Angel Investor Tax Credit Program

Introduction

This audit satisfies requirements in K.S.A. 46-1137. The Legislative Post Audit Committee authorized us to evaluate this incentive at its June 1, 2020 meeting.

Objectives, Scope, & Methodology

Our audit objective was to answer the following question:

- What are the Kansas angel investor tax credit program’s estimated economic and fiscal impacts?

To answer this question, we talked to officials and reviewed data from the Kansas Departments of Commerce, Labor, and Revenue. This data covered angel investors who received tax credits under the program. It also covered Kansas businesses that received investment and a control group of non-participating Kansas businesses. We didn’t look at businesses that applied for the program but didn’t participate. We also reviewed academic literature and other states’ evaluation reports to determine what research shows about the effectiveness of these tax incentives.

We determined where program investment came from and went during 2015-2018. We statistically evaluated 181 participating businesses and a control group of 65 other businesses during 2009-2019. This analysis compared how long they stayed in business and how many jobs they created. Finally, we looked at whether 16 businesses that received investment during 2011-2018 stayed in Kansas for 10 years after receiving investment. Our results aren’t projectible.

State law (K.S.A. 46-1137(d)(3)) lists several analyses for us to consider when evaluating economic development incentives. For this evaluation, we focused on whether the program is achieving its goals. We also looked at certain elements of Commerce and Revenue’s administration of the program. Data availability and the program’s nature influenced these decisions.

More specific details about the scope of our work and the methods we used are included throughout the report as appropriate. This includes any significant assumptions we relied on for our analyses.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

Audit standards require us to report our work on internal controls relevant to our audit objectives. They also require us to report deficiencies we identified through this work. We evaluated Commerce and Revenue’s controls for ensuring investor and business data are accurate. We also evaluated Commerce’s controls for ensuring participating businesses stay in Kansas for at least 10 years after receiving investment. Commerce didn’t have a process to proactively enforce this statutory requirement.

The angel investor tax credit program cost Kansas about $20.2 million in forgone income tax revenue in exchange for about $51.5 million in investment during 2015-2018, but we couldn’t tell if the program met its goals.

Incentive Background

The angel investor tax credit program gives investors a tax credit for investing in certain Kansas startups.

- The Legislature created the program in 2004. The program sunsets in 2021 unless the Legislature extends it during the 2021 legislative session.

- The Departments of Commerce and Revenue administer the program. Commerce is responsible for reviewing applications and selecting which businesses can participate in the program. Commerce also determines how much each business can award in tax credits to its investors. Revenue is responsible for processing investors’ credits.

- Statute (K.S.A. 74-8133(b)) allocates $6 million for Commerce to distribute in tax credits each year through 2021. Commerce can roll these allocations over to subsequent years if they don’t award the full $6 million.

- These one-time credits reduce investors’ Kansas tax liabilities dollar-for-dollar. They usually go toward investors’ income taxes. They can also go toward insurance companies’ premium taxes, but this didn’t appear to happen in the years we reviewed.

- Reducing investors’ tax liabilities reduces state revenues. When investors claim their tax credits, the state collects less from them.

- Investors receive credits equal to up to 50% of their investments. They can receive up to $50,000 for each investment in a participating business and $250,000 total each year. Businesses must give investors equity in return for their investment.

- The tax credit partially offsets the cost of an investment. This lowers the investor’s risk and may encourage someone to invest when they otherwise wouldn’t have. Or it may encourage someone to invest more than they otherwise would have. An investor who receives a 50% tax credit only risks 50% of their investment amount.

- We didn’t determine the extent to which the tax credit influenced individual investors’ behavior.

- Investors can transfer their credits to other taxpayers if they haven’t owed Kansas income tax for the past 3 years and don’t expect to owe for the current year. Or they can roll them over to subsequent years until they are used up. Investors must transfer the entire credit amount and can only transfer each credit once. Investors can use credits after 2021 even if the program ends.

The program’s goal is to generate economic growth and support jobs by increasing investment in innovative businesses.

- The Legislature created the program to increase investment opportunities for startup businesses developing innovative and proprietary products or services. It also targets businesses the Secretary of Commerce determines to have the greatest potential to benefit the state’s economy.

- State law (K.S.A. 74-8132, et seq.) requires that businesses be “qualified for investment” before their investors can get tax credits. Businesses must meet certain criteria to qualify.

- Businesses must be headquartered and do business primarily in Kansas. Commerce officials told us this means 80% of operations or 60% of employees must be located in Kansas. Businesses also typically must be less than 5 years old and have $5 million or less in revenue in the most recent tax year.

- Businesses also must have a reasonable potential for success and measurable job creation. And they must have an innovative and proprietary product or service. For example, things like organic foods for soil or nutritional supplements.

- Statute prohibits businesses from certain industries from qualifying. This includes industries like banking, insurance, legal or accounting firms, and construction.

- Commerce is responsible for determining whether a business qualifies and for monitoring the program’s success. After investment, Commerce officials said they look primarily at how long businesses operate to determine the angel investor tax credit program’s success. They said they consider the program to be successful if businesses last at least 5 years. They look secondarily at whether the participating businesses have created jobs.

- Statute doesn’t provide benchmarks for measuring program success. The Legislature didn’t outline its expectations for the program beyond its general purpose. The Legislature hasn’t modified the program’s purpose since creating it in 2004.

Literature suggests these types of programs increase investment but may not help businesses succeed long term.

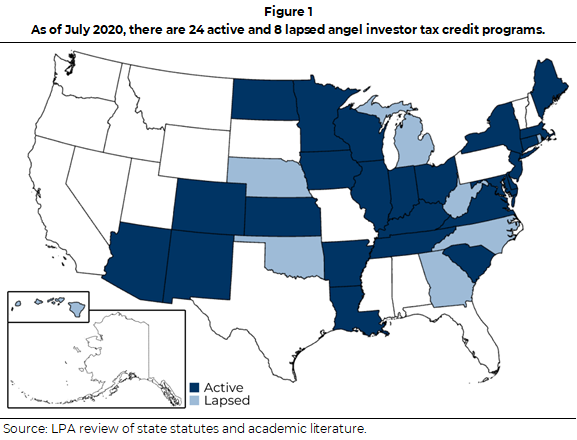

- We reviewed the current literature on angel investor tax credit programs’ effectiveness. We included both academic research and other states’ evaluation reports. Figure 1 shows states with active or lapsed programs.

- Two studies we reviewed suggest these programs increase the number of investors and amount of investments in startups. One academic study reviewed angel investor programs in 31 states across 30 years. It found a 31% increase in the overall number of investors and a 14%-25% increase in the average investment amount. Likewise, a study in Minnesota concluded that fewer investors would have invested in startups without the program. In that study, 48% of investors told evaluators they wouldn’t have invested during the 3-year period reviewed without that state’s credit.

- But two studies show these increases in investor and investment quantity aren’t linked with increases in quality. They showed investors who use angel investor tax credit programs are often inexperienced. They are more likely to be first-time investors and less likely to be professionals compared to the average startup investor. Investments made under credit programs tend to go to lower quality businesses. They have lower sales and employment compared to similar startup investment.

- Finally, one study suggested these programs help businesses keep operating and create jobs in the short term. Initial growth is consistent with any early-stage capital infusion, not just angel investment. However, two studies showed businesses had lower growth and productivity after the initial years. Thus, these programs may not ultimately improve important measures of success like startup creation, employment, and successful exits (e.g. mergers).

Program Evaluation Results

We focused our analysis on the program’s general goals rather than economic or fiscal impact.

- The angel investor tax credit program’s primary goal is to stimulate investment in Kansas startups. So, we looked at where program investment came from and went. We also focused on the program’s other general goals. These include supporting innovation and job creation and helping participating businesses keep operating.

- We didn’t have specific benchmarks to compare our results to. This means we couldn’t conclude on the program’s overall success.

- Further, we didn’t quantify the program’s direct, indirect, and induced economic effects or its return on investment. We also didn’t determine whether it changed business behavior. This is partially because we didn’t have the necessary data. But it’s also because this program doesn’t provide incentives to businesses like many other programs do. Instead, it provides incentives to investors. This makes these types of measures less applicable.

- Finally, we didn’t precisely quantify the program’s fiscal impact to the state. The tax credits awarded under the program reflect its maximum potential impact. Revenue officials told us there aren’t many reasons why investors wouldn’t use their credits. But they couldn’t definitively predict what would happen. The fiscal impact to the state would be less if these credits weren’t fully used.

During 2015-2018, investors received $20.2 million in income tax credits for investing $51.5 million in Kansas businesses.

- We reviewed Commerce and Revenue data on participating investors and businesses during 2015-2018. It showed investments, income tax credits, and investor and business locations.

- 78 Kansas start-ups received $51.5 million in angel investment during the 4 years we reviewed. This capital infusion came from 716 investors. During that same period, these investors received $20.2 million in income tax credits through the program. On average, this means these 78 Kansas startups received $2.54 in private investment for every $1 the state gave up in income tax revenue. Program tax credits equaled 39.3% of investments in the years we reviewed.

Most investors were Kansans, but more than 25% were from out of state.

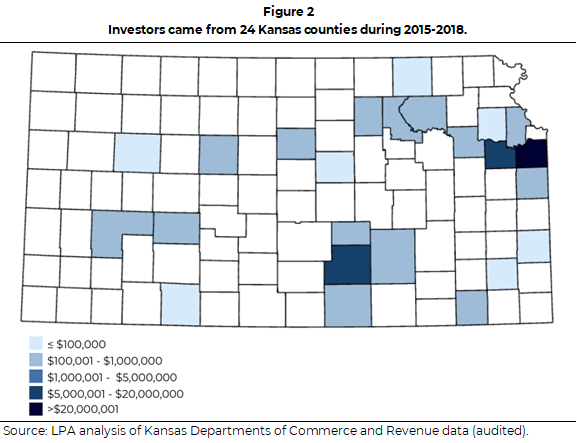

- Kansans invested $37.5 million (about 73% of the total) during 2015-2018. Figure 2 shows how much investors from each Kansas county invested during these years. As the figure shows, most Kansas investment came from Johnson, Sedgwick, and Douglas counties. $21.2 million or about 56% of in-state investment came from investors in Johnson County alone.

- Kansas investors received $14.6 million in total income tax credits. We assume these credits will be used. If so, they reflect the cost to the state for Kansans’ investments.

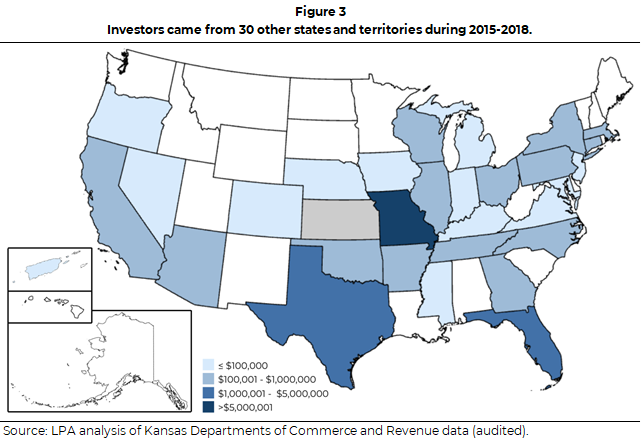

- Investors from 30 states and territories outside Kansas invested $14 million (about 27% of the total) during 2015-2018. Figure 3 shows how much investors from other states invested during these years. As the figure shows, most out-of-state investment came from Missouri, Texas, and Florida. $6.4 million or about 46% of out-of-state investment came from Missouri investors.

- Investors from outside Kansas received $5.6 million in total income tax credits. These credits reflect the cost to the state for these investors’ investments.

- Investors from outside Kansas may be the most likely to transfer their credits. They don’t live in Kansas, so they may not have Kansas tax liability. They may transfer or sell these credits to people who owe Kansas taxes. Again, we assume these credits will be used, either by the investors or someone else.

- Investment from outside Kansas is especially valuable. It adds new money to the state’s economy.

- During 2015-2018, about 72% of all investors (in-state and out-of-state) invested only once. Commerce officials told us these investors likely wouldn’t have invested without the angel investor tax credit program. But Commerce lacks data to support this claim.

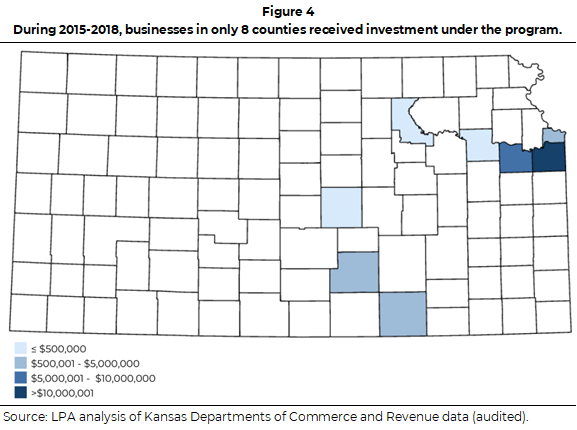

Program investment went to businesses in only 8 counties, meaning it didn’t benefit the state evenly.

- The $51.5 million in investment didn’t directly benefit the entire state. Figure 4 shows the investment totals for each county with a business that received investment during 2015-2018. As the figure shows, the 78 businesses that received investment were located in only 8 counties. One business is counted in 2 counties because it moved during these years.

- 48 businesses in Johnson County received $32.6 million (about 63% of total investment).

- 27 businesses across Douglas, Sedgwick, and Wyandotte counties received $17.1 million (about 33% of total investment).

- 4 businesses across Cowley, McPherson, Riley, and Shawnee counties received $1.7 million. Each of these counties had only 1 participating business.

During 2015-2018, the participating businesses generally appear to have met program intent.

- Statute requires participating businesses to have an innovative or proprietary product or service. We used Department of Labor data to identify the industries of participating businesses.

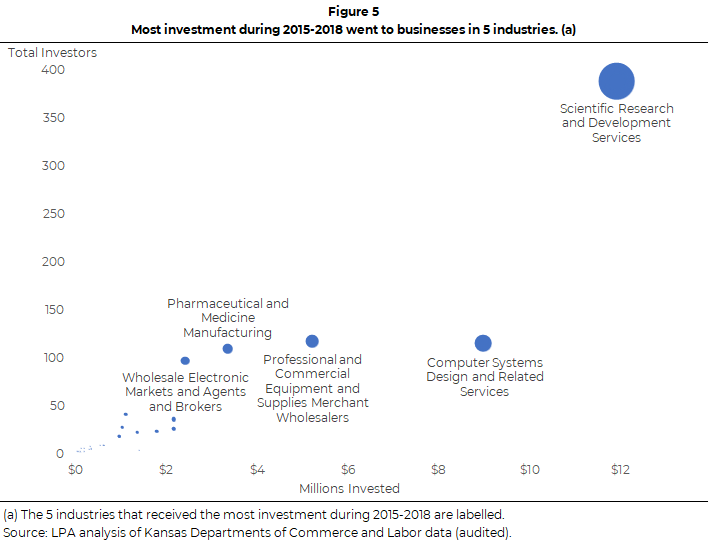

- Participating businesses operated in 31 industries during 2015-2018. Figure 5 shows the top 5 industries that received investment under the program during these years. As the figure shows, most investments went to businesses in industries like scientific research, information technology, and pharmaceuticals.

- Commerce officials told us these are the types of high-tech industries legislators want the program to benefit. We didn’t evaluate the product or service each business provides. But we agree these generally appear to be the right types of industries for this program. The participating businesses working in these industries create things like new therapies for cancer in dogs and bone density loss in humans. But we couldn’t determine whether the program spurs innovation among these businesses. We didn’t have the necessary data (e.g. patent information).

During 2009-2019, the participating businesses we reviewed stayed in business through their first 3-to-5 years about as often as non-participants.

- Commerce officials said they primarily use participating business’ operating life to determine program success. They also look at job creation. We analyzed 2009-2019 Labor and Revenue data to determine whether businesses were still operating at the 3- and 5-year marks. We also analyzed job creation. We reviewed a 10-year timeframe to get a better sense of long-term success.

- Of the 219 businesses that participated in the program during 2009-2019, we had enough data to review 181 of them. We compared them to a control group of similar Kansas businesses that didn’t participate in the program. A Kansas venture capitalist helped us identify a group of 79 of these businesses. Of this 79, we had enough data to review 65.

- Our analysis used several assumptions. We think they impacted both groups of businesses about equally. First, some businesses operated in multiple locations. We combined their employment numbers, which may have overstated the number of jobs they created.

- Further, we assumed businesses that didn’t pay for unemployment insurance had an owner but no employees. We counted them as being in business but not creating jobs. They may have had contracted staff, for which we didn’t have data. But these staff differ from employees and may not reflect newly created jobs. They may be employed by a staffing agency. Or they may do additional work for other businesses. Commerce’s annual report includes contractors and doesn’t account for lost jobs. So, their job creation numbers differ from ours.

- Finally, the Labor data we reviewed only covered the second quarter of each year. So, our analysis shows changes between but not within years. We assumed businesses that appeared in our data and then suddenly dropped out had gone out of business and no longer had employees.

- Overall, few of the businesses that participated in the angel investor tax credit program lasted for 3-to-5 years. But they weren’t statistically different from our control group. Our analysis showed participating businesses lasted about as long as non-participating businesses.

- Only 39% of the participating businesses we reviewed operated for 3 years. 28% lasted for 5 years.

- For our control group of non-participating businesses, 53% lasted for 3 years. 38% stayed in business for 5 years.

- We can’t say whether these percentages prove the program is successful. Neither state law nor Commerce define what percentage is adequate. Consequently, we didn’t have a benchmark to compare to our results.

Kansas businesses that participated in the program created fewer average jobs than non-participating businesses during 2009-2019.

- Each of the 181 participating businesses we reviewed created about 1 job every 2 years on average. This is about half as many as the 65 businesses in our control group. On average, they each created about 1 job each year. This difference is statistically significant at a 95% confidence level. It’s likely participating businesses created fewer jobs than non-participating businesses.

- Further, the participating businesses we reviewed didn’t keep the jobs they created during 2009-2019. On average, they each created about 1 job every 2 years. But for each job they created during 2009-2019, they had lost 0.8 job by the end of this period. Most of the jobs they created didn’t last.

- Overall, the participating businesses we reviewed created 212 net jobs during 2009-2019. The total increased from 298 to 510 jobs in these 10 years. We can’t say whether these job numbers prove the program is successful. Neither state law nor Commerce define the number of jobs they expect participating businesses to create. Again, we didn’t have a benchmark to compare to our results.

- For example, one participating business we reviewed created no jobs from 2009-2012. It created 1 job by 2013 and grew to a peak of 17 jobs in 2016. But by 2017, it didn’t have any employees. It had no employees through 2019.

We couldn’t determine whether participating businesses stayed in business or created jobs because of the program or something else.

- We didn’t have the data required to control for other variables that could affect our comparison. This includes things like geographic location or ownership background. We also didn’t have data on successful exits, such as mergers. Commerce officials said successful exits are an important goal for participating businesses.

- But two scenarios may explain our comparison results. We can’t say which is more likely.

- The program may help lower quality businesses perform more like their higher quality peers. The businesses that participate in the angel investor tax credit program might differ from businesses that don’t participate. For example, Commerce officials said non-participating businesses may be higher quality because they didn’t need the program to attract investment. If that’s true and the program attracts businesses that are lower quality, our results suggest the program may be effective. It may help lower quality businesses perform better than they otherwise would have.

- Or the program may not have a meaningful impact. If the program attracts businesses that are the same quality as businesses that didn’t participate, our results suggest the program may be ineffective. The participating businesses we reviewed performed slightly worse overall than the businesses that didn’t participate.

Other Findings

Commerce didn’t penalize at least 3 participating businesses that left the state more quickly than statute allows.

- Statute (K.S.A. 74-8136(g)) requires participating businesses to stay in Kansas for at least 10 years after getting investment. They are supposed to pay a penalty if they leave early. Commerce’s agreement with participating businesses says this penalty equals the tax credits the business’ investors received. So, businesses agree to this penalty amount.

- We reviewed 16 participating businesses that received investment during 2011-2018. We looked at businesses that had dissolved or converted to a foreign entity in their Secretary of State filings. A foreign entity business is headquartered in another state or country. We thought these businesses may be the most likely to have left Kansas early.

- Of these 16 businesses, at least 3 appear to have left Kansas sooner than 10 years after receiving investment. Investors in these businesses received about $340,000 in tax credits. A fourth business whose investors received $25,000 in tax credits may also have left too soon. We couldn’t tell for sure based on the information we had. Commerce didn’t require any of these businesses to pay a penalty. Commerce officials said it may be too late to do so because the companies left Kansas so long ago or have already returned.

- One business received investment in 2012 and moved to California that year.

- Another business received investment in 2016 and moved to Missouri in 2017. It returned to Kansas in 2020 and is seeking additional incentives.

- A third business received investment in 2015 and moved to Missouri in 2016. Commerce officials said they didn’t think this business was a problem because its parent company is in Kansas. We disagree because the business receiving investment and giving its investors tax credits is in Missouri. Kansas is foregoing tax revenue for the benefit of a Missouri business, regardless of where its parent is.

- Commerce doesn’t proactively monitor businesses to ensure they stay in Kansas for 10 years. That’s likely because Commerce officials consider this rule to be detrimental to some businesses.

- The literature we reviewed suggests startups generally seek successful exits, such as mergers. Requiring participating businesses to remain in Kansas for 10 years may limit their opportunities for such exits. For example, a business in another state may want to acquire and relocate a successful business. But statute would keep this from happening until 10 years have passed. By then, the acquisition opportunity may be gone.

- Commerce officials told us fewer businesses likely apply for the program because of this requirement.

Conclusion

We didn’t draw any conclusions beyond the findings already presented in the audit.

Recommendations

- The Department of Commerce should proactively enforce statute’s requirement that participating businesses remain in Kansas for 10 years. Or for whatever time frame the Legislature decides is appropriate if it amends current state law.

- The Kansas Legislature should consider amending statute to shorten the 10-year requirement.

- The Kansas Legislature should consider amending statute to clarify the angel investor tax credit program’s goals. This might include specific benchmarks for program success.

Agency Response

On November 6, 2020, we provided the draft audit report to the Departments of Commerce and Revenue. Commerce officials generally agreed with our findings and conclusions. Their response is below. Because we did not make any recommendations to Revenue, their response was optional. Revenue officials chose not to submit a response.

Department of Commerce Response

Thank you for the opportunity to review the Angel Investor Tax Credit Program Audit. First, we would like to thank the entire Legislative Post Audit team for their professionalism and patience in conducting this audit. It was truly a pleasure to worth with this team and we look forward to their continued work on future economic development audits in the upcoming months.

We believe that this audit clearly shows the value of the Angel Investor Tax Credit Program to the State. The program is meant to assist innovative Kansas companies so they can compete with companies that have easier access to angel investors/early stage capital. In the report’s control group study, angel investor companies performed similarly to companies not participating in the program. This clearly points to the success the Angel Investor program is having and the value this program has to innovative entrepreneurs in our State.

As one of the few programs in our State focused on innovative entrepreneurship, we must continue to support this crucial program. We look forward to working with the Legislature in renewing the Angel Investor Program before it is scheduled to sunset in 2021.

Once again, we would like to thank Legislative Post Audit for allowing us to be part of this important audit.

Sincerely,

David C. Toland

Secretary

Response to LPA Recommendations

- The Department of Commerce should proactively enforce statute’s requirement that participating businesses remain in Kansas for 10 years. Or for whatever time frame the Legislature decides is appropriate if it amends current state law.

- Agency Response: Under the direction of Secretary Toland, the Department has been conducting site visits for all company applicants, each year that they apply. The Secretary also requested that a review of each economic incentive program take place, including the Angel Investor program. Reviewing previous applicants and making sure they were abiding by the statutory requirements of the program, is part of that process. This review was disrupted as a result of the pandemic, however the Department is committed to making sure it reviews every previous business thoroughly and making sure policies are in place to review applicants on an annual basis.

Appendix A – Cited References

This appendix lists the major publications we relied on for this report.

- 2016 Income Tax Credit Review (December 2016). Arizona Joint Legislative Budget Committee.

- Evaluation of the Minnesota Angel Tax Credit Program: 2010-2012 (January 2014). Economic Development Research Group and Karl F. Seidman Consulting Services.

- Financing Entrepreneurship: Tax Incentives for Early-Stage Investors (December 2019). Matthew Denes, Xinxin Wang, and Ting Xu.

- Financing Entrepreneurship Through the Tax Code: Angel Investor Tax Credits (October 2019). Sabrina T. Howell and Filippo Mezzanotti.

- Investor Tax Credits and Entrepreneurship: Evidence from U.S. States (May 2020). Matthew Denes, Sabrina Howell, Filippo Mezzanotti, Xinxin Wang, and Ting Xu.

- Iowa’s Venture Capital Tax Credits (December 2014). Iowa Department of Revenue.

- State Economic Development Programs (June 2012). Wisconsin Legislative Audit Bureau.

- The Globalization of Angel Investments: Evidence Across Countries (December 2015). Josh Lerner, Antoinette Schoar, Stanislav Sokolinski, and Karen Wilson.