Division of the Budget: Evaluating the Accuracy of Certain Economic Impact Statements

Introduction

This audit is required by K.S.A. 77-416.

Objectives, Scope, & Methodology

Our audit objective was to answer the following questions:

- Are economic impact statements submitted by state agencies generally accurate, and what impact did the director of budget’s review have on them?

- Is the $3 million cost threshold appropriate to trigger the state’s hearing procedure?

To answer these questions, we reviewed a judgmental sample of 23 economic impact statements, submitted by nine different state agencies. This sample was not projectable. State law requires we review statements submitted over the last seven years. We reviewed 21 statements submitted between 2018 and 2020, 1 statement from 2017, and 1 statement from 2014. That’s because prior to legislative changes made in 2018, economic impact statements had much less information for us to evaluate. We did not evaluate statements from 2021 because reports were not yet available for that year. We also reviewed Division of the Budget policies, forms, and annual reports. Finally, we spoke to officials at the agencies involved, the Division of the Budget, and other stakeholders involved in this process.

More specific details about the scope of our work and the methods we used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Through our work we found limited information and inconsistencies in how state agencies reported costs on their economic impact statements. This prevented us from fully assessing the impact of adjusting the $3 million threshold.

Our audit reports and podcasts are available on our website (www.kslpa.org).

The economic impact statements we reviewed had minor issues and inconsistencies that the Division of the Budget did not identify or correct.

Background

Since 2008, state law required state agency officials to complete an economic impact statement for every new or amended Kansas Administrative Regulation.

- State agencies can enact Kansas Administrative Regulations. These regulations assist state agencies in carrying out their duties and responsibilities. They can clarify or expand on requirements in state law and vary in complexity. For example, administrative regulations can establish hunting fees, set criteria for programs like Medicaid and unemployment, and create other rules for businesses, local governments, or the public.

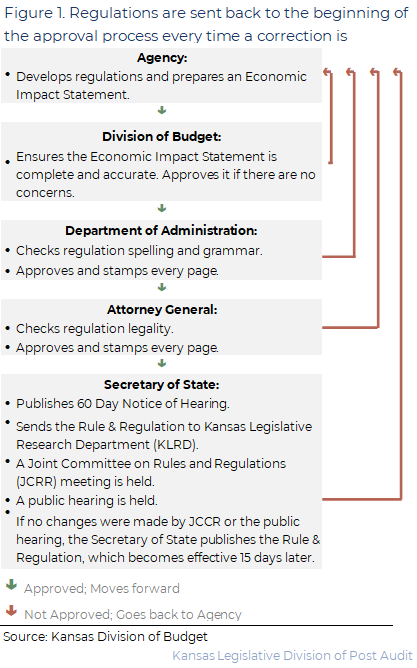

- Administrative regulations go through a multi-step approval process. This includes review by the Kansas Department of Administration, the Kansas Attorney General’s Office, and the Kansas Secretary of State’s Office.

- Originally passed in 2008, K.S.A. 77-416 required state agencies to complete an economic impact statement for every new or amended Kansas Administrative Regulation. Among other things, the statements included a description of any costs or benefits to businesses, local governments, or the public resulting from the regulation. State agencies could, but were not required to, submit these statements to the Division of the Budget for review. Submitted statements were ultimately filed with the Kansas Secretary of State’s Office along with the approved regulation.

In 2018, amendments to state law significantly changed the economic impact statement process.

- The legislature amended K.S.A. 77-416 in 2018. These changes expanded economic impact statement requirements to include additional cost information, economic impact, and other effects of all new or amended regulations. For example, agencies must provide a specific dollar estimate of any implementation or compliance costs associated with new or changed regulation. Agencies must also document steps taken to minimize costs, describe any new economic impact, and show how changes would affect specific businesses or entities.

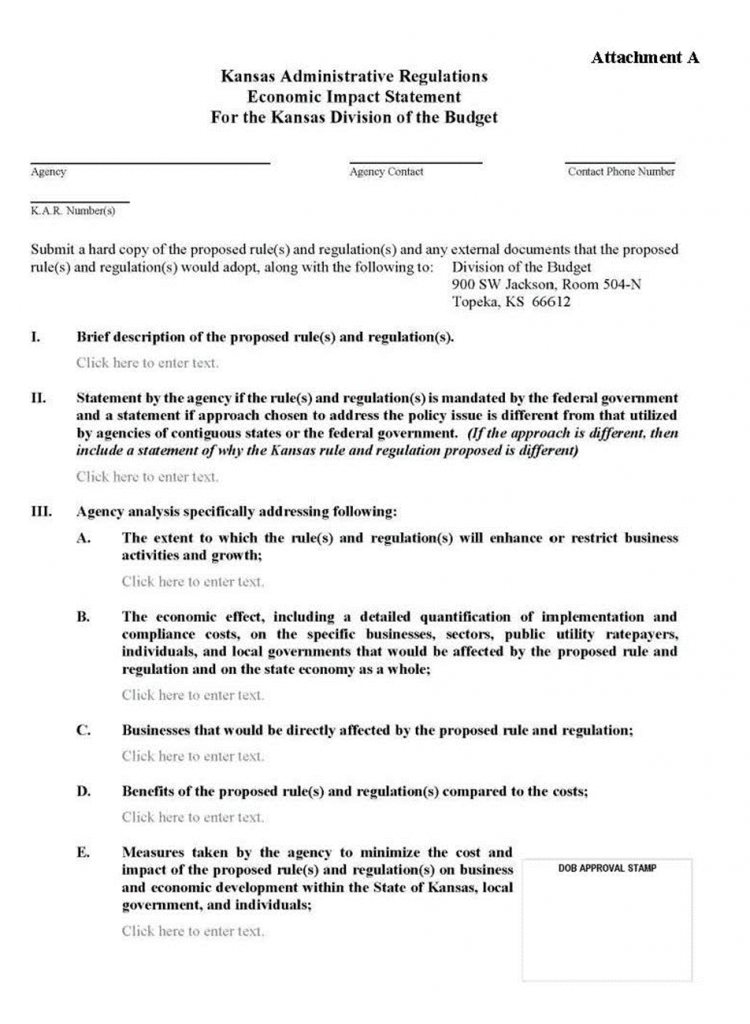

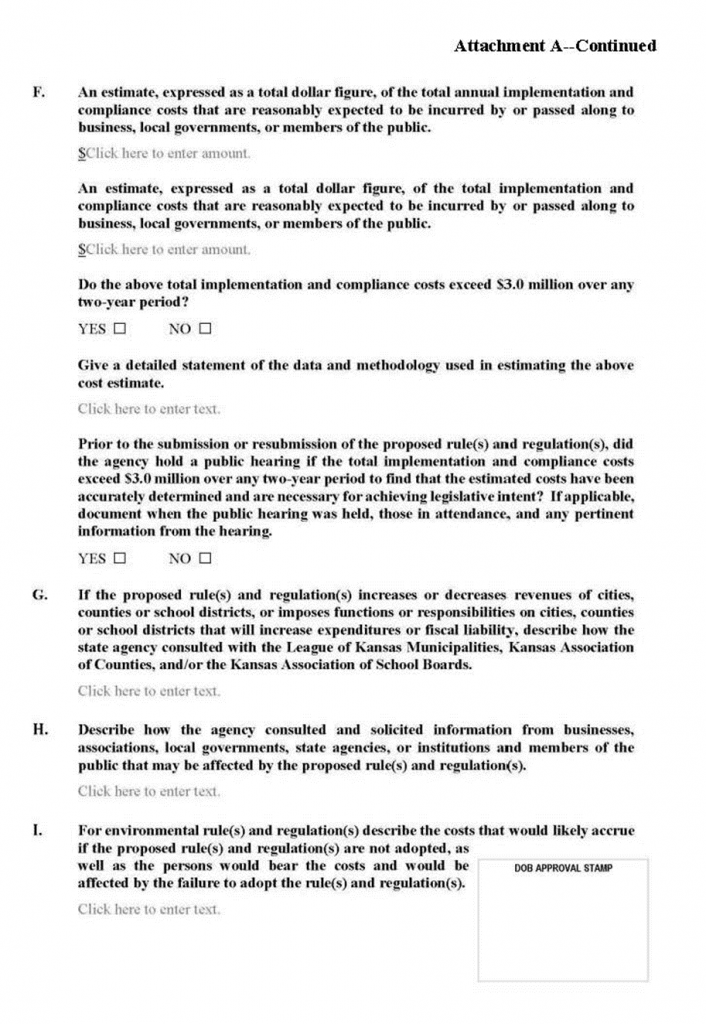

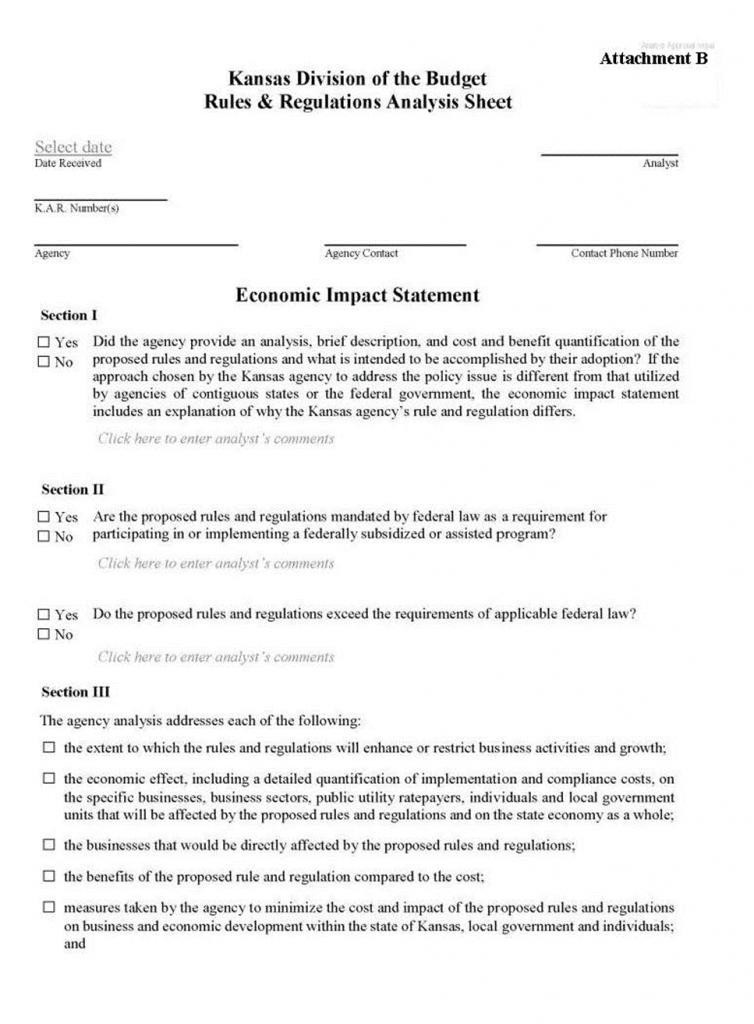

- The legislature also amended K.S.A. 77-420 in 2018. This change required the Kansas Division of the Budget to review and approve all economic impact statements. Under the law, the Director of Budget must review the accuracy and completeness of every economic impact statement. That includes an independent analysis of the costs and economic factors for each statement. The director can reject statements that are incomplete, contain errors, or don’t comply with state law. Rejected statements are sent back to state agencies to be corrected and resubmitted. The Division of the Budget created an economic impact statement template for agencies to use to complete this process. Appendix B contains a copy of that template.

Economic Impact Statement Accuracy Review

Most economic impact statements (84%) submitted from 2018 to 2020 did not have a cost estimate because agencies either believed there was no cost or did not report one.

- Among other things, state law requires agencies use the statements to document a specific dollar amount for any compliance cost (e.g., new license fees) on any new or amended regulations. Agencies must also consider whether two-year costs could exceed $3 million.

- Agencies submitted roughly 380 economic impact statements to the Division of the Budget from 2018 to 2020. Our review showed that only about 60 of the 380 economic impact statements included a compliance cost estimate. Additionally, only 40 of those 60 statements had enough information to determine if two-year costs exceeded $3 million. We were unable to confirm whether or how many of the remaining statements should have had a cost listed but did not.

- We spoke to agency officials at nine state agencies about their experience filling out these statements. Those agencies are listed in the next section. We asked specifically about the cost section. A few agency officials told us they sometimes lack the expertise or data necessary to estimate costs for some regulations. In these cases, although a cost could exist, agency officials were unable to estimate it.

Several economic impact statements we reviewed had small errors.

- We reviewed a judgmental sample of 23 economic impact statements from nine state agencies to determine if they were complete and reasonable. This sample was not projectable. We reviewed these statements to ensure agency officials completed all required fields, that their responses were logical, and that any cost estimates were free of obvious errors. Most of the statements (21) were from 2018 to 2020. We focused on these three years because economic impact statements had more information for us to review after 2018. We also reviewed one statement from 2014 and one from 2017. We selected statements from agencies that perform a variety of functions. Because we were asked to evaluate costs, we made sure about half of our sampled statements had a cost estimate. For those without costs, we made sure no obvious cost estimates were missing or not reported.

- We also spoke to the following agency officials responsible for completing the sampled impact statements:

- Attorney General’s Office

- Board of Healing Arts

- Department on Aging and Disability Services

- Department of Agriculture

- Department for Children and Families

- Department of Health and Environment

- Department of Labor

- Department of Wildlife Parks and Tourism

- Office of the State Banking Commissioner

- We found some minor issues in four of the 23 statements we reviewed. Specifically, two statements did not have enough detail for us to fully understand their cost methodology. One of those statements also left sections on federal requirements and environmental impacts blank. A third impact statement included a minor calculation error related to state savings. Finally, a fourth statement included a single new license cost, but did not estimate that cost across all licensees in the state.

- Some agency officials told us they did their best to complete these statements as accurately as possible. However, they acknowledged that in some cases they lacked the expertise or knowledge to fully complete the statements. Officials also told us they rarely received feedback from the Division of the Budget, so they assumed their approach was acceptable.

State agencies were not consistent in how they filled out economic impact statements, which could limit the usefulness of the statements.

- The Division of the Budget did not provide formal guidance for agencies on how to fill out economic impact statements. They created an economic impact template for agencies to use. However, the Division of the Budget did not provide any guidance to agencies on how to use it. As a result, agencies took different approaches filling out the statements, creating inconsistencies.

- For example, agencies differed on what they reported as a compliance cost. We defined compliance costs as any new costs to an agency, business, or the public (e.g., new or increased license fees). However, several agencies reported changes in revenue or savings as a compliance cost. For example, in one statement the Department of Wildlife, Parks, and Tourism reported state revenue as a cost. In another statement, the Kansas Department of Health and Environment reported state savings as a cost. In these cases, no obvious compliance cost existed. However, an official from Wildlife, Parks, and Tourism told us they wanted to provide some information rather than put an N/A on the statement. Conversely, other agencies reported no costs or N/A in similar situations.

- Agencies also differed on whether to report costs associated with state law. For example, in 2019 the Kansas Board of Healing Arts did not estimate costs for a new Kansas regulation on midwife care. The regulation was created to align with a recently passed state law (K.S.A. 65-28b). Officials noted there could be licensing and other costs related to the statutory changes, but they did not estimate them. That’s because in their opinion, any costs were the result of the recently passed legislation and not a result of its regulation. Conversely, in 2018 the Department for Children and Families reported costs for new juvenile crisis intervention centers. These centers were established under K.S.A. 65-536.

- Finally, agencies differed on how many economic impact statements to submit for large regulatory changes. It’s not uncommon for agencies to revise several similar regulations at once. In some of these instances, agencies submitted a separate economic impact statement for each amended regulation. Other agencies bundled several, similar regulatory changes under a single economic impact statement.

- These inconsistencies could make it difficult for government officials, the public, or other stakeholders to correctly interpret the impact of regulatory changes.

Impact of Review by Division of the Budget

The Division of the Budget’s review appeared to have little effect on agencies’ economic impact statements.

- State law required we evaluate the impact the Division of the Budget’s review had on economic impact statements. To do that, we interviewed Division of the Budget staff, reviewed the division’s policies and templates, and reviewed economic impact statements.

- The Division of the Budget’s tracking records showed they sent back 3 of the roughly 380 economic impact statements to agencies for correction from 2018 to 2020. However, we could not verify whether or how many corrections the agencies made. That’s because the division only maintained the final, corrected version of the statements. It’s possible some corrections may have been resolved with a phone call instead of sending back the form, so we don’t know the full extent of the division’s review. A few of the nine state agency officials we interviewed told us they rarely received feedback from the Division of the Budget.

- The Division of the Budget approved some statements that should not have been approved. We reviewed the worksheets the Division of the Budget used to review our sample of 23 economic impact statements. As discussed above, we found minor errors and inconsistencies in how agencies completed those statements. For example, one statement didn’t include enough information to determine a two-year cost. Other agencies listed revenues instead of costs. Despite that, the Division of the Budget approved those statements. Finally, in one case the Director’s worksheet was not fully completed or signed.

The Division of the Budget’s review process did not include two requirements in state law.

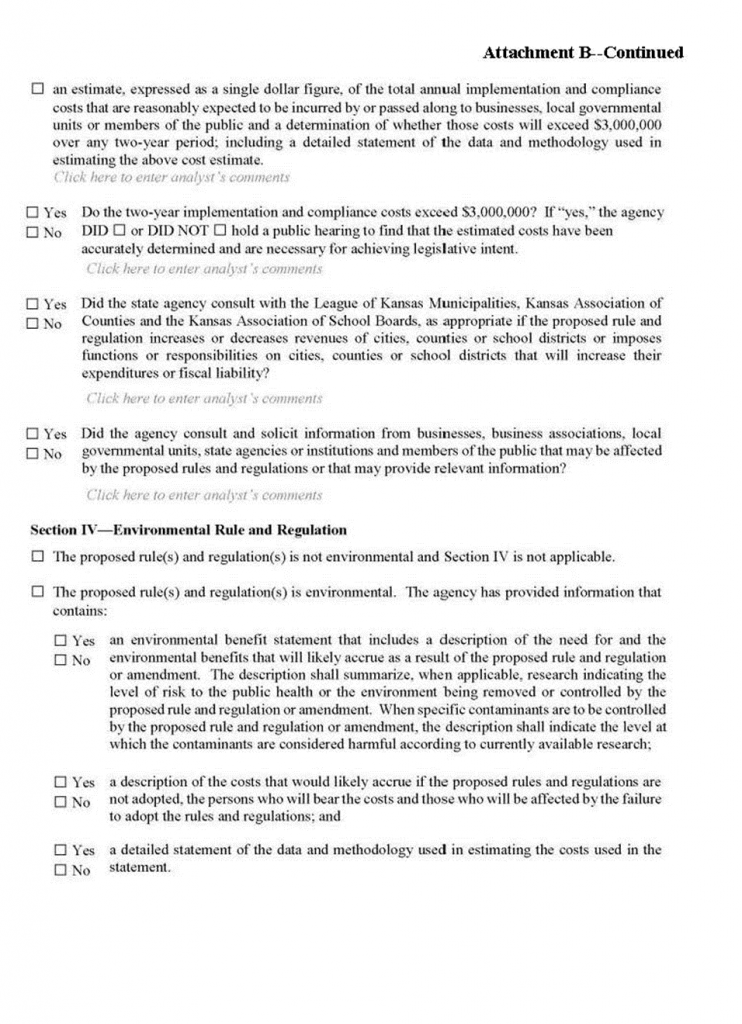

- K.S.A. 77-416 and 77-420 outlined several steps the Division of the Budget must take when reviewing economic impact statements. The division created two worksheets to help ensure it complied with these requirements. The first worksheet documented the division’s initial analyst’s review. The other documented the Director of Budget’s final review and ultimate decision to approve or reject the statement. Both worksheets are included in Appendix B of the report.

- Our review found the worksheets were missing two steps required in state law. State law required the Division of the Budget to estimate any changes in state revenue or expenditures, when possible. It also required an estimate of any immediate or long-term economic impacts, as appropriate. Neither of the division’s worksheets included a section for the division to consider these two requirements.

- The Division of the Budget also does not independently validate agencies’ cost estimates, but this may be okay. State law requires the Division of the Budget conduct an independent analysis of the costs and economic factors for each economic impact statement. However, state law does not specify how detailed their analysis should be. A few staff told us they do not ask for supporting documentation or perform their own analysis to validate estimates. Instead, they review statements at a high level to ensure cost estimates are complete and free of obvious errors.

- One Division of the Budget official told us they lacked the expertise to validate economic impact statements or provide independent estimates. As such, they said they can only perform a high-level review of the economic impact statements. Division of the Budget officials told us a more detailed review to validate or come up with their own estimates would likely require additional resources.

Introduced in 2021, House Bill 2087 would make several changes to the Division of the Budget’s role in reviewing economic impact statements.

- Introduced in the 2021 Legislative Session, House Bill 2087 would have significantly reduced the number of economic impact statements the Division of the Budget reviews. Currently all regulations are required to have an economic impact statement and the Division of the Budget is required to review them all. The bill proposed dropping reviews for all but those economic impact statements with two-year costs exceeding $3 million starting in fiscal year 2025. Of the roughly 380 economic impact statements submitted between 2018 and 2020 that had any costs listed, there were only 2 with costs exceeding $3 million.

- The bill also removed references to the division’s responsibility to “independently determine costs.” Instead, the division would only be required to “review the accuracy and completeness of the agency’s economic impact statements.”

- House Bill 2087 also moved the Division of the Budget’s review to later in the approval process. Figure 1 summarizes the state’s current rules and regulation approval process. As the figure shows, the Division of the Budget is the first agency in the review process. The Department of Administration is second and reviews regulation language for grammatical errors. The Attorney General’s Office is third and reviews regulations for legal issues. House Bill 2087 would have moved the Division of the Budget’s review to after the Attorney General. Stakeholders involved in this process said this would be preferable to the current order. That’s because currently, the Division of the Budget must re-review economic impact statements every time the other two other agencies send a regulation back for correction, which they say happens often.

- House Bill 2087 was not passed during the 2021 session. However, there was further action on the bill during the 2022 session. At the time of this audit, both the House and Senate had passed the bill.

Other Findings

The overall rules and regulation approval process was paper-based and inefficient.

- The state’s administrative regulation approval process was entirely paper based. For example, the Director of Budget physically stamped and signed each economic impact statement he reviewed. The completed paper documents were then sent to the Department of Administration, who followed a similar process before sending the paper documents to the Kansas Attorney General.

- The paper-based process created bottlenecks in the approval process. Officials from a few of our sampled agencies told us the paper-based process was inefficient and caused issues getting their draft regulations approved. A few officials said this was especially true during the pandemic. That’s because remote work accommodations took more time to physically receive, stamp, and mail paper documents.

- Agency officials involved in this review process told us they’ve historically used a paper-based process to approve draft regulations. However, there does not seem to be a requirement they do so. Agency officials told us they’d be willing to explore the idea of an electronic process in the future.

Limited information and inconsistencies in how agencies reported costs prevented us from fully assessing the impact of adjusting the $3 million threshold.

Since 2018, state law required agencies to hold public hearings for any economic impact statements that had two-year compliance costs exceeding $3 million

- The purpose of these hearings is to get public input on potentially significant additional compliance costs related to the new regulation.

- Revisor of Statutes staff were not sure why the threshold was set at $3 million. They thought it might have been modeled after a similar law passed in Wisconsin in 2017. Under Wisconsin’s law, regulations with two-year costs exceeding $10 million must be revised to lower the cost. Otherwise, work on the regulation must be stopped.

From 2018 to 2020, only two economic impact statements had a two-year cost that exceeded the $3 million threshold, according to the Division of the Budget’s records.

- We used the Division of the Budget’s annual reports and its internal tracking document to review two-year cost totals from 2018 to 2020. We only identified two economic impact statements with a two-year cost total that exceeded the current $3 million threshold.

- In 2018 the Department of Labor submitted an economic impact statement that had a two-year cost of $22 million. The regulation made changes to the state’s worker compensation fee schedule. A hearing was held on September 14, 2018.

- Also in 2018, the Department for Children and Families submitted an economic impact statement that had a two-year cost of about $6.8 million. It would have created crisis intervention centers for juvenile offenders. A hearing was held on November 9, 2018.

We were unable to fully evaluate the impact of adjusting the $3 million threshold because of how agencies reported costs.

- As mentioned before, very few economic impact statements from 2018 to 2020 had a cost listed (about 60 of 380). We were unable to determine whether the remaining 320 statements had no cost or if officials just couldn’t estimate one. Further, we found inconsistencies in when and how agencies reported costs. For example, some of the 60 had incorrectly listed a revenue instead of a cost. For these reasons we could not fully evaluate the impact of adjusting the $3 million threshold for these statements.

- However, as mentioned above, only two economic impact statements had a cost above $3 million. As a result, raising the $3 million threshold would have little to no impact. However, lowering the threshold to $1 million may result in a few more hearings. That’s because 9 economic impact statements had two-year costs between $1 million and $3 million.

- Some agencies already hold public hearings for all proposed rules and regulations regardless of cost. Of the nine agencies we sampled, two told us they do this. They told us it helps ensure public buy-in before the regulation is passed.

Conclusion

We did not draw any conclusions beyond the findings already presented in the audit.

Recommendations

- The Division of the Budget should ensure state agency officials understand how to complete economic impact statements so they are consistent across agencies.

- Agency Response: The Division of the Budget (DOB) has supplied the standard economic impact statement template to each agency, and we continue to serve as a resource for agencies when they have questions. While we aim to see consistent methods across all agencies, we also recognize that each agency comes with its own nuances, and methods for analyzing potential economic impacts. DOB will refresh all Executive Branch agencies on how to complete the forms and will reiterate the importance of the economic impact analysis.

- The Division of the Budget should update its economic impact statement templates to ensure they comply with all requirements in state law.

- Agency Response: The Division of the Budget (DOB) is committed to ensuring that we are complying with all statutory requirements for the rules and regulations process. To that end, DOB will conduct a thorough review of all statutes governing the rules and regulations process and will match the listed requirements with our current economic impact statement templates. DOB will identify exactly which statutory requirements are not already listed on our templates and will make necessary edits.

- The Division of the Budget should work with other agencies involved in the regulation process to explore an electronic alternative to the current paper-based approval process.

- Agency Response: The Division of the Budget fully supports transitioning to an electronic process and has suggested this in the past. We will re-surface this conversation with key stakeholders – including Department of Administration and the Attorney General’s Office – and will pursue modernizing the process. The speed at which the process can be modernized will be contingent upon stakeholder buy-in, as well as access to (and funding for) a suitable and secure platform on which this process can be hosted.

Agency Response

On February 28, 2022 we provided the draft audit report to the Division of the Budget. Agency officials generally agreed with our findings and conclusions.

Appendix A – Cited References

There were no cited references for this audit.

Appendix B – Division of the Budget Templates

This appendix includes three templates developed by the Division of the Budget. The first is the Economic Impact Statement template for agencies. The second is the Division of the Budget’s analyst worksheet. The third is the Division of the Budget’s Director’s worksheet.