebuyers must meet income requirements and the home cannot exceed a certain price.

- Qualified redevelopment bonds finance projects in blighted areas. We did not identify any states using these bonds. Limited federal data suggests they are not used much.

- Qualified small issue bonds fund buying, building, or improving land or property. These bonds generally cannot total more than $1 million. However, the bonds can total up to $10 million if capital expenditures are included.

- Qualified student loan bonds fund student loans financed under the Higher Education Act of 1965. They can also fund loans made under state-approved student loan programs.

- Qualified 501(c)(3) bonds fund projects for tax-exempt non-profit organizations. These organizations, for example, exist for charitable or educational purposes.

- This audit focuses only on qualified private activity bonds. We refer to qualified bonds as private activity bonds in this report.

The federal government limits the amount of private activity bonds each state can issue.

- The federal government sets an annual limit for each state that is based on its population.

- This one limit applies to the first five types of bonds listed earlier. There is not a separate limit for each type of bond. This audit does not discuss qualified 501(c)(3) bonds because they are not subject to the limit.

- The federal government does not give states money to issue private activity bonds. It simply gives states the authority to issue them. The federal government limits states’ authority because the bonds reduce federal tax revenues.

- States can also issue mortgage credit certificates under this federal authority. Mortgage credit certificates are federal tax credits for first-time homebuyers. Because they are not bonds, we did not include them in our analyses. Kansas did not issue these certificates in any year we studied.

Kansas used much less of its bond authority than most other states in recent years.

- We interviewed officials and reviewed documents from the Department of Commerce to learn how much of its bond authority Kansas used in recent years. We also gathered calendar year 2016-2018 data on the 49 other states and the District of Columbia from the Council of Development Finance Agencies. The data is not accurate for all states. For example, the 2018 data matched information we received directly from Iowa officials. However, it overreported Indiana’s private activity bond use by 39%. Despite these inaccuracies, we think the data provides a general sense of how other states compare to Kansas.

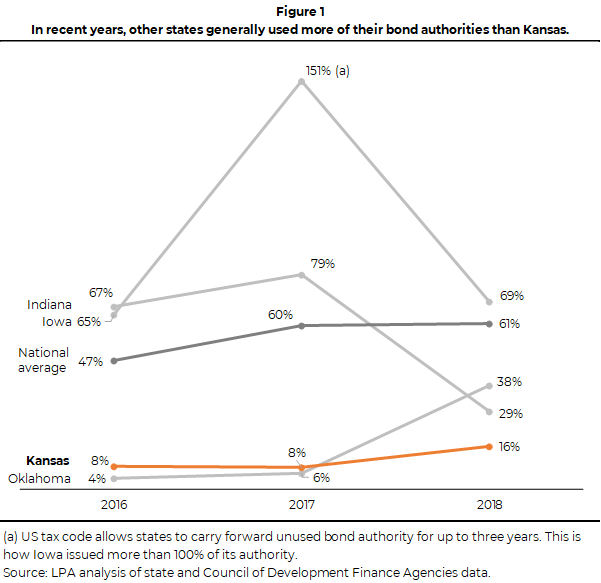

- In 2018, Kansas only issued 16% ($49 million) of its $311 million in bond authority. By contrast, the 49 other states and the District of Columbia issued an average of 61% of their bond authorities, as shown in Figure 1. In fact, 44 of those states and the District of Columbia reported using more of their bond authorities than Kansas.

- We also looked at three nearby states in more detail because we thought they would be like Kansas: Indiana, Iowa, and Oklahoma. We thought they would be like Kansas because they are midwestern states with generally similar demographics. We talked to officials and reviewed documents and calendar year 2016-2018 data from these states. We used the data we received from officials in these states for state-to-state comparisons but not to calculate national averages.

- These three nearby states used more of their bond authorities in 2018 than Kansas. These three states’ bond authorities ranged from about $330 million (Iowa) to $700 million (Indiana) in 2018. As Figure 1 shows, Indiana used 29%, Oklahoma used 38%, and Iowa used 69%. These and other states’ bond issuance amounts varied over the three years we reviewed. Despite this, states generally used more of their bond authorities than Kansas.

In 2018, Kansas used its bond authority primarily for exempt facility bonds, but not as much as other states did.

- State and local governments can sell exempt facility bonds to pay for certain kinds of facilities. These include things like airports and waste disposal facilities. They also include multifamily housing for low-income individuals, like apartments.

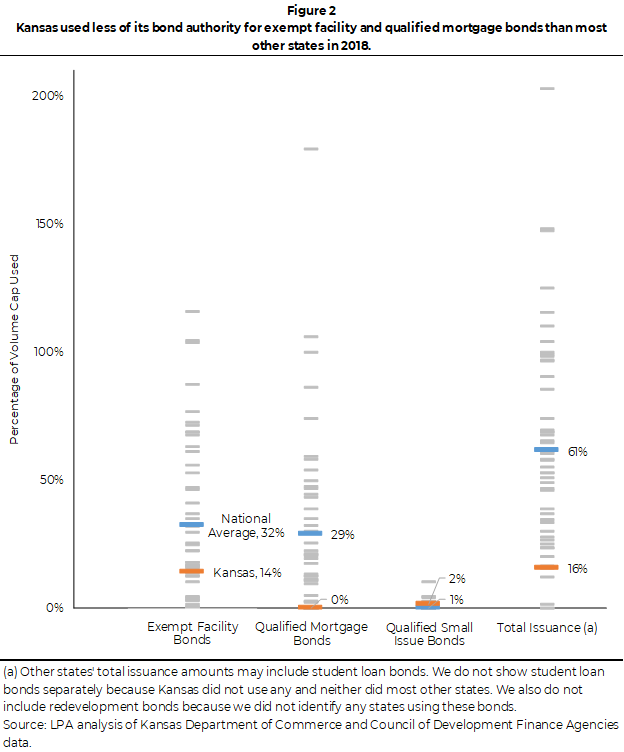

- In 2018, Kansas issued 14% ($43.6 million) of its bond authority for exempt facility bonds.

- Most other states issued more exempt facility bonds than Kansas, as Figure 2 shows. The 49 other states and the District of Columbia issued an average of 32% of their bond authorities for these bonds in 2018.

- Indiana, Iowa, and Oklahoma used between 16% and 28% of their bond authorities for exempt facility bonds in 2018.

- Although there were small differences in how states issued their bond authorities in 2016 and 2017, Kansas was still at or near the bottom across all three bond categories in Figure 2. For example, Kansas used only 2-3% of its authority for exempt facility bonds in 2016 and 2017, whereas the national average was 28-35%.

Unlike most other states, Kansas did not use qualified mortgage bonds to assist first-time homebuyers from 2016 through 2018.

- Qualified mortgage bonds are a type of private activity bond to help first-time homebuyers and veterans obtain more affordable mortgages. Neither the homebuyer’s income nor the home price can exceed certain limits.

- Kansas has not issued any qualified mortgage bonds in more than 10 years. The last time it did was in 2008.

- As Figure 2 shows, the 49 other states and the District of Columbia issued qualified mortgage bonds that averaged 29% of their bond authorities in 2018. However, there were 11 other states that, like Kansas, issued no qualified mortgage bonds in 2018.

- Indiana, Iowa, and Oklahoma issued between 10% and 35% of their bond authorities for qualified mortgage bonds in 2018.

- Kansas issues fewer private activity bonds than other states mainly because Kansas does not use qualified mortgage bonds.

Kansas used more of its bond authority for small issue bonds than most other states from 2016 through 2018, but no state issued significant amounts of these bonds.

- Small issue bonds can buy, build, or improve land or property. These bonds can finance things like manufacturing facilities and first-time farmer programs. Small issue bonds sold for a project generally cannot total more than $1 million.

- Kansas used 2% ($5.4 million) of its bond authority for small issue bonds in 2018.

- The 49 other states and the District of Columbia did not make much use of these bonds, as Figure 2 shows. Only 16 other states used these kinds of bonds in 2018.

- In the three states we looked at, Indiana and Iowa also used small portions of their authorities for these bonds. Oklahoma did not use small issue bonds.

A few factors might explain why Kansas uses private activity bonds less than other states.

- Kansas issues fewer private activity bonds than other states mainly because Kansas does not use qualified mortgage bonds. Kansas counties used to issue mortgage bonds as part of a homebuyer program but have not done so since 2008. We discuss the current homebuyer program later in the report.

- Commerce and Kansas Development Finance Authority (KDFA) officials thought Kansas’ low private activity bond use might be due in part to the low interest rate environment and a small population. If these things are true, it could mean Kansas’ low use of private activity bonds is due to factors beyond state agencies’ control.

- Low interest rates may make private activity bonds less attractive to borrowers. This is because tax-exempt bonds have more administrative requirements than taxable bonds. Taxable bonds or conventional financing may be easier to use without significant extra cost when interest rates are low.

- Kansas’ small population may mean there is less demand for private activity bonds. KDFA officials also said Kansas’ population might not be big enough for a cost-efficient mortgage bond program in the current interest rate environment.

- These factors did not limit other small states’ use of private activity bonds. We therefore think it is unlikely these factors explain why Kansas is different.

- Other states may be better able to use private activity bonds than Kansas because they started housing programs many years ago. These programs likely benefitted from more advantageous interest rate environments in the past. The current interest environment is less favorable for private activity bonds.

- However, private entities may not know they can use private activity bonds to borrow money. It is possible more borrowers would use these bonds if they knew about them.

Administering the Kansas Housing Assistance Program at the county level costs the state nothing but may result in missed opportunities.

The Kansas Housing Assistance Program is a program for low and moderate-income homebuyers.

- This program makes mortgages to low and moderate-income Kansans. It offers a variety of 30-year fixed-rate mortgage options. It also includes optional down payment assistance.

- This program has been around since the 1980s but has changed with shifts in economic conditions.

- Program officials told us that prior to 2008 the program financed mortgages using qualified mortgage bonds, a type of private activity bond. That is likely because interest rates were higher than they are now.

- Program officials said this program did not operate during 2008-2014. The national recession took place during some of these years and interest rates were very low. The program restarted in 2014.

- The current program does not use qualified mortgage bonds (nor any other kind of private activity bond). Instead, it uses mortgage-backed securities. Mortgage-backed securities are investments that are backed up by mortgage loans. Program officials said qualified mortgage bonds do not work well in the current economy. Mortgage-backed securities work better in low interest rate environments and are less restrictive than qualified mortgage bonds. For example, they are not limited to first-time homebuyers. The securities also finance the program’s operation.

- Kansas also has other housing programs. For example, the Kansas Housing Resources Corporation has a federally funded down payment assistance program. However, it is not statewide and is only available to low-income individuals. We did not look at these other housing programs because they do not operate statewide or do not involve mortgage loans.

Two counties administer the Kansas Housing Assistance Program, but homebuyers in all Kansas counties can participate.

- Under state law (K.S.A. 12-5219 et seq), only local governments can issue qualified mortgage bonds. State entities like the Kansas Housing Resources Corporation cannot issue these bonds. Because the program originally issued qualified mortgage bonds, it was set up as a county-run program.

- Sedgwick and Shawnee counties co-sponsor the program and set its policies. The two counties contract with an investment banking firm, Stifel, Nicolaus & Company, Incorporated, to manage the program’s day-to-day operations. That includes activities such as recruiting lenders and selling mortgage-backed securities.

- To take part in the program, a homebuyer must buy a home in an area that has an agreement with the program. These agreements are with incorporated cities and, for unincorporated areas, counties. As of 2019, the program had agreements with 86 counties and 334 cities.

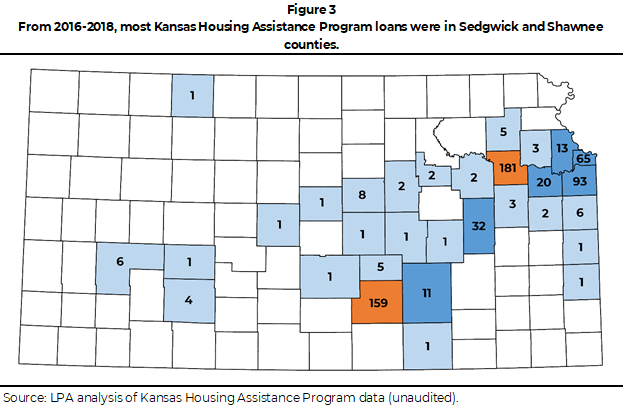

- According to Stifel, the program made 633 loans in 31 different counties from 2016 through 2018. As Figure 3 shows, the program made most loans in Sedgwick and Shawnee counties.

Unlike Kansas, all other states administer homebuyer programs through state agencies.

- We worked with officials from the National Council of State Housing Agencies to learn how other states run homebuyer programs. Those officials told us state entities operate homebuyer programs in all 49 other states. Kansas is unique because it does not have a homebuyer program administered by a state-level entity.

- Other states’ programs use some combination of qualified mortgage bonds and mortgage-backed securities. National Council of State Housing Agencies officials told us housing agencies started using mortgage-backed securities after the recession. Most states use both qualified mortgage bonds and mortgage-backed securities. However, some states, including Kansas, use only one of these options.

We identified some important tradeoffs for policymakers to consider when looking at how Kansas administers its homebuyer program.

- We interviewed a variety of stakeholders in Kansas and other states to get their perspectives on the advantages and disadvantages associated with how Kansas administers its homebuyer program.

- We interviewed Kansas stakeholders to get their perspectives on how the Kansas Housing Assistance Program is administered. Those stakeholders included officials from the Kansas Development Finance Authority, Kansas Housing Resources Corporation, Department of Commerce, Sedgwick and Shawnee counties and their bond counsels, and Stifel. Because Kansas officials’ only experience is with a county-administered program, they could not say what the advantages or disadvantages would be if it switched to the state.

- We also spoke with officials from four other states about their opinions: Indiana, Iowa, Oklahoma, and Pennsylvania. We selected states similar to Kansas in population and geography and one state that is very different (Pennsylvania) for contrast. Unlike Kansas, officials in those states have only experienced a state-administered program. Therefore, they could only speculate about what the advantages and disadvantages would be if counties administered their programs.

Kansas’ county-administered homebuyer program is advantageous because it creates no cost or risk for the state.

- Kansas’ program currently does not cost the state anything. Administering the program at the state level would likely involve both initial and ongoing costs. KDFA officials said a state-run program could need significant funding for at least several years. This is because a new program would not be able to fund itself immediately. A bond-financed program would need a reliable source of funding to pay debt service on any bonds issued.

- The current program structure does not expose the state to financial risks. A state-administered program may expose the state to financial or reputational risks. For example, homebuyers might default on loans. That could cause problems with the program’s finances and require the state to contribute additional funds. If the program failed to repay bond buyers, the state’s reputation could suffer.

Kansas’ county-administered program is disadvantageous because it reduces opportunities for additional state housing revenue and program use.

- Kansas’ program currently generates revenues for Sedgwick and Shawnee counties and Stifel. A state-administered program could provide revenue to the entity that operates it.

- Other states that operate homebuyer programs usually profit from them. These profits are possible because homebuyer programs can charge homebuyers slightly higher interest rates than the interest rates on the bonds used to finance the loans. Officials in other states said program revenues fund their state housing agencies. They told us their agencies do not get state appropriations.

- A state-administered program may generate enough revenue to expand other programs without state appropriations. Homebuyer programs in other states make enough money to fund other programs or services. For example, Iowa officials told us state housing finance agencies are typically supported by their first-time homebuyer programs. Pennsylvania officials told us they use homebuyer program revenue to fund programs for veterans and foster children. However, a state-administered program in Kansas might not be able to do this because of the current low-interest rate environment.

- A state-administered program may be able to reach a wider audience by leveraging existing housing resources and expertise. State housing agencies run other housing programs and have existing partnerships with peers. They also are familiar with local housing needs across the state. For example, Kansas Housing Resources Corporation officials said they may be able to combine the homebuyer program benefits with those from other programs they administer to give homebuyers more options. This might allow them to reach a wider audience and expand interest in the program.

Conclusion

Kansas uses private activity bonds much less than other states and doesn’t use them to help first-time homebuyers. It may be okay that Kansas is different in this way, but it also may result in missed opportunities. For example, the Kansas economy simply may not support greater use of private activity bonds. Conversely, Kansas may be missing opportunities to generate revenue or expand its homebuyer program based on its current structure. Ultimately, policymakers must weigh the tradeoffs associated with changes to Kansas current structure. The data is inconclusive.

Recommendations

We did not make any recommendations for this audit.

Agency Response

On December 23, 2019 we provided the draft audit report to the Kansas Department of Commerce, the Kansas Development Finance Authority, the Kansas Housing Resources Corporation, Sedgwick County, Shawnee County’s bond counsel, and Stifel, Nicolaus & Company, Incorporated. The Kansas Housing Resources Corporation submitted an optional response. In its response, the Kansas Housing Resources Corporation generally agreed with our findings.

Additionally, during the draft review process, we made minor changes to the draft based on informal feedback from the parties to which we provided a report. These changes did not affect our findings or conclusions.

Appendix A – Cited References

This appendix lists the major publications we relied on for this report.

- An Overview of Housing Finance Agencies (September 2018). Moody’s Investors Service.

- CDFA Annual Volume Cap Report: An Analysis of 2016 Private Activity Bond & Volume Cap Trends (September 2017). Council of Development Finance Agencies.

- CDFA Annual Volume Cap Report: An Analysis of 2017 Private Activity Bond & Volume Cap Trends (September 2018). Council of Development Finance Agencies.

- CDFA Annual Volume Cap Report: An Analysis of 2018 Private Activity Bond & Volume Cap Trends (October 2019). Council of Development Finance Agencies.

- Private Activity Bonds: An Introduction (July 2018). Steven Maguire & Joseph S. Hughes, Congressional Research Service.

- State Housing Agencies: At the Center of the Affordable Housing System (September 2018). National Council of State Housing Agencies.