State Surplus Property: Evaluating Opportunities to Generate Revenue from State Owned Land and Buildings

Introduction

Representative Ken Corbet requested this audit, which was authorized by the Legislative Post Audit Committee at its April 25th, 2018 meeting.

Objectives, Scope & Methodology

Our audit objective was to answer the following question:

- How much surplus property does the state own that could feasibly be sold, and how much revenue could be generated by selling that property?

The scope and method included evaluating the state’s real property inventory for a judgmental sample of nine state agencies to identity potential surplus property. We interviewed state officials from those agencies to determine whether those properties were surplus. We then worked with county and city officials to estimate the potential net revenue to the state from selling that surplus property. More specific details about the scope of our work and the methods we used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

Audit standards require that we report on any work we did related to internal controls relevant to our audit objectives and the deficiencies we identified. In this audit, we reviewed the Department of Administration’s controls to help agencies identify and sell surplus real property and determined they were inadequate. Details on this finding appear later in the report. We also reviewed the reliability of the state’s inventory of real property and found it reliable for the purpose of our audit.

The state could generate about $500,000 in one-time revenue by selling surplus property at three state agencies.

Surplus Real Property in Kansas

State owned real property can become surplus when it no longer supports an agency’s mission or function.

- State owned real property includes fixed or immovable assets such as office buildings, storage facilities, or undeveloped land. It is typically acquired with state funds, federal funds, or as a gift to the state.

- According to federal guidance, real property is considered excess when it is no longer critical to a program’s mission. When this occurs, an agency can work with the Department of Administration to declare it surplus and sell it through the state’s surplus process.

- The state also has a process to sell surplus personal property (e.g., computers, office equipment). We did not evaluate surplus personal property as part of this audit.

State agencies must complete a multi-step approval process involving several entities to sell surplus property.

- Those steps include:

- State agencies work with the Department of Administration to determine whether property they own should be deemed surplus.

- The Secretary of the Department of Administration recommends to the Governor that the property is surplus.

- The Governor must approve the property as surplus.

- The property must have at least one independent appraisal.

- The Joint Committee on State Building Construction must be consulted.

- The State Finance Council must approve the sale.

- Once the sale is approved, state law gives the Department of Administration the authority to sell surplus property through one of several methods. These include public auction, a real estate broker, or sealed bid.

Our review of nine state agencies identified only four properties that we think could feasibly be sold to generate revenue for the state.

- We

selected nine state agencies we thought were likely to own valuable surplus property

because of their size or function. Those agencies included:

- The Adjutant General’s Department

- The Commission on Veteran’s Affairs

- The Department of Administration

- The Department of Commerce

- The Department of Corrections

- The Department of Labor

- The Department of Wildlife, Parks, and Tourism

- The Kansas Bureau of Investigation

- The Kansas Highway Patrol

- We excluded a few large agencies from our review for specific reasons. For example, we excluded the Kansas Department of Transportation because the property it owns is difficult to sell (e.g., right-of-way land). We also excluded the Kansas Board of Regent’s institutions because they follow a different process for selling surplus property than other state agencies.

- We developed criteria to determine whether property was surplus. Our criteria were based on federal guidance and focused on how often property was used and whether we considered its use to be mission critical.

- Based on interviews with officials from our nine sampled agencies, we identified only four properties that met our definition of surplus. In two cases agency officials agreed that the property was surplus and in two cases they did not. Moreover, none of these properties have begun the formal process to be declared surplus property.

- Past audits and studies of state surplus property had similar results as this audit. For example, our previous 2012 audit of state-owned property only identified eight surplus properties and several barriers to selling them. We also reviewed property identified as surplus by the 2016 Alvarez and Marsal study but did not consider them surplus because they were actively used by state agencies.

Our revenue estimates are based on numerous assumptions and will likely differ from final sale amounts.

- We worked with county appraisers and city officials to estimate the one-time revenue to the state associated with selling the surplus property identified in this audit. We primarily based our revenue estimates on the properties’ 2019 appraised values.

- Appraised values differ from actual sale price for several reasons, including market conditions at the time of sale, current demand for property, and method of sale (e.g., auction, real estate broker, etc.).

- Moreover, some of the properties we identified could be used in a variety of ways (e.g., as farmland or as a residential development), which can result in a wide range of potential value.

- Consequently, we rounded our estimates to reflect this lack of precision and to reflect the various ways surplus property could be used.

Surplus Property that May Be Feasible to Sell

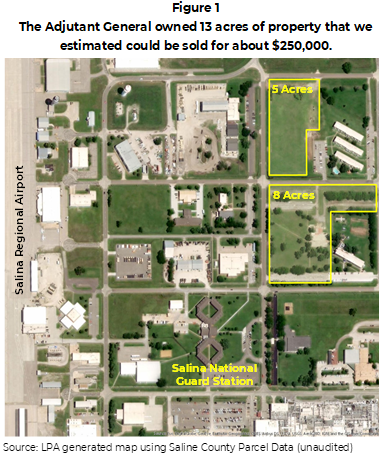

#1: The Adjutant General’s Department owned 13 acres of property near the Salina Municipal Airport that we estimated could be sold for about $250,000.

- As Figure 1 shows, this property included two vacant lots (13 acres total) located near the Salina Regional Airport. Department officials told us the property was mostly inactive, except to occasionally provide extra parking.

- However, department officials disagreed that this property was surplus. Officials told us they plan to build a new training center on this property. Officials told us the training center is not likely to be funded or built for at least 20 years from the time of this audit. Thus, we concluded the property was surplus because of how long it would remain inactive before it was utilized by the Adjutant General’s Department.

- Selling this property could generate about $250,000 in one-time revenue for the state. We worked with the Saline County Appraiser to estimate the potential value of this property. We relied on the county’s 2019 appraised value of the property, which the county appraiser confirmed was a reasonable estimate for its potential sale price.

- If sold, the Adjutant General’s Department would need to find a new location for its future training center assuming it builds one in 20 years as currently planned.

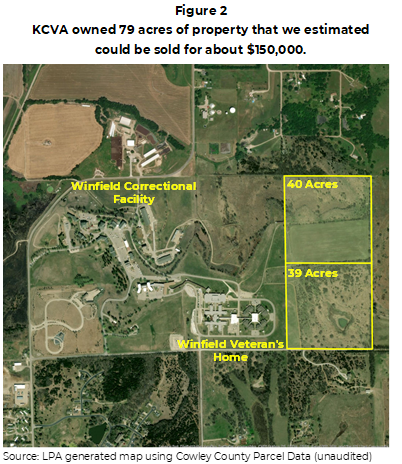

#2: The Kansas Commission on Veteran’s Affairs owned 79 acres of property near the Winfield Veteran’s Home that we estimated could be sold for about $150,000.

- As Figure 2 shows, this property included two tracts of mostly undeveloped land (79 acres total) north and east of the Winfield Veteran’s Home. Officials told us they leased a portion of this property (about 16 acres) to a private farmer. They told us the remaining property was inactive. Although a portion of the property was leased to a private farmer, we concluded it was not mission critical and that all 79 acres were surplus.

- Veteran’s Affairs officials disagreed that this property was surplus. Officials told us the property served as a buffer between veteran’s home residents and potentially disruptive commercial or livestock operations (i.e., noise or odor pollution). Officials told us if the property was sold, they could no longer ensure the property’s use was consistent with the residents’ best interests. Although some buffer may be reasonable, we concluded a buffer of this size was not critical to the agency’s mission.

- Selling this property could generate about $150,000 in one-time revenue for the state. We worked with the Cowley County Appraiser to estimate the potential value of this property. We relied on the county appraiser’s 2019 market value estimate of the property, which the county appraiser confirmed was a reasonable estimate for its potential sale price.

- A few unique barriers may affect this property’s final sale price:

- It is located near the Winfield Correctional Facility, which may reduce public interest in buying the property.

- Veteran’s Affairs leased 16 acres of this property to a private farmer, which would need to be considered as part of a sale. Officials would either need to terminate this lease or exclude the leased property from any potential sale. Officials told us the lease generated about $1,000 in annual revenue for Veteran’s Affairs.

- According to the county appraiser, if sold separately, the north tract would be landlocked and would need access to a nearby county road.

#3: The Kansas Department of Corrections owned 34 acres of property near the Winfield Correctional Facility that we estimated could be sold for about $100,000.

- As Figure 3 shows, this property included one tract of undeveloped land (34 acres) east of the Winfield Correctional Facility. Officials told us this property was inactive and agreed with our conclusion that it was surplus.

- Selling this property could generate about $100,000 in one-time revenue for the state. We worked with the Cowley County Appraiser to estimate the potential value of this property. We relied on the county’s 2019 appraised value of the property, which the county appraiser confirmed was a reasonable estimate for its potential sale price.

- A few unique barriers may affect this property’s final sale price:

- This property was located near the Winfield Correctional Facility which may reduce public interest in buying the property.

- Department of Corrections officials told us being next to a correctional facility also limited how the property should be used to ensure public and inmate safety. For example, officials told us agricultural use would be acceptable, whereas commercial use could create safety concerns.

- The county appraiser told us the property was landlocked and would likely need access to a nearby county road.

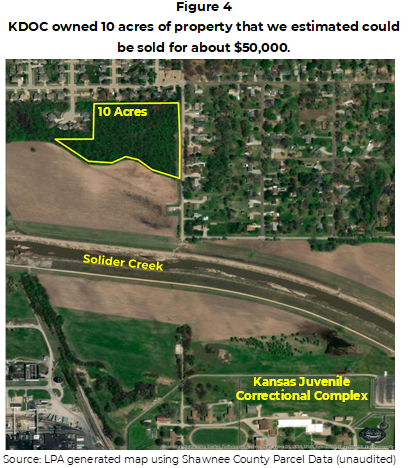

#4: The Kansas Department of Corrections owned 10 acres of property near the Kansas Juvenile Correctional Complex that we estimated could be sold for about $50,000 as is, but could be sold for significantly more if developed as residential property.

- As Figure 4 shows, this property included 10 acres of undeveloped land north of the Kansas Juvenile Correctional Complex in Topeka. Agency officials told us this property was inactive and agreed with our conclusion that it was surplus.

- Selling this property as is could generate about $50,000 in one-time revenue for the state. The Shawnee County Appraiser agreed this would be an appropriate baseline estimate, assuming the property were not developed for residential purposes.

- Selling this property as a residential

development could increase its value to about $500,000, but development costs

would reduce its sale price.

- This property was zoned as residential and was located near other residential neighborhoods. However, the property’s appraised value was not based on the potential for residential development. For that reason, we worked with the Topeka Planning Department and Shawnee County Appraiser to estimate the potential value of this property for residential use. Specifically, we estimated up to 30 residential lots could be developed on this property, with a total estimated value of about $500,000.

- However, the Shawnee County Appraiser told us the sale price for those lots would be less than $500,000 because of development costs (e.g., road construction, utility connections). However, the county appraiser told us additional study would be needed to estimate those costs.

Caveats Regarding Sale Proceed Estimates

We estimated the potential one-time net revenue to the state for selling the surplus property we identified but excluded other tangential benefits or costs.

- We worked with county appraisers and city officials to estimate the one-time revenue to the state associated with selling surplus property identified in this audit. We primarily based our revenue estimates on the properties’ 2019 appraised values. We also accounted for the costs of state required appraisals which ranged from $1,000 to $3,000 for the properties we evaluated.

- Future tax revenue from selling surplus property was insignificant so we did not include it in our revenue estimates. Although state owned real property is generally exempt from state and local property tax, selling it to a private entity would likely remove its exempt status. We estimated the potential tax revenue to the state from selling the surplus property we identified would only be about $200 annually. This was largely because the state’s portion of property tax revenue was small compared to county, city, and other local property taxes.

- We did not account for savings associated with avoided maintenance costs in our revenue estimates. By selling surplus property, the state could avoid ongoing costs associated with maintaining it (e.g., mowing) but we did not try to estimate those savings as part of this audit.

The vast majority (80%) of any surplus real property sale revenues go to the Kansas Public Employees Retirement System (KPERS) and the remainder goes to the selling agency.

- K.S.A. 75-6609 requires 80% of revenue from selling surplus real property to be applied to the KPERS unfunded liability.

- The remaining 20% of revenue is generally distributed to the selling agencies. None of the proceeds from selling surplus real property are directly applied to the state general fund.

- Consequently, for our estimated sale proceeds of about $500,000 in this audit, $400,000 would go to KPERS and $100,000 would go to the state agencies.

- Between fiscal year 2014 and 2018, $1.4 million in revenue from selling surplus real property went to KPERS, which accounted for less than 1% of the KPERS unfunded liability ($8.9 billion as of December 2017).

Surplus Property that Currently May Not Be Feasible to Sell

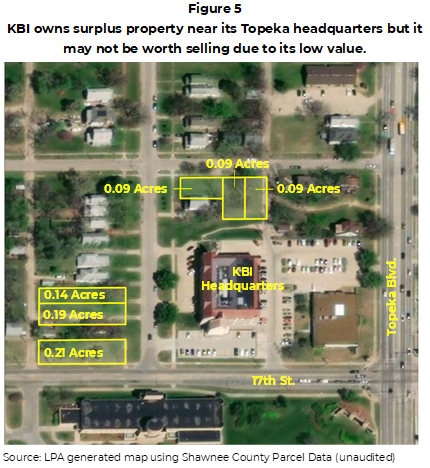

The Kansas Bureau of Investigation (KBI) owned six tracts of property near its Topeka headquarters that we identified as surplus but would generate almost no revenue.

- As Figure 5 shows, this property included six residential tracts totaling less than one acre. Agency officials told us the tracts were inactive, but they had informal plans to build a parking lot and a new document retention center on these properties. However, we concluded the property was surplus because those plans were still informal. Officials agreed with our conclusion.

- Selling all six tracts could generate about $5,000 in revenue for the state. We worked with the Shawnee County Appraiser to estimate the potential value of this property. We relied on the county’s 2019 appraised value of the property, which the county appraiser confirmed was a reasonable estimate for its potential sale price.

- According to the county appraiser, property in this area was not in demand, which would likely make it difficult to sell this property. If it did sell, revenue to the state would be insignificant.

We identified properties used by two other agencies that could become surplus in the next few years.

- The Department of Labor owned a warehouse in downtown Topeka that it used for its printing and mail distribution. However, officials told us they are in negotiations to move their entire printing and mail function to the state’s central printing operation in the next few years. If this occurs, it is possible this warehouse could become surplus property.

- The Department of Administration owned 34 acres of property near the Forbes Field Air Base in Topeka. Officials told us this property was leased to the Kansas Department of Health and Environment for its health and environment laboratory. Officials told us they are in the process of seeking legislative approval to potentially build a new laboratory in a vacant lot south of the current lab. If they get approval, a portion of this property could become surplus in the next few years.

Other Findings

The Department of Administration still did not have sufficient guidance or processes to help agencies identify and sell surplus property, as required by state law and identified in our 2012 audit.

- K.S.A. 75-6609 requires the Secretary of Administration to develop criteria to identify surplus real property, guidance on how to sell surplus property, and to have staff periodically review state owned property to identify potential surplus.

- Department of Administration officials did

not have sufficient guidance or processes to address these requirements. Our 2012

audit of surplus property found that the Department of Administration did not

comply with these requirements. We followed up with current Department of

Administration officials to determine whether these issues were addressed.

- Officials told us they still had not developed criteria to identify surplus property.

- Officials provided us with current guidance on how to sell surplus property. However, officials told us the current guidance was not yet available to state agencies. Only an outdated version of the guidance was available at the time of this audit.

- Officials told us they did not have a formal process to periodically review state property to identify potential surplus.

- A lack of guidance and formal review processes could cause the state to miss potential revenue from the sale of surplus property and creates a risk that agencies do not comply with the statutory requirements.

- Department of Administration officials were not sure why this guidance and review process were not in place but agreed they should be developed.

Conclusion

Kansas agencies own a significant amount of real property, but no one has a process for regularly reviewing the property to determine what is surplus and could be sold. This is problematic for two reasons. First, the state may be missing opportunities to generate additional revenue from the sale of surplus real property. However, as this audit and previous audits have shown, it is unlikely that state owned surplus property would generate a significant financial windfall for the state. The property it owns often is not in a prime location and may have other barriers that make it undesirable to potential buyers. Second, surplus real property creates risks for state agencies because it requires ongoing maintenance and may be subject to vandalism or damage if not in use for extended periods.

Recommendations

- The Department of Administration should work with officials from the Adjutant General’s Department, the Department of Corrections, and the Kansas Commission on Veterans Affairs to determine if they agree that the four properties we identified are surplus and if they should be sold.

- The Department of Administration should develop criteria for identifying surplus real property and make existing guidance for selling surplus real property available to state agencies to use. They should also develop a process for periodically reviewing state owned real property to identify surplus property.

Agency Response

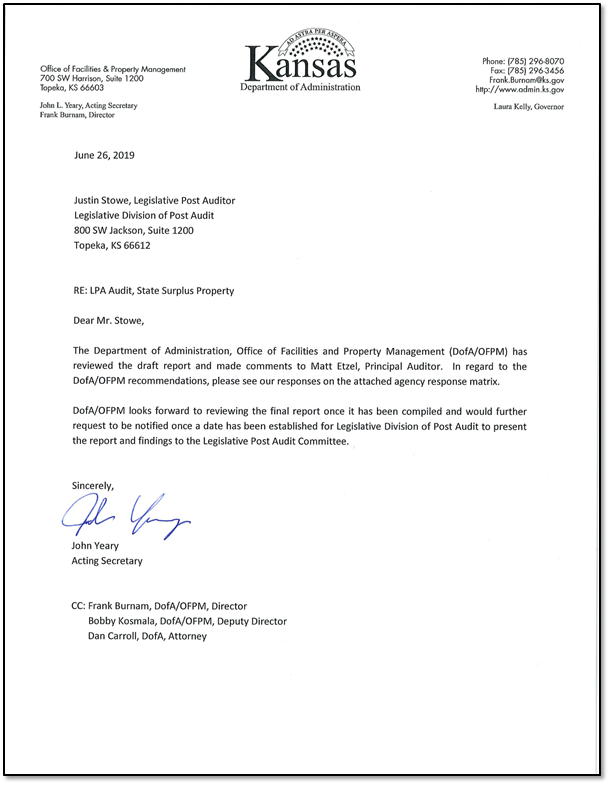

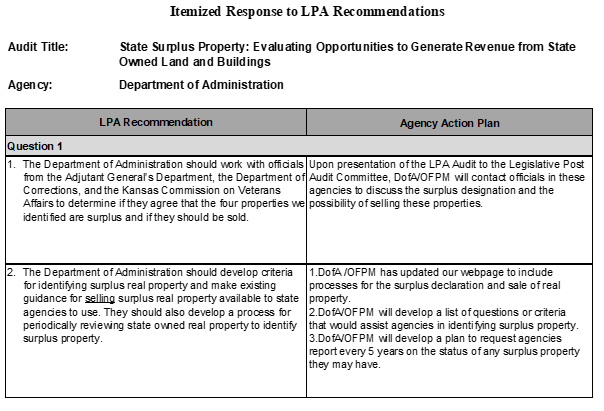

On June 17, 2019 we provided a copy of the draft audit report to the Department of Administration. In their formal response, agency officials generally agreed with our findings and conclusions. Its response is included below.

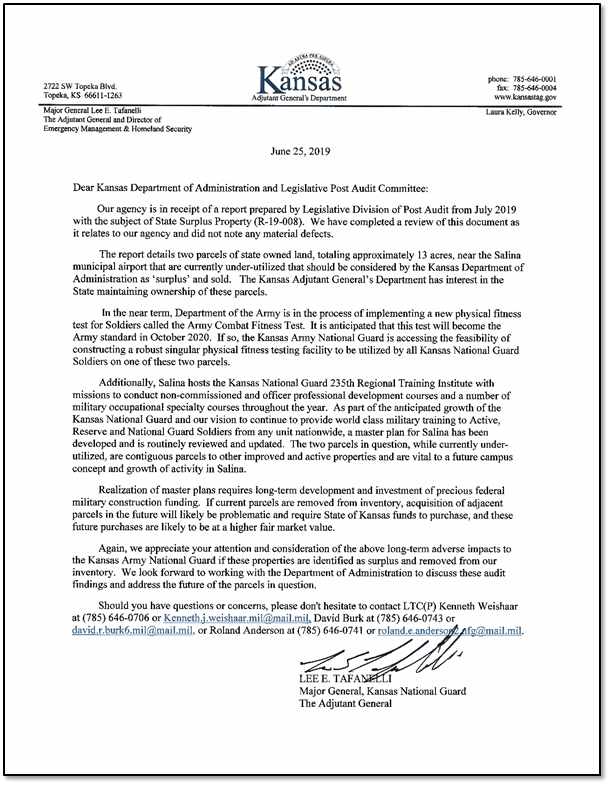

On June 17, 2019 we also provided copies of the draft audit report to the Adjutant General’s Department, the Commission on Veteran’s Affairs, the Department of Corrections, and the Kansas Bureau of Investigation. We did not have recommendations for these agencies, so their response was optional. Although optional, the Adjutant General’s Department submitted a formal response to our audit. In their formal response, agency officials reiterated their desire to maintain the property we identified as surplus for their future use, as was described previously in the report. Its response is included below.

Appendix A – Cited References

This appendix includes a list of the major reports, articles, publications, or studies that we relied on for information in this report.

- Federal Real Property: National Strategy and Better Data Needed to Improve Management of Excess and Underutilized Property (June, 2012). Government Accountability Office.

- Kansas Statewide Efficiency Review (February, 2016). Alvarez & Marsal.

- State Asset Management: Evaluating the Possibility of Cost Savings and Revenue Enhancements through Property Sales (November, 2012) Kansas Legislative Post Audit.