Reviewing the Louisburg School District’s Expenditures

Introduction

Representative Samantha Poetter Parshall requested this limited-scope audit, which was authorized by the Legislative Post Audit Committee at its December 12, 2023 meeting.

Objectives, Scope, & Methodology

Our audit objective was to answer the following question:

- Did he Louisburg school district spend select state and local funding in accordance with state law in the most recent school year?

To answer the audit objective, we reviewed state statute regarding how districts can spend their state and local educational funding. We reviewed the district’s detailed accounting records for the 2022-23 school year. Based on those records, we chose a sample of expenditures to evaluate for compliance with state statutes. This sample was not chosen randomly and so it is not projectable to all expenditures. We also interviewed district officials to understand their budget process. Last, we reviewed Kansas Department of Education (KSDE) documents to better understand what types of capital outlay expenditures were allowable.

More specific details about the scope of our work and the methods we used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

12 of the 57 district expenditures we reviewed were not spent in accordance with the state law related to the fund from which it was spent.

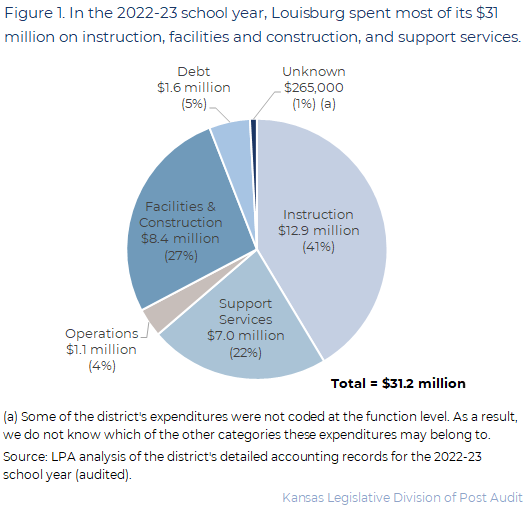

In the 2022-23 school year, the Louisburg school district spent a little more than $31 million.

- The Louisburg school district is in Miami county which is in the northeast part of the state.

- In the 2022-23 school year the district spent $31.2 million or about $18,000 per student. The district had 1,710 full-time-equivalent students.

- School district expenditures are recorded and classified into 5 main “functions” including instruction, support services, and facilities and construction. Figure 1 shows the district’s total spending by function categories. As the figure shows, in 2022-23, the district spent the most in instruction ($12.9 million or 41%). This was followed by facilities and construction ($8.4 million or 27%). The district’s relatively high percentage of money spent on facilities is related to a bond the district passed in 2020. The bond was approved for $24 million to improve district facilities, add a high wind shelter at the middle school, and add a multi-purpose room at the high school. The district finished those projects in the 2022-23 school year.

- Another way school districts record and classify expenditures is by “object” codes. This includes classifications such as salaries and wages, benefits, and supplies. For example, expenditures related to salaries are coded 100 and expenditures related to supplies are coded 600. Typically, we can use those object-level codes to provide a high-level understanding of how a district spent its money.

- The district did not code all of its expenditures at the “object” level. For the year we reviewed, the district did not apply this level of accounting codes to about 30% of its expenditures. Although the district may not be statutorily required to do this, it is good accounting practice to consistently and accurately code expenditures. As a result of the inconsistency, we cannot accurately report how much the district spent in those specific categories.

Generally, state law allows districts broad discretion in how they spend their state and local funding, but there are some exceptions.

- In many cases, state law establishes specific funds that districts must use. For example, the special education, bilingual, and at-risk funds are created by statute.

- Most funds have minimal rules related to how the district can spend its funding.

- Some funds permit any type of operational expenditure. For example, districts can pay for a wide variety of operational expenditures from the general fund. Operational expenditures are a broad category as statute only describes what they are not. For example, an operating expenditure is not a payment to another school district or an expenditure related to a federal program. Further, districts can use the supplemental general fund in the same way they are allowed to use the general fund.

- Other funds only require that the money spent from the fund be directly attributable to a specific activity. For example, any funds spent from the professional development fund must be directly attributable to professional development. Other funds such as special education, bilingual, and virtual school have similar rules.

- However, there are a few funds with more specific rules. For example, money spent from the at-risk fund can only be spent on specific categories of expenditures (i.e. training or educational personnel) for programs approved by KSDE. Additionally, money spent from the capital outlay fund can only be spent on activities such as constructing, repairing, maintaining, or equipping a building.

- Last, there are a few funds that act only as pass-through funds. For example, the state pays the employer’s portion of Kansas Public Employees Retirement System (KPERS). This money is placed in a fund in each district before it is remitted to KPERS.

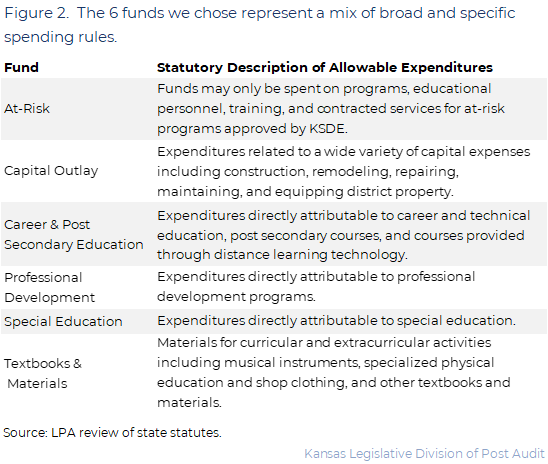

We selected 57 expenditures (representing $1.2 million) across 6 funds to determine whether the district spent them in accordance with state law.

- We reviewed the district’s detailed accounting records for the 2022-23 school year. Based on those records, we selected expenditures to review for compliance with state spending laws.

- First, we selected 6 funds from which to choose expenditures. Figure 2 describes the spending rules in state law for each fund we chose. As the figure shows, the funds have a mix of broad and specific spending rules set in state law. These 6 funds represent 41% ($12.7 million) of the district’s total spending.

- Then, we chose expenditures from each fund that represented a good cross-section of the different types of expenditures (e.g. we chose a mix of salaries, services, and supplies and equipment). Because we did not choose the sample randomly, we cannot project the results to all expenditures. In total, we selected 57 expenditures which represented about $1.2 million in total spending.

- For each expenditure, we determined whether it complied with the state law related to the fund from which it was spent. We also requested documentation and talked with district officials to understand what the expenditures were for.

- For some capital outlay expenditures, we also reviewed KSDE guidance and consulted with KSDE officials. We did this because state law does not define what “equipment” is for purposes of capital outlay. KSDE has created guidance for districts to use which has definitions that distinguish between equipment and supplies. We considered that information when determining whether the district’s capital outlay expenditures were allowable.

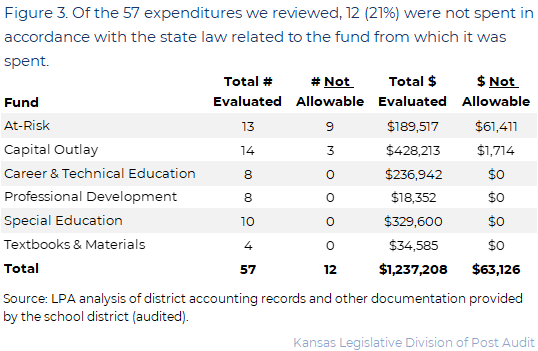

We identified 12 expenditures (about $63,000) related to at-risk and capital outlay that did not comply with the state laws related to those funds.

- As mentioned previously, we chose 57 expenditures from 6 funds. Figure 3 shows the number of expenditures we evaluated in each fund and how many were not allowable. As the figure shows, all of the expenditures we reviewed from 4 of the 6 funds appeared to be allowable.

- However, we found 12 expenditures from 2 funds that were not spent in compliance with law:

- 9 of the 13 (69%) at-risk expenditures we evaluated were not allowed under state law. State law requires that all expenditures from the at-risk fund be for KSDE-approved at-risk programs or the educational staff, training, or contracted services related to an approved at-risk program. The district spent about $61,000 on 9 expenditures that did not meet that requirement. Those expenditures included seating for students, parent workshops, and payment for interpreters.

- 3 of the 14 (21%) capital outlay expenditures we evaluated were also not allowed under state law. State law requires that money in the capital outlay fund be spent on specific categories of building-related expenditures. This includes construction, equipping, and repairing a school. Statute does not define what equipment is. However, KSDE provides guidance to school districts regarding the difference between equipment and supplies. Generally, equipment (i.e. computers, desks, and musical instruments) is allowable. However, supplies (i.e. batteries, soap, gasoline) are generally not allowable. We identified 3 small expenditures totaling about $1,700 that were not allowable. Two of the expenditures were for supplies and one was for operating the light and sound system at various school events.

- The district told us that two of the at-risk expenditures were mistakenly coded to the at-risk fund. They told us they uncovered those issues prior to the audit and have addressed them going forward. For the others, the district told us those expenditures supported at-risk students. However, the district appeared to not fully understand that they could only spend at-risk funds on specific categories of expenditures related to KSDE-approved programs. Additionally, the district disagreed with our assessment regarding the 3 capital outlay expenditures. District officials told us they thought those expenditures were allowable under state law because they were related to maintaining and repairing district equipment.

- Last, we reported these 12 expenditures as unallowable because they did not comply with the laws for the fund from which they were spent. Both the at-risk and capital outlay funds are more restrictive than most funds. It is likely that those expenditures would have been allowable if they had been spent from a less restrictive fund. For example, one of the at-risk expenditures was unallowable because it was training related to a program KSDE had not approved. This makes it unallowable as an at-risk expenditure. However, if the district had paid for it from the professional development fund, which has no specific restrictions, it likely would have complied with the rules for that fund.

Recommendations

- The district should take steps to ensure that all expenditures within their internal accounting system are coded correctly at both the function and object level.

- Agency Response: The district accepts recommendation #1. The district is not currently aware of any statute that requires districts to code expenditures at both the function and object level.

- The district should review state law regarding at-risk expenditures and ensure that their spending is in alignment with those laws.

- Agency Response: The district accepts recommendation #2. The district continually monitors all at-risk expenditures and ensures spending is in alignment with current laws.

- The district should review KSDE guidance regarding capital outlay equipment and ensure their spending is in alignment with that guidance.

- Agency Response: The district accepts recommendation #3. The district has ongoing communication with KSDE regarding capital outlay expenditures.

Potential Issue for Further Consideration

We identified 1 issue that might be worth evaluating in more detail. Because of the limited scope of this audit, we did not have time to fully develop it. We had unresolved questions about the following issue, so more audit work would be needed to determine whether it represents an actual problem or not.

- We noted that about $6.7 million in district expenditures for the 2022-23 school year were not included in Louisburg’s budget document. These expenditures were for building expenses related to the district’s current bond projects. KSDE officials told us they do not require districts to report these types of expenditures on their budget documents because they are reported and tracked elsewhere. It is unclear whether KSDE’s policy might represent a statutory problem or is simply a transparency issue.

Agency Response

On April 4, 2024 we provided the draft audit report to the Louisburg school district and KSDE. The district’s response is below. The district provided additional information that we reviewed. As a result, we made minor changes to the report.

KSDE did not disagree with our decisions about allowability. However, they did note that they did not have enough information to determine whether the expenditures we reviewed were allowable. Additionally, the example KSDE provided regarding the allowability of an interpreter does not reflect the details of the district expenditure we reviewed.

Louisburg Unified School District Response

Thank you for the opportunity for our district to respond to the audit. We appreciate the work of Heidi Zimmerman and the LPA staff. As a district, we always look forward to opportunities to improve. The time you spent reviewing our accounting system is appreciated. Our district cares deeply about our staff and students. We have a supportive community that cares about our school district. Our board and administration make fiscal decisions based on what is best for students. Our Needs Assessment is focused on reviewing data that drives our fiscal decisions. We have high achieving students, both in and out of the classroom. Our assessment scores are some of the highest in the state. USD #416 doesn’t qualify for a high number of weightings so we spend our fiscal resources responsibly and wisely. The three capital outlay expenditures that were deemed not allowable by the LPA made up less than .09% of the 2022-2023 total capital outlay expenditures. The largest At-Risk expense identified in the audit was already corrected before the audit. The other eight At-Risk expenditures that were deemed not allowable by the LPA made up 1.4% of the At-Risk expenditures from 2022-2023. In closing, we are extremely proud of our community and school district. Louisburg is a special place and we invite any member of the Legislative Post Audit Committee to Louisburg to witness the great things we do for all kids!

Kansas Department of Education Response

Below is the department’s response to the limited scope audit conducted on district expenditures for Louisburg USD #416.

Audited Expenditures:

Although KSDE does not question the expenditures cited, we do not have sufficient context to know if all the expenditures are unallowable. One example is the expenditure for an interpreter expended from the At-Risk fund. Interpretation services are not explicitly listed on the approved At-Risk expenditures list. However, being an English Language Learner is on the list that qualifies a student for at-risk services. If the interpreter was needed for a student to participate in an at-risk service that qualifies for using at-risk funding, it should follow that the cost of the interpreter is an at-risk qualified expense. Without sufficient context, it is difficult to be sure if some of the expenditures were qualified for the use of at-risk funds.

It is also important to note that nearly 80% of the expenditures ($50,155) that were deemed in the audit as not allowable were acknowledged by the district as two coding mistakes. As stated, these errors will be remedied going forward. Once addressed, the remaining expenditures deemed unallowable were just over 1% ($12,971 out of $1,237,208). Again, KSDE does not have sufficient context to evaluate this determination.

Potential Issues for Further Consideration

The Department does not agree that there is a concern regarding the recording of bond proceeds or expenses in the USD Budget, these expenditures are currently collected in the 18E Annual Statistical Report. There is not a statutory requirement to include bond expenditures in the USD Budget, therefore, the practices of Louisburg USD #416 and the guidance provided by KSDE are in compliance with current law. As for the question of transparency, all bond issues are subject to a vote of the electorate of the district. Although not included in the USD Budget, the locally elected board of education would approve projects and expenditures during a public meeting of the board. The requirements and practices currently in place give the local community ample opportunity to be involved in the school bond process. Thank you for the opportunity to provide a response to the expenditure audit of Louisburg USD #416. Please let me know if you have any questions or concerns.

Frank Harwood

Deputy Commissioner of Education