Evaluating the Angel Investor Tax Credit Program

Introduction

This audit satisfies requirements in K.S.A. 46-1137. The Legislative Post Audit Committee directed us to evaluate this incentive at its December 12, 2022 meeting.

Objectives, Scope, & Methodology

Our audit objective was to answer the following question:

- What did participating investors and businesses say about how the Angel Investor Tax Credit program affected their behaviors?

This evaluation assesses whether the tax credit influences investors’ behaviors.

To answer this question, we surveyed businesses and investors that participated in the program between 2015 and 2022. We also reviewed program data from tax years 2015 through 2022 from the Departments of Commerce and Revenue. We used the data to summarize how the program has been used. Finally, we reviewed the Department of Commerce’s process for monitoring whether businesses that participated in the program left the state earlier than state law allows.

Our scope of work did not include an overall evaluation of how the Department of Commerce administers the program. For example, we didn’t assess whether Commerce made appropriate determinations when allowing businesses to participate.

More specific details about the scope of our work and the methods we used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

Audit standards require us to report limitations on the reliability or validity of our evidence. In this audit, we used North American Industry Classification System (NAICS) codes to identify the industries participating businesses were in. These codes are self-reported to the Departments of Commerce (as part of program participation) and Labor (for unemployment tax purposes). We couldn’t verify the reliability of these codes. That’s in part because they’re self-reported. It’s also because each business is only allowed 1 code per location. So, a business with multiple functions but only 1 location only reports 1 code. That code may not convey the breadth of the work it’s involved in. We still used the self-reported NAICS codes because it’s the best and only information available. We think the codes provide a reasonable idea of the types of industries participating businesses are in.

Audit standards require us to report our work on internal controls relevant to our audit objectives. They also require us to report deficiencies we identified through this work. In this audit, we evaluated the Department of Commerce’s controls for monitoring whether businesses that participated in the program stay in Kansas as long as state law requires. We identified implementation deficiencies, as detailed later in the report.

Our audit reports and podcasts are available on our website (www.kslpa.org).

Most investors said the program caused them to invest more or sooner than they otherwise would have, and most businesses said the program helped them do more than they otherwise would have been able to do.

Background

The Angel Investor Tax Credit program gives investors an income tax credit for investing in participating Kansas start-up businesses.

- The Legislature created the Angel Investor Tax Credit (AITC) program in 2004. The program will sunset in 2026 unless the Legislature extends it.

- The Departments of Commerce and Revenue administer the program. Commerce oversees business and investor participation in the program. For example, Commerce reviews businesses’ applications to decide which businesses can participate. Commerce also decides how much in tax credits to allocate to them. Businesses issue those credits to investors in exchange for investment. Revenue then oversees and processes investors’ use of those tax credits.

- State law (K.S.A. 74-8133(b)) limits the amount of credits Commerce can allocate to businesses each year. In 2021 and 2022, the limit was $6 million total. The limit increases by $500,000 per year, up to $8 million in 2026 when the program sunsets. If Commerce doesn’t fully use an allocation in one year, it can use what remains in the next year.

- These tax credits reduce investors’ Kansas income tax liabilities on a dollar-for-dollar basis. For example, if an investor owed $1,000 in taxes and had $500 in credits, the investor would pay only $500 in taxes.

- This reduces the state’s income tax revenues. That’s because investors pay less in income taxes than they otherwise would have.

- Investors receive income tax credits for up to 50% of their investments in participating businesses. An investor can get up to $100,000 in tax credits per business they invest in each year. State law caps the amount of credits an investor can get each year at $350,000. These credit limits are higher than they were when we last evaluated the program in 2020. That’s because the Legislature increased the limits in the 2021 session. Businesses must also give investors equity in return for their investment.

- The tax credit partially offsets the cost of an investment. This lowers investors’ risks and may encourage investors to invest when they otherwise wouldn’t.

- Investors who don’t have enough tax liability to fully use their tax credits can carry unused credits forward for use in future years. Investors can carry their credits forward indefinitely. Investors may also transfer or sell their credits to another person. For this to happen, an investor must have no tax liability in the tax year they earn the credit. The investor must transfer the full amount of the credit.

- In 2021, the Legislature made it easier for investors to transfer their credits. Previously, an investor must have had no tax liability for the prior 3 tax years to transfer their credit. Now, they only need no tax liability for the current tax year.

Commerce administers the AITC program, which is meant to create economic growth by increasing investment in start-up businesses.

- According to state law (K.S.A. 74-8131), the program’s primary goal is to encourage investment in innovative Kansas start-up businesses. The investment is to help create or expand Kansas businesses. This creates jobs and wealth in the state. One of the purposes of this evaluation is to evaluate whether the tax credit influences investors’ behaviors.

- Businesses must meet certain criteria defined in state law (K.S.A. 74-8132 et seq.) to participate in the program. Commerce determines whether businesses meet those criteria.

- Businesses must do most of their business or production in Kansas. According to Commerce guidelines, a business can do this by meeting 1 of 2 criteria. A business may have at least 80% of its operations in Kansas. Or a business may have at least 60% of its employees be Kansas employees.

- Businesses must be relatively new. Most businesses must be less than 5 years old. Bioscience businesses must be less than 10 years old. Any business, regardless of industry, must have had revenues of $5 million or less in the most recent tax year.

- Businesses cannot be in certain industries, such as banking, construction, or real estate.

- Businesses must have a reasonable chance of succeeding, creating jobs, and producing an innovative product or service.

- Commerce monitors businesses while they participate. For example, Commerce ensures businesses appropriately exchange tax credits with investors for investment.

- Commerce is responsible for tracking whether businesses stay in Kansas after they participate in the program. State law (K.S.A. 74-8136(g)) requires businesses to stay in Kansas for at least 5 years after they last participated in the program. Bioscience businesses must stay in Kansas for at least 10 years. Businesses that leave the state too early must repay the state in an amount determined by the Secretary of Commerce.

The literature suggests these types of programs increase investment in lower-growth start-ups.

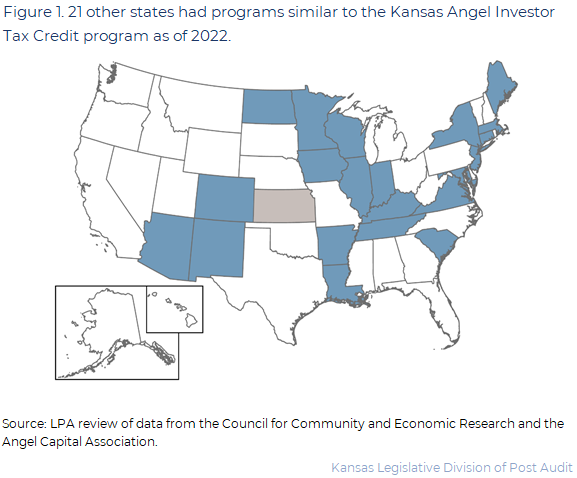

- Many other states have programs like Kansas’s AITC program. We identified 21 other states that had a similar program as of 2022. Figure 1 shows the states we identified.

- We reviewed academic literature and studies from other states. Based on that literature, angel investor tax credit programs increase investment in start-ups. But the investments may be made by non-professional investors and go to lower-growth start-ups.

- For example, we reviewed 1 piece of academic literature that looked at what happened in 31 states that started or ended angel investor tax credit programs. The authors found these programs increase investment, but they aren’t associated with new business creation or employment increases.

- The authors suggest tax credits are more important to non-professional investors. Non-professional investors may be more interested in investments with lower risks, but also lower returns. In these cases, the relative value of a tax credit is higher. This would make credits more appealing to these investors.

- Conversely, professional investors who responded to a survey by the authors said such tax credits weren’t as important to their investment decisions as other factors like management team quality. Professional investors tend to have greater access to high-risk, high-return investments. The authors suggested that in these scenarios tax credits have low value relative to potential profits or losses. They concluded that this makes them unimportant to many professional investors.

Program Use

Between 2015 and 2022, investors received $44.4 million in tax credits for investing $102.1 million in Kansas businesses.

- We reviewed AITC program data from the Departments of Commerce and Revenue. The data showed things like how much investors invested in each business and the tax credits they received. The data also showed where investors and businesses were located. We reviewed data that started in 2015 because our prior evaluation of the program also reviewed data from 2015. We reviewed data through 2022 because 2022 was the most recent year for which complete data was available.

- 123 Kansas start-ups received $102.1 million in angel investment between 2015 and 2022. This investment came from 1,161 investors. Those investors received $44.4 million in income tax credits through the program. On average, start-ups received about $2.30 in investment for every $1 in credit issued to investors.

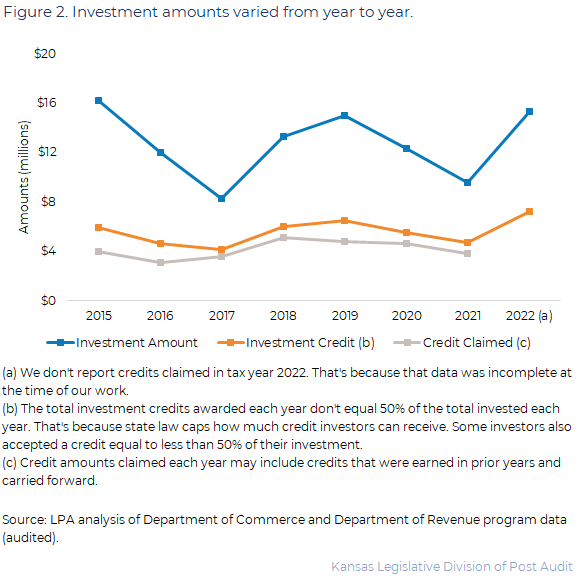

- Figure 2 shows total annual investments made since 2015. As the figure shows, the total amounts invested in start-up businesses varied from year to year.

- Investors claimed $29.1 million in credits between 2015 and 2021. In other words, investors reduced their tax liabilities by $29.1 million in those 7 years. On average, investors claimed $4.2 million in credits each tax year. Investors received more credits ($37.1 million) than they used ($29.1 million). This shows investors don’t claim all credits as soon as they get them.

Most investors were Kansans, but almost 40% were from out of state.

- An investor must be accredited to participate in the AITC program. Generally, an accredited investor is someone with high annual income (i.e., greater than $200,000) or of high net worth (i.e., greater than $1 million). However, other entities are also allowed to invest through the program. For example, general partnerships and LLCs may invest through the program if all owners are accredited investors. An investor must register with Commerce and pay a $150 fee each year they participate in the program.

- An investor doesn’t need to be from Kansas to participate in the program. 729 investors (63%) were from Kansas. The other 432 (37%) were from another state or territory.

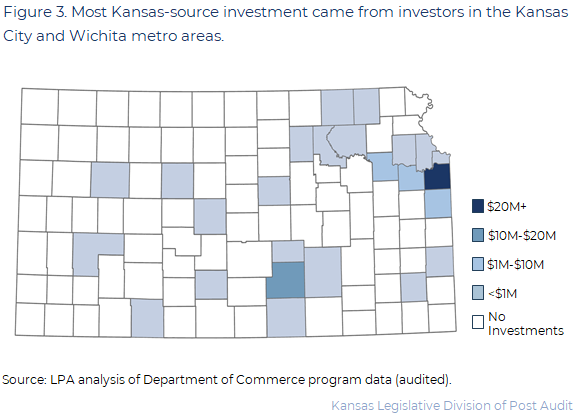

- Kansans invested $72.5 million (71% of total investment) between 2015 and 2022. Figure 3 shows how much investors from each Kansas county invested. As the figure shows, most Kansas investment came from Johnson County. In exchange for their investment, Kansas investors received $31.4 million in income tax credits.

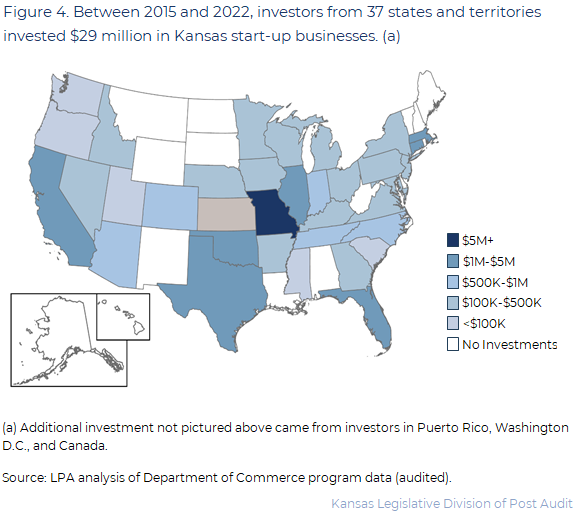

- Investors from 37 other states and territories invested $29.5 million (29% of total investment) between 2015 and 2022. Figure 4 shows how much investors from other states invested. As the figure shows, most out-of-state investment came from Missouri. In exchange for their investment, out-of-state investors received $13.0 million in Kansas income tax credits.

- Investors from outside of Kansas may be less likely to claim their credits. That’s because they may not have Kansas tax liability because they don’t live in Kansas. Instead, out-of-state investors may be more likely to transfer or sell their credits to Kansas taxpayers.

- Between 2015 and 2022, 62% of all investors (in-state and out-of-state) invested once. 34% invested between 2 and 5 times. Only 4% invested more than 5 times.

Most businesses that received investment were in Johnson County and in 4 industries.

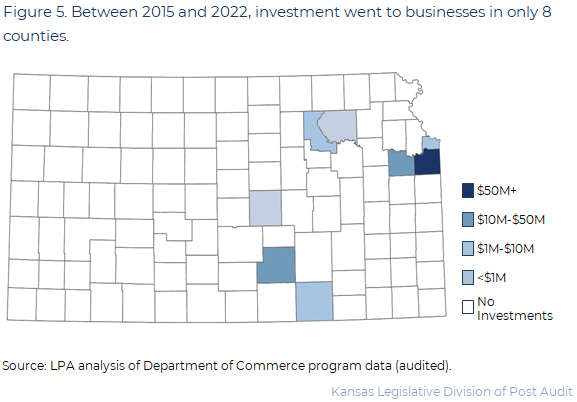

- Businesses that received investment through the AITC program were located in 8 counties. Figure 5 shows how much investment went to businesses in each county between 2015 and 2022. As the figure shows, most counties didn’t have a participating business in them. Further, almost two-thirds of investment went to businesses in Johnson County.

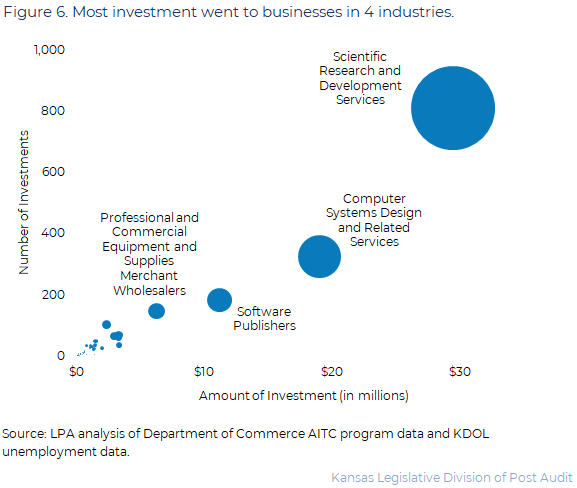

- The 123 businesses that got investment through the AITC program during this time period were in 39 industries. Figure 6 shows that businesses in 4 industries received the most investment through the AITC program. As the figure shows, businesses involved in scientific research and development received the most investment of any industry. Based on their names, businesses in this industry often appeared to be involved in human or animal health work. Businesses self-report the industries they’re in, and we did not research each business to determine exactly what they do. Although we couldn’t verify the industry codes businesses reported, we think they provide a reasonable idea of the types of industries businesses are in.

Survey Results

We surveyed investors and businesses to determine how the AITC program influenced their behaviors.

- For this evaluation, we focused on how the AITC program influenced investors and businesses. We chose this objective because it helps to determine whether the program is meeting its goal of increasing investment in Kansas start-ups.

- To determine how the program influenced behaviors, we surveyed investors and businesses. We used surveys because there’s no other feasible way to evaluate what investors and businesses would have done if they hadn’t received tax credits.

- We surveyed 1,073 investors or groups of investors that participated in the AITC program between 2015 and 2022. 355 (33%) provided complete responses. Most investors (56%) said they were business professionals, business owners, or entrepreneurs. Only 5% said they were professional investors. Most (68%) also said they had no more than 10 years of experience investing in start-ups.

- We surveyed 158 owners, executive officers, or finance officers at businesses that participated in the AITC program between 2015 and 2022. Most of those businesses received investment (119), but some did not (39). The businesses that didn’t receive investment were approved to participate in the program and had the opportunity to use tax credits to attract investment. However, those businesses didn’t successfully attract investment. 52 (33%) of the individuals we surveyed provided complete responses. Some of these respondents represented multiple businesses, and in a few cases, multiple respondents may have answered for the same businesses.

- We can’t generalize the results of our survey to all investors and businesses. But we think our results provide meaningful insights about how the program changed their behaviors.

Investors told us the program caused them to invest more or sooner, but other factors were more important to their investment decisions.

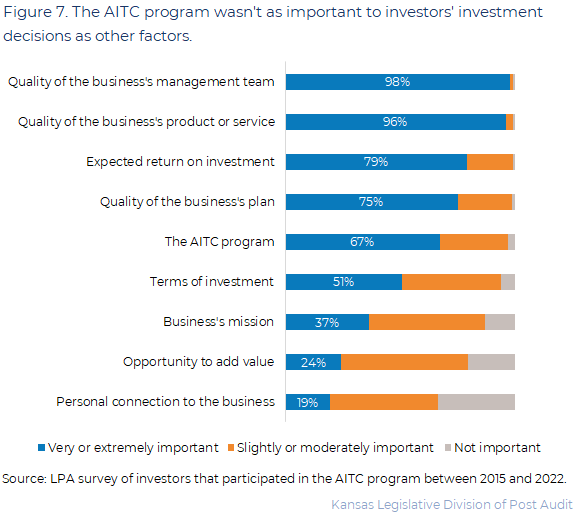

- We asked investors how important various factors were to their decisions to invest in start-up businesses that participated in the AITC program. Investors ranked each factor on a 5-option scale. The scale ranged from “not important” to “extremely important.” Percentages will not sum to 100% because respondents could rank several factors at the same level of importance.

- Most investors said the AITC program was very or extremely important to their investment decisions. This suggests the program often influenced investors’ decisions. However, as Figure 7 shows, investors said other factors were important more often than the AITC program. This means the program wasn’t the only factor investors considered.

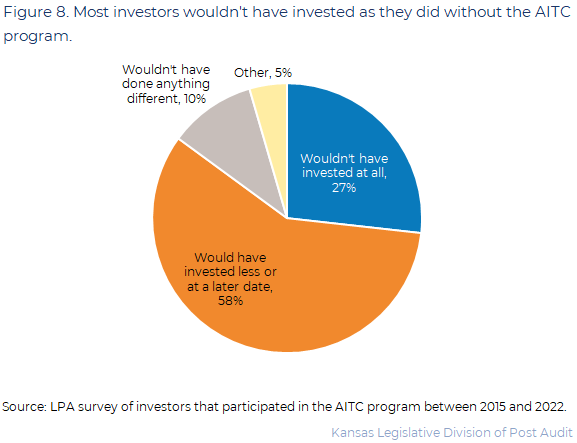

- We also asked investors what they would have done if the AITC program hadn’t been available. As Figure 8 shows, almost all investors told us they wouldn’t have invested as they did if the program hadn’t been available.

- Most investors (58%) said they would have invested less in start-ups or invested at a later date. In some of these cases, the program may have increased the investment start-ups got. In other cases, the program may have helped start-ups get investments earlier. This may have helped start-ups establish themselves when they otherwise wouldn’t have.

- 27% said they wouldn’t have invested at all. Most of these investors (85%) said investing would have been too financially risky without the tax credit. In these cases, the AITC program may have been responsible for the investment start-ups received.

- Only 10% said they wouldn’t have done anything different. In other words, even if the AITC program and tax credits were not available, they would have still invested in the same business for the same amount. In these cases, the AITC program may not have caused anything to happen. Investors received a tax credit for investments they would have made anyway.

- Our survey results suggest Kansas’s AITC program increased investment in start-up businesses. This is consistent with literature we reviewed, which found angel investor tax credit programs appear to increase investment in start-ups.

Most businesses said investments through the AITC program were important and helped them do things they otherwise wouldn’t have been able to do.

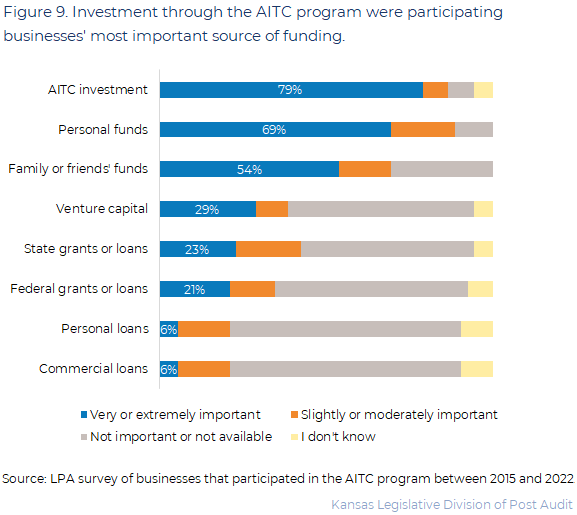

- We asked businesses how important various funding sources were. Respondents ranked each factor on a 5-option scale that ranged from “not important” to “extremely important.” Percentages will not sum to 100% because respondents could rank several factors at the same level of importance.

- Most respondents said AITC investments were very or extremely important. As Figure 9 shows, respondents said AITC investment was important more often than any other funding source.

- We also asked respondents what would have happened if the AITC program hadn’t been available. Respondents could choose multiple options. Percentages below will not sum to 100% because of that.

- Most respondents said their businesses would have started even without the AITC program. But they also said the program benefitted their businesses in other ways. For example, even though they said their businesses would have started:

- 56% said their businesses would have hired fewer employees.

- 44% said their businesses would have had to use less desirable types of financing.

- 27% said their businesses would have offered fewer or lower quality products or services.

- 13% said their businesses would have started later.

- And, as part of a different question, 5 respondents (10%) said the program caused their businesses to locate in Kansas instead of another state.

- Additionally, 17% of respondents said their businesses wouldn’t have started without the AITC program.

- Only 6% said nothing would have been different without the AITC program. In these cases, the program may not have caused anything to happen.

The investors and businesses who responded to our survey said AITC programs help start-up businesses attract investment.

- We asked all respondents if they thought programs like Kansas’s AITC program help start-ups attract new investment and why or why not. We allowed respondents to respond freely to this question. We then grouped responses based on why respondents said these programs attract investment.

- Almost all investors and businesses thought AITC programs attract investment into start-up businesses.

- One of the most common reasons they gave was AITC programs attract investment by reducing the risk of investing in start-ups.

- Other reasons included these programs increasing how much investors invest and that they enhance investors’ financial benefits.

- Finally, some businesses told us the Kansas AITC program specifically encourages investors to invest in Kansas. According to 1 respondent, “Investors can and do invest anywhere in the world. The existence of the tax credit program provides Kansas companies a unique selling point when raising capital. The limited presence of investment capital in this region makes it more challenging to raise needed capital to grow and hire here than on the coasts.”

The survey results suggest the AITC program had a positive effect on businesses that responded to our survey, but it’s not clear that’s true for all businesses that participated in the program.

- The survey results from this evaluation suggest the program helps participating businesses. Most investors told us they wouldn’t have invested as much or as soon without the AITC program. And businesses told us the program helped them start sooner, hire more people, or offer more or better products.

- However, we don’t know if investors and businesses who didn’t respond to our survey have different opinions from those who responded. Most investors and businesses that participated in the program didn’t respond to our survey. They may have different perspectives on the program.

Some survey respondents also suggested ways to improve the AITC program.

- Some of the investors and businesses who responded to the survey thought the AITC program could be improved. Their suggested improvements primarily related to the program’s scope, administration, and advertisement.

- For example, respondents suggested making more tax credits available each year, allowing non-accredited investors to participate, increasing the number of years a business can participate, or reducing how long businesses have to stay in Kansas after participating.

- Others suggested improvements to Commerce’s processes for registering for the program and managing tax credits, and to the AITC website and online portal.

- Finally, some respondents suggested improving the way the program is promoted to increase awareness.

Other Findings

Commerce’s AITC program data was incomplete and sometimes inaccurate.

- The program data Commerce initially provided was incomplete and had inaccuracies. The data was missing records representing about $4 million in tax credits. Most of those missing records were related to 1 business. It also contained a variety of other inaccuracies. For example, data about businesses’ use of the credits they were allocated was incorrect. We worked with Commerce to develop a complete and accurate dataset to use in this evaluation.

- Commerce officials told us the data errors were caused by 2 issues.

- Commerce officials told us they migrated the program data to a new database. Some data didn’t transfer from the old database to the new database during the migration. The new database also can’t currently calculate the credits businesses were allocated but didn’t issue to investors. So, the data has to be manually updated. Commerce hadn’t updated some of those amounts in the data they initially provided us.

- Officials said other errors were due to human errors (e.g., typos during data entry).

- These issues make it difficult to evaluate the program in a timely manner. Although the data is fixable, it takes times to correct errors. This can delay any evaluation that depends on the data.

Commerce appears to have implemented a process to monitor whether participating businesses leave the state sooner than state law allows, but the process needs improvement.

- In our 2020 evaluation, we found Commerce didn’t proactively monitor businesses that participated in the AITC program to ensure they stayed in Kansas for as long as state law requires. At the time of our 2020 evaluation, all businesses were required to stay in Kansas for 10 years. In 2021, the Legislature changed the requirement to 10 years for bioscience businesses and 5 years for all other businesses. We recommended Commerce proactively enforce the requirements in state law.

- Commerce officials told us they developed processes to check for businesses that leave Kansas and to take action against those that do.

- Commerce officials told us that each year, AITC staff review businesses that participated in the program in the past 5 to 10 years. They said they use resources like the Department of Labor’s unemployment data, Secretary of State’s business filings, and internet research to determine if businesses are still in Kansas.

- If staff find that a business may have left the state, officials told us Commerce’s legal department does more investigation before pursuing legal action. If a business doesn’t comply (e.g., by moving business operations back to Kansas) after receiving notification from the department, Commerce may sue the business to get at least a portion of the funds it received through the AITC program.

- We couldn’t evaluate how consistently Commerce follows the process officials described to us because Commerce’s process isn’t well-documented. They also couldn’t provide high-level data about how many businesses Commerce found to be compliant and non-compliant each year or the number of businesses they’re investigating or pursued legal action against.

- However, based on the information we could review, it appears Commerce may not review all businesses timely. For example, Commerce officials told us they checked all businesses in the Department of Labor and Secretary of State data in 2023. But they said they hadn’t completed further investigations on businesses that may have left Kansas.

- The data, documentation, and timeliness issues we observed are likely because the AITC program doesn’t have enough staff. Commerce officials told us only 1 individual currently works on the program. Under their current process, 1 staff member doesn’t appear to be enough to manage day-to-day operations and investigate past participants.

- However, Commerce officials told us they’re revising their process to make it more efficient. Commerce plans to start an annual survey that may increase the speed and efficiency of their monitoring process. In their survey, Commerce will request updates on businesses’ statuses. Commerce will also require businesses to provide documentation showing they have Kansas employees.

Conclusion

Our surveys in this audit show both investors and businesses like and use the program and many said the program influenced their behaviors. However, determining whether the program leads to better business performance is still unclear. According to the literature we reviewed, lower-growth businesses are most often the beneficiaries of angel investor tax credit programs. Our 2020 evaluation found businesses that participated in Kansas’s AITC program survived about as long as non-participating peer businesses. We couldn’t tell whether this meant the AITC program had no effect on businesses, or if it helped lower-growth businesses perform better than they otherwise would have. The business survey from this evaluation suggests the program helped some participating businesses perform better. But we don’t know if those businesses had lower growth potentials. We also don’t know whether the program helped businesses that didn’t respond to our survey.

Recommendations

- The Department of Commerce should develop processes to regularly and systematically review its Angel Investor Tax Credit program data and correct inaccuracies.

- Agency Response: As the agency continues to migrate to a new data system, we will work to systematically review program data and eliminate inaccuracies. As we finalize the transition to a new data system, we will implement strategies to further ensure that our program dataset is complete and accurate. The agency will work with the data system programmers to identify ways to increase automation to improve both efficiency and accuracy.

- Commerce should continue with its plan to make its monitoring processes more efficient. This may include the new survey process Commerce officials described to us. After implementing its plan, Commerce should evaluate whether it helped them provide all the oversight functions required by state law.

- Agency Response: Commerce will continue to update our monitoring processes to ensure the most efficiency possible. Commerce will continue to collaborate with the Department of Labor and Secretary of State to thoroughly document our investigation process to guarantee that businesses are staying in Kansas to meet the statutory requirement. The agency agrees with LPA that additional staff would improve the process. However, we recognize the importance of thorough documentation and will continue to update our monitoring processes to continue to be successful within our current capacity.

Agency Response

On February 7, 2024 we provided the draft audit report to the Departments of Commerce and Revenue. The Department of Commerce’s response is below. The Department of Revenue did not provide an optional written response to the audit. Agency officials generally agreed with our findings and conclusions.

Department of Commerce Response

Dear Ms. Clarke:

The Department of Commerce (Commerce) has reviewed the Performance Audit Report titled, “Evaluating the Angel Investor Tax Credit Program.” The audit objective was to evaluate if the Angel Investor Tax Credit (AITC) program affected the behaviors of participating investors and businesses. In general, we do not disagree with the statements in the report written by the Legislative Post Audit team. The literature review and survey results indicated that the Angel Investor Tax Credit program increases both the amount of and pace of investment in start-ups. Commerce agrees with this assessment and sees this conclusion regularly as we work with these businesses and investors. The program is positively impacting the behaviors of all participants. As the agency continues to migrate to a new data system, we will work to systematically review program data and eliminate inaccuracies. Commerce will also continue to update our monitoring processes to ensure the most efficiency possible.

As we finalize the transition to the new data system, we will implement strategies to further ensure that our program dataset is complete and accurate. It is important to note that the records that were still in the old and had not transferred to the new system represent less than 5% of the entire dataset. Furthermore, the records identified by LP A involved less than 3% of the dataset. While this is a very small amount, Commerce will create further checks and reviews of the transition as well as any manual calculations that must be made. The agency will work with the data system programmers to identify ways to increase automation to improve both efficiency and accuracy.

Commerce will continue to collaborate with the Department of Labor and Secretary of State to thoroughly document our investigation process to guarantee that businesses are staying in Kansas to meet the statutory requirement. The agency agrees with LPA that additional staff would improve the process. However, we recognize the importance of thorough documentation and will continue to update our monitoring processes to continue to be successful within our current capacity.

We are committed to managing the day-to-day operations and investigating past participants of the AITC program for compliance. Both the migration to the data system and implementation of the monitoring system will be completed by the end of 2024. The monitoring system will include updated policies and procedures and each participant will have the proper documentation to demonstrate the location and operation of the business. Annual reviews of these policies will take place to identify improvements and confirm our database integrity.

The Angel Investor Tax Credit program is valuable to start-ups in the state. Commerce is proud to be one of the twenty-one states that offer this type of program to new businesses. We appreciate LPA’s evaluation of program and look forward to fine tuning our operations to improve efficiencies.

Sincerely,

David C. Toland

Lt. Governor/Secretary

Appendix A – Cited References

This appendix lists the major publications we relied on for this report.

- Investor Tax Credits and Entrepreneurship: Evidence from U.S. States (August, 2022). Matthew Denes, Sabrina T. Howell, Filippo Mezzanotti, Xinxin Wang, and Ting Xu.

- Stairway to Heaven (November, 2020). Richard T. Harrison, Adam J. Bock, and Geoff Gregson.