Reviewing the Department of Revenue’s Procedures to Ensure Correct Payment of Sales and Compensating Use Taxes on Motor Vehicle Sales

Introduction

Representative Carl Turner requested this audit, which was authorized by the Legislative Post Audit Committee at its April 25, 2023 meeting.

Objectives, Scope, & Methodology

Our audit objective was to answer the following question:

- Does the Kansas Department of Revenue (KDOR) have adequate procedures to ensure all sales and compensating use taxes due on vehicle sales are remitted to the state?

The scope of our work included reviewing procedures that KDOR currently has to ensure sales and compensating use taxes due on motor vehicles were remitted to the state. It did not include procedures used by county treasurer’s offices or dealerships. However, we looked at fiscal year 2023 county-level vehicle registration and subsequent supporting documentation held by KDOR across multiple divisions that included the Division of Taxation and the Division of Motor Vehicles.

Our methodology included interviewing KDOR officials and a few county treasurers about KDOR’s process and procedures to collect vehicle sales and use tax. We also reviewed documents, training materials, and reports used by KDOR. KDOR staff also demonstrated the use of tools and a database they use in motor vehicle tax collection (for instance a web site used by county treasurers). Additionally, we evaluated whether a sample of counties and dealerships collected and remitted vehicle tax appropriately. To do this, we looked at tax and vehicle records for a non-projectable sample of transactions from fiscal year 2023.

More specific details about the scope of our work and the methods we used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

Audit standards require us to report confidential or sensitive information we have omitted when circumstances call for that (in other words, we had to mask or not specify information the reader would have expected to get due to that information being confidential). In this audit, we omitted the name of the county that was past due on sales and use tax remittances in FY 23. This information is considered identifiable tax information which is confidential under K.S.A. 75-5113.

Audit standards require us to report our work on internal controls relevant to our audit objectives. In this audit, we evaluated whether KDOR had adequate procedures related to collecting motor vehicle sales and use taxes. We did not evaluate their procedures to collect any other state tax (i.e., property taxes). Audit standards also require us to report deficiencies we identified through this work. In this audit, we found that some internal controls related to monitoring and enforcement were inadequate. These are noted throughout the report.

The Kansas Department of Revenue had procedures to help ensure dealerships remit vehicle tax but was missing key procedures related to county tax remittance.

Background

In Kansas, individuals must pay a 6.5% sales or use tax when purchasing any vehicle that is primarily stored or used in the state.

- State law (K.S.A. 79-3603 & K.S.A. 79-3703) requires individuals to pay sales tax or compensating use tax when they purchase tangible property, which includes motor vehicles. Examples of motor vehicles include cars, SUVs, vans, and ATVs.

- Sales and compensating use taxes function in a similar manner for motor vehicle sales. Both assess a 6.5% tax on vehicles. The primary difference is where the vehicle is purchased. Sales tax is assessed on vehicles purchased in Kansas. Use tax is assessed on out-of-state purchases when the buyer returns to Kansas.

- Local jurisdictions also have the authority to assess additional taxes on vehicle sales. For example, cities may charge up to an additional 3%. State and local taxes are collected and remitted (together) to the Kansas Department of Revenue (KDOR) for every vehicle sale. The state then distributes the local government’s share of the tax revenues to the appropriate jurisdiction. We did not evaluate local taxes as a part of this audit.

- Some vehicle purchases are exempt from sales or use tax. For example, vehicles bought for resale (from a wholesaler or other retailer) and vehicles purchased by certain government or non-profit entities are exempt from taxes. Vehicle sales between immediate family members are also exempt. Kansas Regulations (K.A.R. 92-19-30) make county treasurers responsible for reviewing the validity of tax exemptions. If any doubt exists, the county treasurer should collect the taxes owed. The buyer can file a claim with the Kansas Department of Revenue (KDOR) if they disagree.

Sales or use tax is paid either at the dealership upon purchase of the vehicle or at a county treasurer’s office when the buyer registers the vehicle.

- Licensed Kansas dealerships are responsible for collecting sales tax on vehicle sales. In Kansas, anyone who sells more than 5 vehicles a year must register with KDOR to become a licensed dealership. Per K.S.A. 79-3607, dealerships are required to remit the sales taxes they collect to the state. They remit either yearly, quarterly, or monthly. Remittance frequency is based on the amount the dealership collects in taxes. Most dealerships remit monthly. The vehicle purchaser then presents proof of sales tax payment to the county treasurer’s office when registering the vehicle.

- If a vehicle is not purchased at a licensed Kansas dealership, the buyer is responsible for paying sales or use tax at their county treasurer’s office. They pay when registering the vehicle to get a license plate. This includes when a buyer has purchased a vehicle from an out-of-state dealership or from an individual seller (either within or out-of-state).

- KDOR treats the sales of online car retailers (like Carvana or Vroom) as a person-to-person sale. In other words, online car retailers are not treated as licensed dealerships. As such, there is no dealer remittance. Buyers are responsible for paying Kansas sales or use tax at their local county treasurer’s office.

- Kansas does not always receive full tax revenue on vehicles purchased from an out-of-state dealership. If a Kansas buyer is required to pay out-of-state sales tax to a dealership, then Kansas does not receive any of that tax revenue. The buyer must show proof they paid taxes when registering their vehicle in Kansas. The buyer is only responsible for paying any differences between the other state’s sales tax and Kansas use tax.

- Counties record vehicle registration information in a database called MOVRS which KDOR administers. Counties then remit the taxes they collect to KDOR. KDOR officials told us that counties usually remit taxes monthly.

- It is important to note that this audit looks only at the initial payment of sales and use taxes on motor vehicles. It does not review motor vehicle fees or property taxes paid yearly through the county.

In fiscal year 2023, state and local governments received about $1 billion from vehicle and merchandise sales and use taxes.

- Kansas collected $6 billion in local and state sales and use taxes in fiscal year 2023. This included sales and use taxes on all goods or services such as food, clothing, furniture, vehicles, computers, equipment, or books.

- According to KDOR’s estimates almost 17% of this total amount, or $1 billion, was for local and state sales and use taxes on the sales of motor vehicles as well as additional services and merchandise sold at dealerships in fiscal year 2023.

- Of the $1 billion related to motor vehicle sales or merchandise, about $780 million (77%) was collected at Kansas dealerships. Around $230 million (23%) was collected by county treasurer offices.

Two divisions within KDOR are responsible for collecting motor vehicle sales and use tax.

- KDOR is a large agency with over 1,000 employees across several divisions. It serves several functions. These include issuing licenses, assisting local units of government, overseeing distribution and sale of alcoholic beverages, property valuation, and collecting taxes and fees.

- 2 divisions are primarily responsible for ensuring that vehicle sales and use tax is remitted to the state: the Division of Taxation and the Division of Motor Vehicles. However, data and information systems staff, audit staff members, and administrative hearings officers also play key roles in monitoring and enforcing the state’s tax laws.

- The Division of Taxation is responsible for collecting and managing most state taxes, which include motor vehicle sales taxes. They are also responsible for tax collections from local governments, retailers, and individuals.

- The Division of Motor Vehicles handles motor vehicle dealer licensing and works with counties on vehicle registrations.

- The Division of Taxation is responsible for collecting and managing most state taxes, which include motor vehicle sales taxes. They are also responsible for tax collections from local governments, retailers, and individuals.

In 2003, we released an audit that showed KDOR had inadequate procedures to ensure counties and dealerships remitted vehicle sales and use taxes to the state.

- In 2003, we conducted a similar audit of KDOR’s procedures to ensure the state received vehicle sales and use taxes. That audit identified several problems with KDORs procedures. Specifically, it found:

- KDOR’s efforts to ensure that dealerships were remitting all the sales taxes they collected weren’t as effective as they could be.

- Some dealerships didn’t remit all taxes owed to the state.

- Many privately sold vehicles sold for less than fair market value.

- Some claimed tax exemptions were invalid.

- KDOR’s efforts to ensure that dealerships were remitting all the sales taxes they collected weren’t as effective as they could be.

- The audit made several recommendations for KDOR to address these issues. They included improving KDOR’s procedures for dealerships, making tax exemptions harder to replicate, and adjusting how to evaluate the fair market value of privately sold vehicles.

In this audit, we were also asked to review whether KDOR’s procedures were adequate to help ensure the state receives all vehicle sales and use taxes.

- To do this, we identified 19 different procedures related to collecting and remitting vehicle tax. We used LPA’s 2003 audit to develop procedures we expected KDOR to have in place to ensure the state receives vehicle sales and use taxes. We then cross-checked that list with generally accepted auditing standards for internal controls from the Government Accountability Office to ensure the procedures were appropriate. These procedures generally fell into two broad categories: 1) training and guidance and 2) monitoring and enforcement. The procedures applied to dealerships, counties, or both.

- We evaluated whether KDOR designed adequate procedures and checked to see if those procedures had been implemented. We did not evaluate whether KDOR consistently used these procedures. However, we checked actual tax remittances for a sample of transactions to evaluate how the process functioned.

- We did several things to evaluate KDOR’s procedures. We reviewed training materials, county and dealership handbooks, and county and dealer online portals. We looked for examples of delinquent tax notices being sent to dealerships. We also followed up with dealerships and county officials to understand their experiences with KDOR.

- In some cases, KDOR did not have a documented procedure. However, if staff were able to describe an adequate procedure, and show evidence it was being used, we documented that as having a procedure. However, we hoped to see formal, written procedures to ensure efficient and continuous execution through staff changes or other variables.

- It’s important to note that strong procedures help ensure the state collects its tax revenue, but it can’t guarantee every dollar gets collected. There are other factors that impact the state’s ability to collect tax revenue. For example, a taxpayer’s willingness to pay taxes, agency resources, or the number and type of accounts can all influence the state’s ability to collect tax. Even with considerably robust procedures, it’s entirely possible a state still wouldn’t be able to collect 100% of tax revenue owed each year.

Guidance and Training Procedures

We saw evidence that KDOR had several procedures related to training and guidance for counties and dealerships.

- Counties and dealerships collect taxes on behalf of the state and are responsible for remitting them to KDOR. Strong training and guidance procedures help ensure dealerships and counties understand how to properly do this work. We evaluated whether KDOR had 3 procedures related to training and guidance for both dealerships and counties based on generally accepted auditing standards for internal controls. To do this, we interviewed KDOR and county staff and reviewed relevant documents. KDOR staff also demonstrated to us how counties and dealerships access information through online portals. Figure 1 shows the results of this work.

|

Figure 1. KDOR showed evidence they had training and guidance

procedures for counties and dealerships. |

||

|

Training and Guidance Procedures |

Counties |

Dealerships |

|

KDOR provides adequate and regular training or guidance. |

ü |

ü |

|

KDOR routinely updates guidance. |

ü |

ü |

|

KDOR provides contact information and an accessible way to reach KDOR staff. |

ü |

ü |

|

|

|

|

|

Source: LPA review of KDOR procedures. |

|

|

|

Kansas Legislative

Division of Post Audit |

||

- As Figure 1 shows, KDOR had adequate training and guidance procedures for counties. We reviewed training and guidance documents KDOR created for counties. These documents adequately explained key responsibilities and expectations for collecting and remitting taxes to KDOR. KDOR showed they routinely update those documents as needed. We also saw evidence that KDOR provided multiple training presentations to county treasurers in 2023. Topics included handling tax exemptions and evaluating vehicles’ fair market value. Finally, we saw evidence that KDOR provided contact information to counties.

- As Figure 1 also shows, KDOR also had training and guidance procedures for dealerships. However, we noted some improvements could be made.

- We expected KDOR to provide resources to dealerships that explained their role in collecting and remitting taxes. We reviewed KDOR’s guidance documents which had detailed examples of how to collect and remit taxes. They also provided contact information for a KDOR helpline. These documents were available on KDOR’s website and updated periodically.

- However, we noted an area that could be improved. The guidance documents were not available in the dealership portal. Dealerships frequently use the portal as part of their day-to-day operations. Adding the guidance documents to the portal could make it easier for dealerships to see and use.

- We also expected KDOR to provide training to dealerships. Training allows KDOR to give additional explanations and dealerships a chance to ask questions. We reviewed KDOR’s training materials. Although we couldn’t directly observe KDOR’s training, the material covered key concepts related to collecting and remitting taxes.

- However, KDOR officials told us the training is only required for new dealerships applying for their first license. As such, existing dealerships don’t receive periodic training. Having reoccurring training for all dealerships could help ensure they’re all up to date with current requirements.

- We expected KDOR to provide resources to dealerships that explained their role in collecting and remitting taxes. We reviewed KDOR’s guidance documents which had detailed examples of how to collect and remit taxes. They also provided contact information for a KDOR helpline. These documents were available on KDOR’s website and updated periodically.

County Monitoring and Enforcement

KDOR was missing 2 procedures related to the monitoring and enforcement of counties.

- We evaluated whether KDOR had procedures related to monitoring and enforcing motor vehicle tax collections and remittances for counties which are based on generally accepted auditing standards for internal controls. We spoke with KDOR staff and some county treasurers about their processes. We looked for documentation of timelines and enforcement policies, a complaint log in the KDOR audit department, and fiscal year 2023 dealership audits. We also had demonstrations of the county treasurers’ online portal and their monitoring process. The results of our work are summarized in Figure 2.

|

Figure 2. KDOR needs to create additional procedures to ensure counties

remit taxes on-time and in full. |

|

|

KDOR Procedures Related to Counties |

Implemented |

|

Monitoring |

|

|

Uniform process for counties to remit taxes |

ü |

|

Requires use of fair market value |

ü |

|

Clear deadlines for counties to remit taxes |

ü |

|

Process to identify delinquent remittances |

ü |

|

Process to test the accuracy of county tax computations |

ü |

|

Enforcement |

|

|

Progressively increasing enforcement actions |

O |

|

Additional Oversight |

|

|

Process to follow-up on issues reported by counties |

ü |

|

Use MOVRS data to identify suspicious sales prices or tax exemptions |

O |

|

|

|

|

Source: LPA review of KDOR procedures. |

|

|

Kansas Legislative

Division of Post Audit |

|

- KDOR showed evidence of having 6 of the 8 procedures we evaluated. As Figure 2 shows, KDOR required counties to use a uniform online portal to remit taxes and counties are required to remit taxes monthly. Additionally, KDOR officials described a quality assurance process to make sure sales tax is accurately calculated. KDOR also showed evidence of processes to identify late remittances and to follow-up on potential tax issues reported by county staff (e.g., questionable selling prices, suspicious tax exemptions, etc.). County staff report these issues to KDOR. KDOR staff follow up directly or assign the concern to their internal audit team.

- KDOR was missing 2 of the 8 monitoring and enforcement procedures we evaluated. Those are also shown in Figure 2 and summarized below.

- KDOR didn’t have standard enforcement procedures for counties that don’t remit properly. Enforcement procedures ensure counties are notified of delinquent or incorrect payments. They also establish timelines to correct the issue. If needed, they can also establish punitive steps. KDOR officials told us they do not have formal enforcement procedures for counties. Instead, officials told us they prefer to work with counties directly on any issues that arise because they are government entities. We also didn’t find evidence of any punitive steps. It’s unclear whether state law allows KDOR to take punitive steps against counties (e.g., withhold local tax revenue).

- KDOR did not utilize county registration data to identify questionable sales prices or tax exemptions. County treasurers input vehicle registration information into the state’s MOVRS database. In theory, databases like MOVRS can be used to efficiently monitor large volumes of transactions across several locations. KDOR staff could use the data to do things like identify extremely low sales prices or ensure $0 sales had corresponding tax exemptions. However, KDOR officials do not use the MOVRS database in this way. Instead, it is primarily used to look up information on a case-by-case basis (rather than a state-wide review).

- KDOR didn’t have standard enforcement procedures for counties that don’t remit properly. Enforcement procedures ensure counties are notified of delinquent or incorrect payments. They also establish timelines to correct the issue. If needed, they can also establish punitive steps. KDOR officials told us they do not have formal enforcement procedures for counties. Instead, officials told us they prefer to work with counties directly on any issues that arise because they are government entities. We also didn’t find evidence of any punitive steps. It’s unclear whether state law allows KDOR to take punitive steps against counties (e.g., withhold local tax revenue).

- KDOR has prioritized collaboration over enforcement. KDOR officials told us they view county treasurers as fellow government employees and partners. As such, KDOR takes a more collaborative approach with these offices. KDOR officials said they prefer to work informally with county officials to resolve any issues.

- Accepting late payments with no penalty or enforcement actions creates a risk that the state won’t receive tax revenue in full or on time. We evaluated the extent to which these risks occurred. Specifically, we evaluated whether a sample of counties remitted taxes on time. We evaluated whether the selling price for a sample of vehicles resembled fair market value. We also evaluated whether a sample of tax exemptions were properly handled and documented. We did not evaluate the accuracy of county taxes calculations. Our findings for this work are explained below.

Although most of the counties we reviewed remitted taxes on time, one county didn’t remit taxes for 15 months, resulting in around $10 million in delinquent taxes.

- We reviewed whether a sample of county treasurers remitted sales and use taxes at least monthly. We judgmentally selected 10 counties based on their population size and location. These counties were varied in population size and locations throughout the state. We reviewed remittance reports to determine if they remitted taxes at least monthly (as required by K.S.A. 79-3604) in fiscal year 2023. We did not evaluate the accuracy of those taxes.

- We didn’t find any issues with the 10 counties we originally selected for review. The reports we reviewed showed the 10 counties remitted taxes to the state at least monthly in fiscal year 2023.

- However, KDOR officials made us aware of a remittance issue with another county. In August of 2022, this county started being overdue on sales and use tax remittances. Payments were up to 15 months late (until December of 2023). This resulted in the county being delinquent on approximately $10 million in taxes that were due in fiscal year 2023. We only reviewed fiscal year 2023 reports. We can’t say whether there were late payments before or after this period. County officials told us the delays were caused by issues transitioning to a new computer system. KDOR records showed that the county paid off all fiscal year 2023 outstanding debt by the end of December 2023. However, KDOR management was not aware of this issue until December 2023.

- While the results of our review are not projectable, this situation highlights the importance of strong enforcement procedures. Delinquent payments are problematic because they can create an inaccurate picture of the state’s tax situation. There’s also additional risk of inaccuracies or collection issues when taxes are left outstanding for this long. Ultimately, KDOR reported the state received its tax revenue. If KDOR had an enforcement process that was triggered by late remittance, it’s unlikely this issue would have remained unresolved for so long.

We also checked a number of transactions to see if vehicles sold for significantly less than their estimated value or sold at or above estimated value.

- As mentioned above, it is important that county treasurer staff review a vehicle’s sale price during registration. Specifically, K.A.R. 92-19-30 requires a vehicle’s selling price to be indicative of or bear a reasonable relationship to the NADA used car value or fair market value. The NADA is the National Automobile Dealers Association’s official used car guidebook. Vehicles sold for significantly less than their value could reduce the state’s tax collections.

- We reviewed 88 vehicle transactions to determine whether the reported sales price and taxes paid to county treasurers seemed reasonable. To do this, we looked at 88 randomly selected vehicle transactions from fiscal year 2023. That’s out of an estimated 724,000 transactions that year. Our sample did not include watercraft, trailers, or ATVs because we did not have an efficient way of looking up value estimates for these vehicles (e.g., a VIN search). We compared the reported sales price of these vehicles to their Kelly Blue Book value. Kelley Blue Book is another resource that estimates the fair market value of vehicles sold by dealerships like NADA and includes estimates for private sales. We defined “significantly under value” as vehicles that sold for less than 50% of their value. We defined “significantly over value” as vehicles that sold for more than 50% of their value. Vehicles sold between these ranges were considered sold at or near value.

- It is possible our sample includes sales from online vendors, but online sales are not specifically labeled. Vehicles purchased through an online vendor (like Carvana) must be registered in Kansas. Buyers pay their vehicle taxes when registering their vehicle with the county treasurer. For that reason, these purchases would be included in the county registration data used for this analysis. However, online sales aren’t specifically denoted in the data. As such, we can’t say whether or how many online sales were included in this analysis.

- There are a few caveats to our analysis:

- We used Kelly Blue Book for several reasons. First, it allowed us to look up vehicles by VIN number. In some cases, this provided additional accuracy on the vehicle values (e.g., value accounted for equipment packages, sale location, private sale vs. dealership sale, etc.). Second, Kelly Blue Book bears a reasonable resemblance to NADA values, which is required under Kansas Administrative Regulations.

- When unknown, we assumed vehicles were in fair condition with standard equipment. Kelly Blue Book requires this information to determine a vehicle’s value. If VIN matching didn’t provide this information, there was no way for us to know. Our data was limited to year, make, model, and milage of each vehicle. In cases where the VIN matching did not provide additional vehicle information, we consistently selected these options because they provided a conservative market value.

- Our analysis was based on the fair market value of the vehicles at the time of our audit. The market value of a vehicle can change daily. The values we used were current as of February 2024. It’s possible the vehicles we reviewed had slightly different values when they were purchased in fiscal year 2023. However, that shouldn’t have a significant impact on our findings.

- Trade-ins can reduce the amount of tax charged for the sale of a vehicle. For consistency, we did not take trade-in amounts into consideration in our analysis. This means our analysis of vehicle prices is based on the reported sales prices before any trade-ins.

- The fair market values we used for this analysis should be considered estimates. As described above, there are several variables that determine the actual fair market value of a vehicle. We did not have information to determine things like vehicle features, condition, or prior accidents. All these could greatly impact fair market value. As such, the fair market values described in the next section should all be viewed as estimates.

- We used Kelly Blue Book for several reasons. First, it allowed us to look up vehicles by VIN number. In some cases, this provided additional accuracy on the vehicle values (e.g., value accounted for equipment packages, sale location, private sale vs. dealership sale, etc.). Second, Kelly Blue Book bears a reasonable resemblance to NADA values, which is required under Kansas Administrative Regulations.

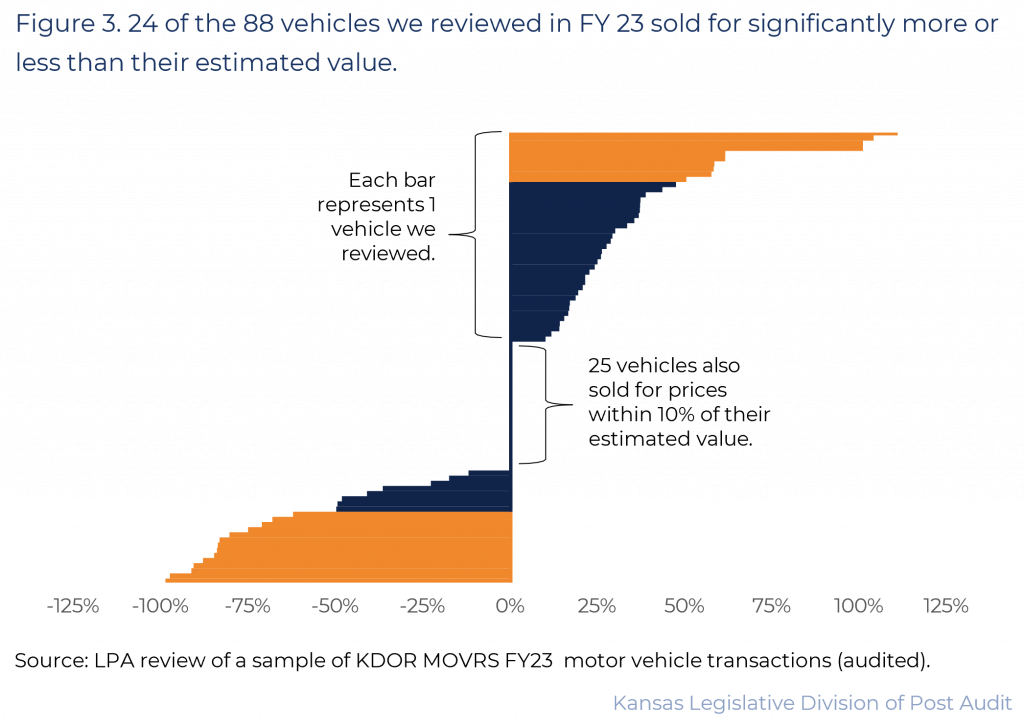

The reported sales prices of the sampled vehicles were at times both significantly higher or lower than their estimated fair market values.

- 47% of the vehicles we reviewed sold above their fair market value, with some selling for significantly more. Figure 3 shows the results of our price comparison. As the figure shows, many vehicles we reviewed sold above their fair market value. Specifically, 41 vehicles we reviewed sold for more than their fair market value. Of those, 10 sold for at least 50% over value.

- 25 (28%) vehicles sold for prices within their fair market value range. That means these vehicles sold for at or near their fair market value (within 10%).

- Some vehicles we reviewed (25%) sold below their fair market value, with some selling for significantly less. As Figure 3 shows, 22 vehicles sold for less than their fair market value. Of those, 14 sold for at least 50% under value. For example, a 2015 truck was valued at about $7,500 but sold for $100. It’s difficult to determine why the vehicle sold for so little because the data we reviewed did not include current condition, prior accidents, or other things that could significantly affect its value.

- KDOR staff told us that determining the reasonableness of a vehicle’s sale price is challenging. Vehicle modifications, the current condition, and prior accidents can also affect selling prices. County staff don’t always have access to this information. For many person-to-person sales, the only evidence of the vehicle selling price is recorded by the buyer and seller on the back of the title transfer document. As such, it can be very difficult to assess the reasonableness of a vehicle’s sale price.

- We can’t definitively say why some of the vehicles we reviewed did not sell at or near their market value. We attempted to select a sample that would be large enough to project across the state. However, significant data entry errors in the state’s MOVRS database prevented us from choosing a large enough sample. It’s entirely possible that a different sample of transactions could show different results. More information about the MOVRS data entry issues is discussed later in the report.

We saw evidence of proper documentation for the sample of tax exemptions we reviewed.

- It is important that county staff receive and review exemption documentation because K.A.R. 92-19-30 requires county treasurers to charge tax if there is any doubt as to the buyer’s claim. Even if a buyer presented the exemption certificate to a dealership (who is required to accept the certificate in good faith), the validity of the exemption is also reviewed at the county treasurer’s office upon registration. Thus, county treasurers’ staff are on the front lines of exemption review. If a buyer believes they were incorrectly charged sales tax, they may file a refund claim with KDOR.

- We reviewed 25 exempt or nontaxable motor vehicle transactions. We also reviewed 6 transactions that had purchase prices listed as $0. In all these instances, we looked at the underlying documentation that was collected by county treasurer’s offices when the vehicle was registered. We expected to see correct documentation of an exemption or documentation that legitimized the $0 transactions. The documentation we looked at included exemption certificates and vehicle titles. We did not verify if individuals were properly claiming exemptions. These transactions were randomly selected, but our findings related to these should not be considered projectable.

- For our sample of 25 exempt or nontaxable transactions, the correct documentation was collected in most cases. But 3 did not have the necessary supporting documents for the exemption. For the 6 transactions with $0 sale prices recorded, all the transactions were exempt from paying sales tax.

Dealership Monitoring and Enforcement

We saw evidence that KDOR had several procedures related to the monitoring and enforcement of dealerships.

- Strong monitoring and enforcement procedures help ensure dealerships collect and remit sales and use tax to the state. As a reminder, dealerships accounted for about 77% of the state’s vehicle taxes in fiscal year 2023. Monitoring procedures help KDOR staff identify delinquent or incorrect remittances. Enforcement procedures inform dealerships of any issues, establish corrective action, and if needed allow KDOR to take action to collect owed taxes. We evaluated whether KDOR had 8 procedures related to monitoring and enforcement for dealerships which are based on generally accepted auditing standards for internal controls.

- To do this, we spoke with KDOR staff and some dealerships. We also reviewed documents that included delinquent dealership reports, a sample of delinquent tax notices, an audit referral list in the KDOR audit department, and KDOR’s fiscal year 2023 dealership audits. We also had a demonstration of the dealership portal. The results of our work are summarized in Figure 4.

|

Figure 4. KDOR showed evidence they had monitoring and enforcement

procedures for dealerships. |

|

|

Monitoring & Enforcement Procedures for Dealerships |

Implemented |

|

Monitoring |

|

|

Uniform process for dealerships to remit taxes |

ü |

|

Clear deadlines for dealerships to remit taxes |

ü |

|

Process to identify delinquent tax remittals |

ü |

|

Process to notify dealerships of delinquent remittals |

ü |

|

Enforcement |

|

|

Progressively increasing enforcement actions |

ü |

|

Deny license renewals for dealerships with outstanding taxes |

ü |

|

Additional Oversight |

|

|

Conduct risk-based audits of dealerships |

ü |

|

Follow up on public tip hotline |

ü |

|

|

|

|

Source: LPA review of KDOR procedures. |

|

|

Kansas Legislative

Division of Post Audit |

|

- KDOR showed evidence of having all 8 procedures we evaluated. As Figure 4 shows:

- KDOR provides an online portal to remit taxes, which most dealerships use. Dealerships are also allowed to file paper returns if they prefer. The agency also showed evidence of established timelines for dealership remittal, as set out in state law. Remittal frequency is determined by the amount of dealership sales.

- KDOR had procedures to monitor dealerships. KDOR’s tax collection system identifies instances where dealerships failed to report or remit vehicle taxes, and those dealerships are sent a notice. The notices included the dates of any missed filings, the delinquent tax amount (based on sales reports), a due date for payment, and possible penalties for further non-compliance. We saw several examples of notices that were sent to dealerships in 2023.

- KDOR had enforcement procedures for handling non-compliant dealerships. Enforcement actions included issuing a lien on assets, levying bank accounts, wage garnishment, or property seizure. Which action is taken is based on the outcome of an administrative hearing. Also, dealerships are unable to renew their license if they have outstanding tax debt (unless they’re complying with the terms of a payment plan). License renewals are mandatory to operate and occur annually.

- KDOR provides an online portal to remit taxes, which most dealerships use. Dealerships are also allowed to file paper returns if they prefer. The agency also showed evidence of established timelines for dealership remittal, as set out in state law. Remittal frequency is determined by the amount of dealership sales.

- KDOR had procedures to provide additional oversight of dealerships. KDOR has an audit division. KDOR told us that as of April of 2024 the division had 23 auditors on staff. The auditors review things like the accuracy and completeness of dealership taxes. Those auditors are also responsible for auditing several other industries (e.g., construction, hotels, grocery stores, restaurants, etc.) and areas (e.g., corporate income tax, liquor tax, oil tax, etc.). As such, KDOR told us that their audit schedule is largely based on the tax risk each industry presents to the state. This means KDOR audits a limited number of dealerships each year. KDOR officials told us they also review the validity of out-of-state exemptions to ensure the individuals claiming the exemption don’t live in Kansas. Their review resulted in 1 dealership and 17 individuals being billed for additional sales taxes in fiscal year 2023.

Generally, our sample of dealerships reported and remitted taxes for a selection of vehicle sales in fiscal year 2023.

- We selected a sample of dealerships to see if they reported and remitted taxes for a selection of vehicle sales in fiscal year 2023. To do this, we judgmentally selected 17 dealerships (out of around 2,000) from KDOR’s list of licensed dealers. This means our findings cannot be projected statewide. Our sample included dealerships from across the state. Our sample was also based on dealerships’ fiscal year 2023 sales. We primarily focused on smaller dealerships. That’s because our 2003 audit found that small dealerships had more problems remitting taxes. Our sample included:

- 8 dealerships with less than $100,000 in sales.

- 3 dealerships with between $100,000 and $500,000 in sales.

- 3 dealerships with between $1 million and $15 million in sales.

- 3 dealerships with more than $15 million in sales.

- We took several steps to determine whether dealerships reported and remitted taxes. First, we selected a total of 36 vehicle sales from the 17 dealerships. All sales occurred in fiscal year 2023. We requested sales reports and remittance receipts from the dealerships or KDOR. We checked that the dealerships reported the vehicle sales to KDOR. We also checked that taxes collected by the dealer matched what buyers reported paying. When possible, we traced remittances from the dealerships to KDOR for each vehicle. We did not evaluate whether dealerships calculated taxes correctly.

- Dealerships’ sales records matched the 36 transactions we reviewed. There’s a risk that dealerships may not report a vehicle sale to KDOR. If they don’t, it can be difficult for KDOR to know the taxes dealers should be remitting. However, buyers must register vehicles with county treasurers. In doing so, they report if and how much they paid in taxes to dealers. We checked that the 36 registered vehicles were included in the dealers’ sales reports. All 36 were included. We also checked that taxes buyers reported paying aligned with what dealerships collected. For all but one dealership (discussed below), we found no issues with what dealerships paid.

- Dealerships appeared to remit taxes for the 36 vehicles, but in some cases, it can be difficult to assess. We checked whether dealerships remitted the taxes they collected to KDOR. We were able to trace specific remittances for most vehicles. However, KDOR’s accounting system doesn’t break out individual vehicle sales. It only shows total remittances for all dealership sales per reporting period. We were able to trace a majority of the 36 remittances through to KDOR. That’s because the dealerships’ remittances were small enough for us to account for individual sales. For one dealership, we noted one small discrepancy of about $50 and notified KDOR of the issue. Five dealerships remitted more than what they collected in vehicle sales taxes. This is because dealerships may also collect sales taxes on parts and labor that are also remitted to the state.

- Because we did not complete a full reconciliation of these dealerships’ tax accounts, we cannot say with certainty that these 5 dealerships remitted on the individual transactions we viewed. However, because they submitted more than was collected, we determined that they likely remitted what was owed for the individual transactions.

- We didn’t find any significant issues with the sample of dealerships we reviewed. Our review was limited to a small sample of dealerships and vehicle sales. Although we didn’t see any significant issues with our sample, we can’t project that to other dealerships across the state. It’s possible that a different sample could yield different results.

Although we didn’t identify issues from our sample, KDOR has identified many dealerships that were late remitting taxes in fiscal year 2023.

- We requested a list of dealerships that received consolidated tax bills. These bills are sent out to dealerships that have not paid their taxes or failed to file their tax returns. Around 900 of around 2,000 licensed dealerships received these types of notices over the course of fiscal year 2023 – for a total of around 3,000 notices being sent to dealerships. These delinquency notices could be for any number of tax compliance issues (like not paying employee income withholding taxes or corporate income tax or failure to file their monthly tax report), not just non-remittance of sales taxes.

- We requested to review fiscal year 2023 notices for 10 dealerships. Many of the notices went out because dealerships failed to file their monthly sales tax filings. In some instances, dealerships were not remitting the sales tax they collected by its due date. We saw remittances owed to the state ranging from around $60 to around $75,000. Based on our review of notices it appeared that, in most instances, the dealerships remitted what they owed. However, for 4 dealerships they still had a balance at the end of fiscal year 2023. We cannot say whether those dealerships were in good standing by the end of calendar year 2023. However, dealerships who repeatedly fail to remit may be referred for an administrative hearing. Under KDOR’s processes, dealerships should not be able to renew their annual dealership license if they are not in good standing. In this case, “good standing” means that they have remitted their taxes or have a payment plan in place.

- As mentioned earlier, KDOR audited a limited number of dealerships in fiscal year 2023. They found 5 dealerships owed the state additional sales tax dollars with 2 of those dealerships owing taxes specifically related to the sale of motor vehicles. KDOR also conducts reviews of individuals claiming a non-resident exemption when they purchase a motor vehicle. They found that 1 dealership owed additional taxes to the state related to the sale of motor vehicles. Because of the limited number of audits conducted, more tax issues could exist with the other dealerships.

- The number of tax notices sent to dealerships could indicate KDOR’s process is working. In 2003, we recommended KDOR improve their process of monitoring dealerships’ tax remittals. Since then, KDOR has leveraged their tax reporting case management system to help identify and collect delinquent taxes. Given the number of notices, it appears the system is working to flag delinquent taxes.

Other Findings

KDOR’s lack of written procedures means efforts to ensure that individual buyers and dealerships are remitting the correct amount of taxes aren’t as effective as they could be.

- We expected to see written guidance for KDOR staff about the procedures outlined in our report. We also expected written guidance for staff to clarify how different roles at KDOR intersect and the different tools, data, and information available to staff across departments. This is because KDOR is a large agency with several divisions and teams handling information about taxpayers, motor vehicles, and licensed dealerships.

- We only saw written procedural documentation for 3 procedures of the 19 reviewed. Additionally, while a staff contact sheet is available, there is no explanation of how those different roles intersect across divisions regarding motor vehicle taxes.

- The lack of written procedures may become problematic in times of staff turnover or when staff with institutional knowledge are lost. It means that the unwritten procedures we found in place over the course of this audit could be lost. Additionally, having no written procedures to update may mean staff lack accountability to implement procedures meant to improve KDOR’s ability to ensure correct motor vehicle taxes are remitted.

- Additionally, not having intentional procedures to communicate across divisions may isolate information to one division. This means data and information related to motor vehicles and motor vehicle taxes may not always be carried across divisions. As such, KDOR may miss opportunities for data coordination that supports the work of other units.

KDOR’s MOVRS database had significant data entry errors, preventing them or us from doing state-wide analysis.

- KDOR collects vehicle registration data from county treasurers across the state. Among other things, the data contains the descriptions, sale price, and exemption status of all registered vehicles. County treasurer staff across all 105 counties submit this information through the state’s MOVRS database. Once the data are submitted, KDOR staff have access to statewide vehicle registration data.

- We found significant data entry errors with the MOVRS data. While KDOR does have accounting reconciliation processes and quality control processes that help ensure counties are charging and remitting the correct amount of taxes, these processes do not ensure that data entry errors are not occurring in other MOVRS data fields. We reviewed fiscal year 2023 data from the MOVRS database. During our review we noted several systemic issues with the data. For example, a significant amount (26%) of entries appeared to be duplicated. One reason this may occur is from county staff re-entering a vehicle transaction without properly backing out prior entries.

- We wanted to use the data to select a projectable sample of vehicles so we could evaluate sales prices and taxes collected across the state. However, the MOVRS data issues prevented us from picking a projectable sample of vehicle sales because there were too many errors for us to fix. As such, we had to pick a judgmental (non-projectable) sample to ensure we selected reliable records.

- Earlier in the report, we noted KDOR doesn’t have a process to review the MOVRS data for suspicious sales prices and exemptions. KDOR also doesn’t use the data to perform statewide analysis. Even if a process existed, KDOR would not be able to use their current data as it is because of the problems we found. It appears that data hygiene hasn’t been a priority for KDOR. That could be because they don’t use the data for state-wide analysis.

Conclusion

Since our 2003 audit, KDOR has improved their procedures for dealership monitoring and enforcement. In our review, we didn’t identify issues in dealerships’ remittances to KDOR. KDOR also showed they were aware of dealerships we didn’t review that were delinquent. These things suggest KDOR’s new procedures are identifying and flagging many cases of delinquent taxes at dealerships. However, KDOR’s procedure for county enforcement was significantly lacking. This appeared to be because KDOR prefers to collaborate with counties rather than proactively implementing enforcement processes. We saw one case where this laxed enforcement for counties lead to significant delays in $10 million in tax revenue. Although counties collect about 23% of vehicle taxes for the state, it’s still critical that KDOR actively monitor their performance to help ensure the state receives all tax revenue for vehicle sales.

Recommendations

1. KDOR should create and implement the missing procedures we pointed out under the heading “ KDOR was missing 2 procedures related to the monitoring and enforcement of counties.“

- Agency Response:

KDOR didn’t have standard enforcement procedures for counties that don’t remit properly.

The Kansas Department of Revenue is implementing a report of all county accounts indicating whether a specific county has any non-filed periods or an outstanding balance. The report will be automated to run on the 10th of every month and will be automatically distributed to the following for review:

- Taxation Executive Administrator

- Senior Taxation Manager

- Sales/Withholding Tax Manager

- Sales Tax Supervisor

- Sales Tax Supervisor

If any of these positions become vacant for any reason, the email distribution would be updated to reflect the replacement.

The report will enable the Department to visit with a county in a timely manner that may be experiencing trouble in submitting required sales tax forms and payments.

KDOR did not utilize county registration data to identify questionable sales prices or tax exemptions.

The Department will investigate the feasibility of using the data to evaluate whether sales prices of motor vehicle transactions are comparable to the fair market value based on condition of the motor vehicle and whether any tax exemptions claimed are proper.

2. KDOR should develop and implement a process to improve the accuracy of existing and ongoing vehicle registration data submitted through MOVRS.

- Agency Response:

The Department believes the vehicle registration data submitted through MOVRS is accurate. The comment provided by LPA may be due to a misunderstanding related to a request for information for this audit. The Department’s MOVRS and IT staff were given an extremely limited amount of time to revise an existing report and try to make it apply to a stated audit objective. With proper notice, preparation, and testing time, the Department would have been able to provide a better formatted report of data for review. Data entry errors are errors in how a system user inputs data for specific fields. That is not the issue in this instance. The issue arose from formatting issues with the report provided which created multiple entries per transaction rather than a properly formatted report easily viewable by transaction.

3. KDOR should provide the current, up-to-date sales tax guidance document to the dealership portal. They should also provide tax guidance updates in the portal as those are made. They should consider if there are points in time where they should offer dealerships a chance to retake KDOR training.

- Agency Response:

Publication KS-1526, Business Taxes for Motor Vehicle Transactions has been published to the Dealer Portal. This document has been historically available on the Kansas Department of Revenue website for the public to access where it will remain as well.

4. KDOR should formally document all existing and new procedures related to motor vehicle training, guidance, monitoring, and enforcement.

- Agency Response:

The Kansas Department of Revenue will ensure that all existing and new procedures related to motor vehicle training, guidance, monitoring and enforcement are documented.

Agency Response

On March 18, 2024 we provided the draft audit report to the Kansas Department of Revenue. Its response is below. Agency officials generally agreed with our findings. However, they disagreed with the extent and nature of the data entry errors we noted in this report. We reviewed the information agency officials provided but did not change our findings or conclusions.

Kansas Department of Revenue Response

Dear Post Auditor Clarke:

Thank you for the opportunity to comment on the audit findings in the “Reviewing the Department of Revenue’s Procedures to Ensure Correct Payment of Sales and Compensating Use Taxes on Motor Vehicle Sales.” The Kansas Department of Revenue (Department) commends the Legislative Post Audit (LPA) staff on their work in conducting this important audit.

Following the last LPA audit in 2003, the Department conducted a thorough review to ensure its procedures and processes were consistent with best practices for monitoring motor vehicle transactions. The Department made many changes, but there is always room for improvement and the Department assures the Committee and the Legislature that additional technical enhancements to its processes will continue to be made.

The significant findings set forth in each of the categories in the report are addressed below.

Guidance and Training Procedures

LPA had hoped to see formal, written procedures to ensure efficient and continuous execution through staff changes or variables.

The Department provides education and training to all new motor vehicle dealers before they are licensed. The Department also provides updates as needed to licensees and visits with motor vehicle dealers intermittently either in person or by phone throughout the year. It was noted in the audit that guidance documents were not available in the dealership portal. The Department has now published Publication KS-1526, Business Taxes for Motor Vehicle Transactions, to the Dealer Portal.

The Department is also exploring options to provide periodic training, updates and a time for questions for all motor vehicle dealers through a virtual option.

County Monitoring and Enforcement

While the report provides that the Department has prioritized collaboration over enforcement with county officials, the Department considers this a critical fact as the Department has established relationships with each county and continues to develop and improve its interactions with the locals. The Department has dedicated one staff member who is focused on working with the counties to ensure that motor vehicle transactions are correctly captured and that filing requirements are properly maintained.

It was noted in the audit report that KDOR did not utilize county registration data to identify questionable sales prices or tax exemptions. On average, there are over 700,000 motor vehicle transactions that are processed within a 12-month period which provides a volume of data that could be used for statistical analysis or investigating transactions that may not be appropriate. The Department will fully explore the feasibility of using the data to evaluate whether sales prices of motor vehicle transactions are comparable to the fair market value based on the condition of the motor vehicle and whether any tax exemptions claimed are proper.

The Department would like to point out that it did not have an adequate analytical tool to provide to the Kansas counties that would accurately assess the value of used vehicles. Multiple factors must be taken into consideration when valuing a motor vehicle, such as mileage, physical condition of the motor vehicle, mechanical condition of the motor vehicle and accident history for the motor vehicle.

By way of historical background, in the mid 2000’s, the Department apparently did attempt to implement sales tax collection based on the fair market value with no regard for condition or mileage of vehicles achieved with the assistance and cooperation of the local county treasurers. However, the public outcry from taxpayers was loud and clear. The numerous complaints regarding the disregard of the physical condition of the vehicle, the high mileage factor and other points affecting a resale market between individuals rose to the highest levels of state government. Eventually, the Department discontinued charging sales tax on a perceived “average retail” or “fair market value” price and returned to collecting sales tax based on the value of the motor vehicle reported on either the title assignment or a bill of sale as reported by the seller/buyer, except when clearly inappropriate sales prices were reported. During the mid 2000’s, unpleasant interactions between customers and front counter staff and their supervisors at county offices were at an unacceptable level creating what might be perceived as a hostile environment. All factors affecting a vehicle’s sales price should be considered, and absent a physical inspection of the vehicle, which would be impractical, the stated sales price on the bill of sale should not be discounted in favor of general valuation guides.

The Department appreciates the work completed regarding the review of the county transactions. As reported, overall, the audit team did not find any issues with the counties, but for one county where unique circumstances were involved in that county’s delayed compliance. The Department did work with the one county continuously through the issues that arose over several months, and as a result that county is now in good standing.

Dealership Monitoring and Enforcement

In general, the Department has significantly enhanced dealer monitoring and enforcement following the 2003 LP A report. Further improvements to those processes will be made on an ongoing basis as the Department’s digital transformation efforts continue and best practices guidelines evolve.

One of the stated concerns in the report relates to the data in the Motor Vehicle Registration System (MOVRS). The Department has already been engaged with the county treasurers to explore enhancements to MOVRS with the goal of enhancing the system’s analytical capabilities. This would involve a major commitment of the Department’s IT resources for which the Department has already made a commitment.

In conclusion, the Department understands that the Division of Vehicles and the Division of Taxation must work closely together on training and policy coordination to manage and track sales tax reporting and remittance activity for motor vehicle transactions and are working to meet that goal. The Department appreciates the constructive suggestions set forth in the audit and has already implemented some of these recommendations and will do more as resources permit.

Sincerely,

Mark A. Burghart

Secretary of Revenue

Appendix A – Cited References

This appendix lists the major publications we relied on for this report.

- Taxes On Motor Vehicle Sales: Reviewing the Department of Revenue’s Procedures for Ensuring that Correct Amounts of Sales and Compensating Use Taxes are Paid. (April, 2003). Legislative Division of Post Audit.

- Standards for Internal Control in the Federal Government (September, 2014). Government Accountability Office.

- Kelley Blue Book. (Vehicle Look up: January 2024). https://www.kbb.com