STAR Bonds Financing Program

Introduction

This audit satisfies requirements in K.S.A. 46-1137. The Legislative Post Audit Committee authorized us to evaluate this incentive at its June 1, 2020 meeting.

Objectives, Scope, & Methodology

State law (K.S.A. 46-1137) requires us to include 3 components in our evaluations of the state’s economic development tax incentives: a description of the incentive, a literature review, and an estimate of the incentive’s economic and fiscal impact.

We selected 2 audit objectives to evaluate the STAR bonds financing program’s economic and fiscal impact:

- Do current STAR bond attractions satisfy the Department of Commerce’s tourism-related goals?

- How long will it take the state to break even on tax revenue it gave up supporting 3 selected STAR bond attractions?

To answer these questions, we talked to officials and reviewed information from the Kansas State Treasurer and the Departments of Commerce, Labor, and Revenue. This included details about all STAR bond attractions, the taxes used to pay their bonds, and their bond repayment progress. We reviewed visitation data for each completed STAR bond attraction in 2018-2019, including where their visitors came from. We reviewed additional financial details and talked with stakeholders for the Hutchinson, Overland Park, and Wichita districts for our break-even analysis. More specific details about the scope of our work and the methods we used are included throughout the report and in Appendix B as appropriate. This includes any significant assumptions we relied on for our analyses.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

Audit standards require us to report our work on internal controls relevant to our audit objectives. They also require us to report deficiencies we identified through this work. We evaluated the internal controls at Commerce, Revenue, and the State Treasurer for ensuring STAR bond data accuracy. Commerce lacked complete and reliable visitation data for STAR bond attractions.

Our audit reports and podcasts are available on our website (www.kslpa.org).

Background

Incentive Description

STAR bonds allow local governments to use future sales tax revenue for development or redevelopment projects.

- The Legislature first authorized the use of sales tax and revenue (STAR) bonds in 1993. In 1997 and 1998, it amended statute to let Wyandotte County use STAR bonds to finance the Kansas Speedway and Village West, respectively. The program sunsets in July 2026.

- STAR bonds are an economic development tool. They allow local governments to use bond proceeds to help finance tourist attractions within development districts they create.

- STAR bonds can help pay for property acquisition, site preparation, and infrastructure costs. The Department of Revenue uses part of the state and local sales tax revenue generated from the businesses in the district to repay the bonds.

- The creation of a STAR bond district is a collaborative effort between state and local government. It uses both state and local sales tax revenue to repay the bonds.

- State law generally requires STAR bonds to be retired in 20 years. After that time, the attraction should be self-sufficient. Once the bonds are paid off, the full amount of sales taxes from the district starts going to the state and local governments.

- The Secretary of Commerce is responsible for approving STAR bond attractions and districts. The Legislature added this requirement in 2003.

As of November 2020, about $873 million in mostly state sales tax revenue has gone toward retiring $1.1 billion in STAR bonds.

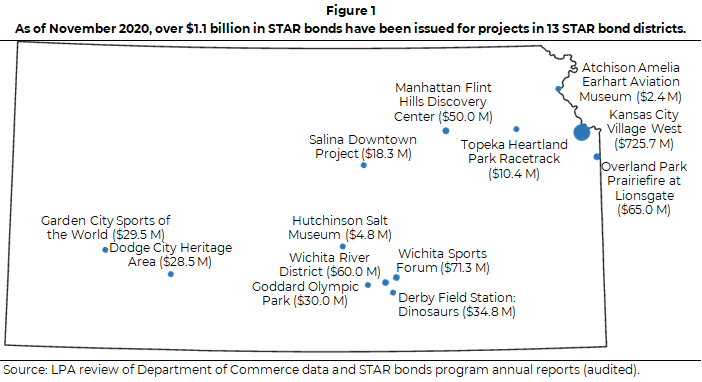

- As Figure 1 shows, 12 cities have created 13 STAR bond districts since the program began. These districts include 20 tourist attractions. The Village West district in Wyandotte County is unique in that it includes 6 of the 20 STAR bond attractions.

- As of November 2020, these 12 cities have issued about $1.1 billion in total bonds. $726 million (64%) of those bonds were for the Village West district.

- So far, $873 million in tax revenue has been used to pay off this bond debt.

- About $668 million (76%) came from state sales and use taxes.

- About $205 million (24%) came from local sales, use, and transient guest taxes.

- State sales taxes represent a larger share of the bond payment because the state tax rate is higher than local rates. The state’s share is highest when the city doesn’t have a sales tax, or when these taxes have already been pledged to something else. In the 13 districts, the state’s share of the tax revenue used to repay the bonds ranged from 70% to 99%. We didn’t look at additional local government payments particular STAR bond agreements may require.

Literature Review

Only Kansas and 2 other states have STAR bonds programs, and virtually no literature about them exists.

- Kansas created the country’s first STAR bonds financing program. Illinois and Nevada also have programs, seemingly modeled on Kansas’. But neither state appears to have used its program since at least 2010.

- Statute requires that we conduct a literature review as part of our evaluation. However, little literature on these programs exists, likely because they’re so uncommon.

- Consequently, we didn’t find enough studies to draw any conclusions about the program’s effectiveness.

Economic and Fiscal Impact

We used two analyses to estimate STAR bonds’ economic and fiscal impact.

- An analysis of tourism. We decided to evaluate STAR bond attractions’ tourism in this audit (not their job creation or effects on quality of life) for two reasons. First, we think generating tourism is the primary purpose of the program based on state law, legislative testimony, and Commerce program guidance. Second, tourism is what sets STAR bonds apart from other economic development incentives that also aim to improve Kansas’ general and economic welfare.

- A break-even analysis. Wedecided to conduct a break-even analysis for 3 selected STAR bond attractions to get a sense of such projects’ fiscal impact on the state. The state gives up significant tax revenues to help repay STAR bonds. We wanted to see whether the state might recoup its investments in these attractions within a reasonable timeframe.

- The results of these two analyses are described in detail below.

We estimate that only 3 of the 16 STAR bond attractions we reviewed met Commerce’s tourism-related program goals.

Tourism is a key component of the STAR bonds program.

- The STAR bonds financing act (K.S.A. 12-17,160 et. seq) broadly defines the purpose of STAR bonds. It identifies the program’s purpose as the promotion, stimulation, and development of the general and economic welfare of the state of Kansas, including Kansas communities.

- State law makes it clear that tourism is an important component of STAR bond projects.

- It lists potential tourist attractions as areas eligible for STAR bond financing. These include a historic theater, major tourism area, major motorsports complex, auto racetrack facility, river walk canal facility, major multi-sport athletic complex, or a major commercial entertainment and tourism area (as determined by the Secretary of Commerce).

- The act also requires a market study for each attraction to determine its ability to gain local, regional, and national market share. The market study must also determine the attraction’s ability to maintain its status as a significant factor for travel decisions.

- Finally, K.S.A. 12-17,166 requires a feasibility study for each attraction. It should identify the attraction’s visitation expectations and how it will contribute significantly to the state’s economic development.

- Its broad statutory purpose also gives the Secretary of Commerce discretion to select STAR bond attractions. In addition to potential tourism, Commerce officials said they consider several things when approving attractions. This includes job creation, effects on local quality of life, and ability to attract compatible industries.

The Department of Commerce has 2 goals related to STAR bond tourism but hasn’t evaluated them.

- State law doesn’t include any requirements related to tourism levels (e.g. how many visitors an attraction must draw and from how far away).

- Commerce has established 2 tourism-related goals for proposed STAR bond attractions. Each attraction should draw:

- 20% of visitors from outside Kansas.

- 30% of visitors from at least 100 miles away.

- Meeting these 2 goals is important because tourists are more likely to create new spending in the Kansas economy than Kansans.

- Economic research suggests attractions that draw in-state visitors are likely to simply shift existing activity and tax revenue from one part of the state to another. If the STAR bond attraction didn’t exist, the Kansans who visited probably would’ve spent money elsewhere in the state. Commerce officials agreed that new spending from out-of-state visitors is a valuable economic goal for the state.

- There may be some cases in which local visitors are spending money in Kansas they otherwise wouldn’t have. For example, a Kansan may have gone shopping in Missouri in the absence of the Village West Legends retail area. But we think it’s more often that local visitors simply move existing economic activity from one part of Kansas to another.

- The department didn’t collect sufficient or reliable data to evaluate whether existing attractions meet these goals.

- Commerce officials said they receive visitation projections as part of attractions’ feasibility studies. But they get these years before attractions are built. And they said these estimates are sometimes overly optimistic.

- Commerce didn’t have the authority to require visitation data from existing attractions until 2021 House Substitute for Senate Bill 124 passed. This bill requires STAR bond project proposals to include a plan for tracking and reporting visitation data. It gives Commerce the authority to require districts to implement this plan and provide visitation information.

- Thus, some attractions hadn’t given Commerce visitation data when we conducted our audit. Others had only provided rough estimates.

- Without comprehensive and objective tourism data, Commerce officials didn’t know which attractions successfully draw out-of-state or long-distance visitors. This has kept them from determining whether attractions successfully stimulate tourism or meet their tourism goals.

To determine whether 16 STAR bond attractions met Commerce’s tourism-related goals, we reviewed data from an objective third party.

- We evaluated 16 STAR bond attractions to estimate how well they drew visitors and met Commerce’s tourism-related program goals.

- Our analysis covered calendar years 2018 and 2019. We excluded attractions that weren’t complete and open to the public by early 2018. This left 16 attractions out of 20 total. We excluded 2020 due to the COVID-19 pandemic.

- Commerce didn’t have sufficient and reliable data for our analysis. But evaluating attractions’ visitation numbers is a critical part of looking at whether the STAR bonds program generates statewide economic development through tourism.

- We reviewed several options and purchased data from a company called StreetLight. Officials from the Mid-America Regional Council of Kansas City-area governments and the City of Overland Park recommended we consider using it to estimate visitation. The company estimates visitation using cell phone and vehicle GPS location data. Transportation agencies are StreetLight’s typical customers. Their data are statistically representative of the U.S. and Canadian populations.

- Perfect visitation data doesn’t exist for STAR bond attractions. But we’re confident StreetLight’s estimates are sufficiently reliable for our analysis. This is especially true for determining the proportions of visitors who come from outside Kansas or over 100 miles away.

- StreetLight has comprehensive data for the attractions we reviewed. We reviewed StreetLight’s methodology, talked to StreetLight officials, and found their data appropriate to estimate attraction visitation. Since StreetLight is a third party, its data are also inherently more likely to be objective than the data the attractions self-report to Commerce.

- We also compared StreetLight’s data to several attractions’ self-reported estimates. We focused on ticketed attractions. And we talked to StreetLight, Commerce, and attraction officials to understand why they might differ and how we should interpret StreetLight’s data. This gave us confidence StreetLight has reasonable estimates of attractions’ visitor numbers and visitors’ home locations.

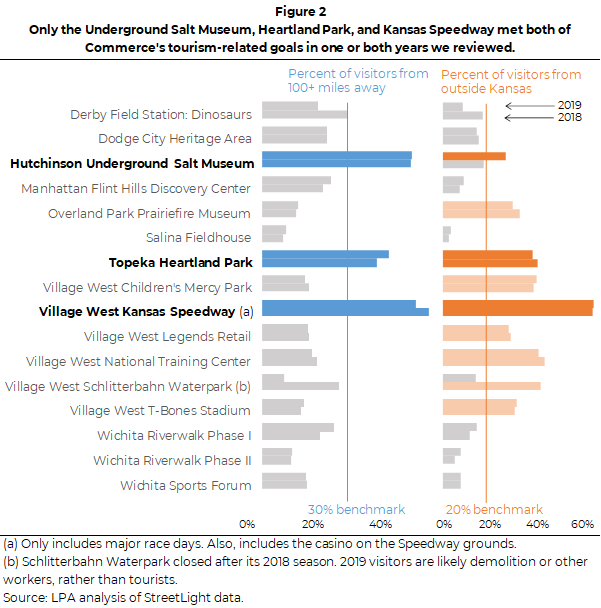

We estimate that only 3 of the 16 attractions we evaluated met Commerce’s tourism-related goals in 1 or both years we reviewed.

- A STAR bond attraction must draw long distance and out-of-state visitors to meet Commerce’s tourism-related goals (20% out of state, 30% more than 100 miles away). Figure 2 shows the percentages of each attraction’s visitors from out-of-state and 100 miles away. It also shows whether they met Commerce’s goals for these things.

- As the figure shows by the dark bars, only 3 attractions met both of Commerce’s goals in 1 or both years we reviewed. The Kansas Speedway and Topeka Heartland Park met both goals in both years. The Hutchinson Underground Salt Museum did so in 2019.

- The Kansas Speedway did not meet both tourism goals when evaluating visitation for the entire year. However, it met them during its major scheduled events in 2018 and 2019.

- Commerce officials told us the Speedway was built largely to host only a few major races each year. So, measuring how well it draws tourists during the entirety of 2018 and 2019 may not show whether it met Commerce’s goals on race days. It might draw people from different places on those days. We found the Speedway drew more than 30% of visitors from over 100 miles away on major race days in these years.

- Children’s Mercy Park, Heartland Park, and the T-Bones Stadium also primarily host scheduled events. Isolating event dates for Children’s Mercy Park and the T-Bones Stadium didn’t change whether they met Commerce’s tourism-related goals. As Figure 2 shows, Heartland Park already met Commerce’s goals when we reviewed all of 2018 and 2019.

- The remaining Village West attractions met Commerce’s goal for out-of-state tourists, but not for long-distance tourists. That’s because they primarily attracted visitors from the Missouri side of the Kansas City metro area.

- The Village West Legends retail area is one of the best-known STAR bond attractions statewide. As Figure 2 shows, more than 20% of the people who visited Legends in 2018 and 2019 came from other states. However, only about 15% came from more than 100 miles away. Most out-of-state visitors came from the Missouri side of the Kansas City metro area. About 76% of the people who visited Legends in 2018 and 2019 were Kansas City-area residents.

- The same is true for the other Village West attractions that met Commerce’s 20% goal for out-of-state visitation in these years. Between 70%-80% of the visitors to each Village West attraction (excluding Schlitterbahn Waterpark, which closed after its 2018 season) were Kansas City-area residents. They didn’t come from 100 miles away.

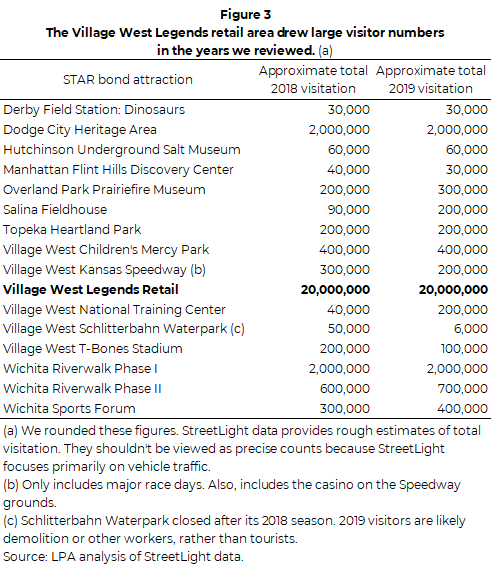

The 16 attractions we reviewed drew very different numbers of visitors.

- Commerce set goals for the percent of out-of-state and long-distance visitors STAR bond attractions should draw. Department guidance also states attractions’ total annual visitation should compare favorably to other attractions in Kansas and elsewhere. But neither Commerce nor state law require attractions to draw a certain minimum number of visitors. However, knowing roughly how many visitors each attraction we reviewed drew in 2018 and 2019 puts the Figure 2 percentages into context.

- Figure 3 shows the estimated numbers of visitors to each of the 16 STAR bond attractions in 2018 and 2019. We relied on data from StreetLight for these estimates. We think the data are reliable enough to provide a rough idea of how many visitors the attractions drew. But they should not be viewed as precise counts because StreetLight focuses primarily on vehicle traffic.

- As the figure shows, the 16 attractions we reviewed drew very different visitor numbers. The Village West Legends retail area had far more visitors than any other attraction.

Our analysis suggests unique attractions may be most likely to meet Commerce’s tourism-related goals.

- We estimate that 3 of the 16 attractions we reviewed met Commerce’s tourism-related program goals. And Village West’s Legends retail area drew a significant number of visitors. This is probably because these attractions are relatively unique within Kansas and the region.

- Heartland Park, the Kansas Speedway, and the Underground Salt Museum likely drew visitors from out-of-state and far away because they’re not available in many other places. For example, in 2018-2019, Heartland Park hosted national racing events. Of the states in the region, only Colorado and Illinois held similar events in these years. And the Underground Salt Museum is the only museum of its kind in the western hemisphere.

- The Village West Legends retail area likely drew large visitor numbers because it’s a major shopping center surrounded by other significant attractions, like the Kansas Speedway. It’s also located in a populous metro area that includes one of Missouri’s largest cities.

STAR bond attractions likely provide local benefits, but that doesn’t satisfy the program’s unique purpose of stimulating the Kansas economy through tourism.

- Current STAR bond attractions likely have value from a local perspective. They enhance the local quality of life by providing new amenities. And they may stimulate local jobs, capital investment, and local governments’ tax revenues. These may in turn stimulate additional economic effects for the local area.

- But local amenities that don’t draw many out-of-state visitors are less likely to produce new economic activity and tax revenue for the state.

- Economic research suggests local visitors are generally likely to shift existing economic activity from one part of Kansas to another. It also suggests people likely spend similar amounts on entertainment regardless of where they do so. For example, a family who visited the Wichita Sports Forum probably would have visited other Kansas attractions even if the Sports Forum hadn’t been built. The STAR bond attraction likely didn’t cause them to spend money in Kansas when they otherwise wouldn’t.

- This may be true even for visitors to Kansas City-area attractions who come from the Missouri side of the metro area, but this is less clear. For example, if the Overland Park Prairiefire area hadn’t been built, it’s possible the Missouri visitors would have visited other entertainment areas in Kansas instead.

- Many current STAR bond attractions may help improve the general and economic welfare of Kansas communities. This is an important part of the program’s statutory goal. But STAR bonds’ focus on developing the Kansas economy through tourism is what sets it apart from other incentives. Primarily drawing local visitors and providing local benefits doesn’t seem to satisfy the intent of the STAR bonds program.

We estimate it will take decades for the state to recoup the sales tax revenue it gave up for 3 STAR bond districts we evaluated.

The state gives up new tax revenues to pay for STAR bonds and will retain those revenues once the bonds are repaid.

- STAR bond attractions are located within a larger geographic area, called a district. A district can include other new or existing businesses in addition to the STAR bond attraction.

- The state gives up sales tax revenue from the entire district to pay off the bonds, which generally must be done in 20 years by state law. In practice, state rather than local revenue repays most bond debt.

- For districts that only include new businesses, the state gives up all tax revenue until the bonds are retired.

- For districts that also include existing businesses, the state gives up new tax revenue until the bonds are retired. New tax revenue is the sales tax the district generated above the amount it generated the year before the district was established. This is called a baseline. The baseline requirement was added to state law (K.S.A. 12-17,162(dd)) in 2007.

- After the bonds are retired, the state gains all the tax revenue from the STAR bond district.

We reviewed 3 STAR bond districts to estimate how long it will take the state to recoup the sales tax revenue it gave up supporting them (break-even).

- The 3 STAR bond districts we evaluated were the Hutchinson Underground Salt Museum, Overland Park Prairiefire, and Wichita Sports Forum districts.

- We chose these 3 because they’re typical STAR bond districts. They also vary in terms of size, attraction type, and bond repayment progress. Thus, their experiences are likely generally indicative of other attractions’. Appendix B more fully describes our methodology.

- We excluded Village West largely because it’s unlike other STAR bond districts. It’s the largest by far, accounts for almost two-thirds of all STAR bonds issued, and isn’t representative of other STAR bond projects.

- We reviewed these districts’ financial data starting with their bond issuance dates. This included their bond principal and interest amounts and the sales and use taxes they’ve generated. We used regressions to estimate what they’ll generate in the future. We also incorporated StreetLight data estimating these districts’ 2018-2019 out-of-state visitation.

- Our analysis excludes income and property tax revenues because they’re minimal for the state compared to these districts’ bonds. For example, the state’s share of these areas’ property taxes is about 1%. This excludes the uniform statewide 20-mill property tax levy, which the state doesn’t retain as revenue. It’s returned to school districts as part of their State Foundation Aid.

- Several important assumptions significantly impacted our analysis. We describe these assumptions in more detail after the results.

- We assumed only out-of-state visitors bring in new revenue for the Kansas economy. Local visitors are likely only shifting existing economic activity and tax revenue from one part of Kansas to another. This may not be the case for certain local visitors. But we think it’s a reasonable general assumption to use for our analysis.

- We assumed only development that happened because of STAR bonds brings in new revenue for the Kansas economy. In most districts, at least some development would’ve happened even without STAR bond financing. Related tax revenues can’t be fairly attributed to the program.

- We calculated how long it would take for the state to break even starting at the point at which each district’s bonds are repaid. So far, only Hutchinson has fully repaid its bonds.

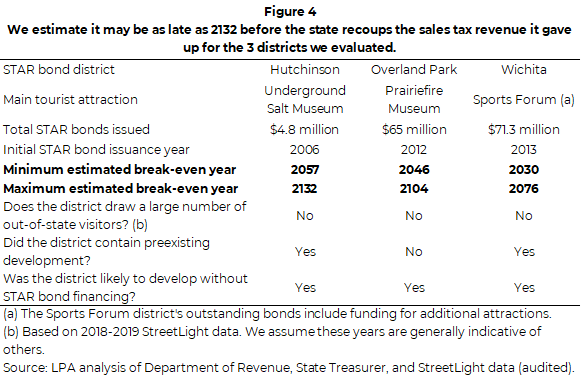

We estimate it will take decades for out-of-state visitor revenues to make up for the tax revenue the state gave up for these 3 districts.

- Hutchinson retired its STAR bonds in 2013. We estimate it might take the state between 43 and 118 years after that to break even, as shown in Figure 4. This estimate was affected by the following factors:

- As Figures 2 and 3 show, the Underground Salt Museum gets few out-of-state visitors each year. So, it doesn’t generate much new sales tax revenue.

- Many of the businesses in the district also existed before STAR bonds. That means the state would’ve gained much of the sales tax revenue even without STAR bond financing.

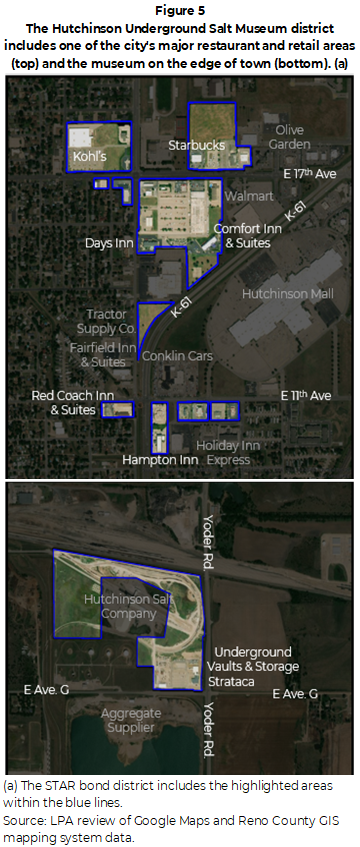

- The district likely would’ve developed similarly without STAR bonds. As Figure 5 shows, the Underground Salt Museum is a small attraction in an industrial area on the edge of town. It’s unlikely the museum meaningfully impacted the development of one of Hutchinson’s main restaurant and retail areas. This area is separate from the museum and was partially developed already.

- We estimate Overland Park may generate enough sales tax revenue to retire its STAR bonds by 2032. We estimate it might take the state between 13 and 71 years after that to break even, as shown in Figure 4. This estimate was affected by the following factors:

- As Figures 2 and 3 show, the Prairiefire Museum gets a modest number of visitors from outside the state each year. So, it doesn’t generate much new sales tax revenue.

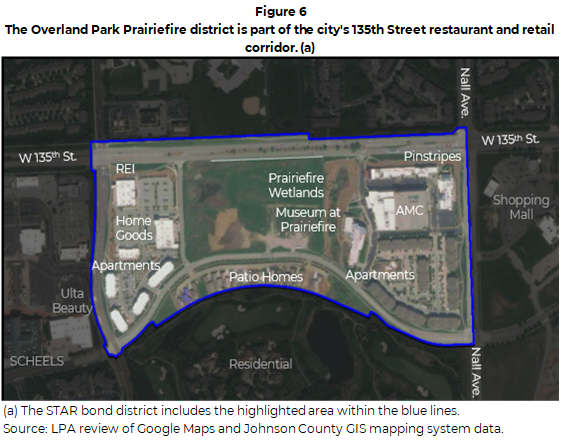

- But most importantly, the district likely would’ve developed without STAR bonds. The Prairiefire district was an undeveloped area before its bonds. But Overland Park officials said this area likely would’ve developed without STAR bond financing at some point. It’s part of the city’s 135th Street restaurant and retail corridor, as Figure 6 shows. We assumed it would’ve developed similarly to the rest of this corridor by 2025 and generated sales taxes like it does now. It’s possible the district may have developed differently (e.g. primarily office space) and generated little or no sales tax. But neither we nor Overland Park officials can predict this with certainty.

- So, the state likely would’ve gained most or all of the sales tax revenue in the district even without STAR bond financing. But this area’s development may have occurred later than it did with STAR bonds.

- We estimate Wichita may generate enough sales tax revenue to retire its STAR bonds by 2025 or 2027. We estimate it might take the state between 5 and 49 years after that to break even, as shown in Figure 4. As such, the Wichita Sports Forum district is likely the best state investment of the 3 we reviewed. These estimates were affected by the following factors:

- As Figures 2 and 3 show, the Sports Forum draws a modest number of out-of-state visitors each year. Most come from the Wichita area instead. So, it doesn’t generate much new state tax revenue.

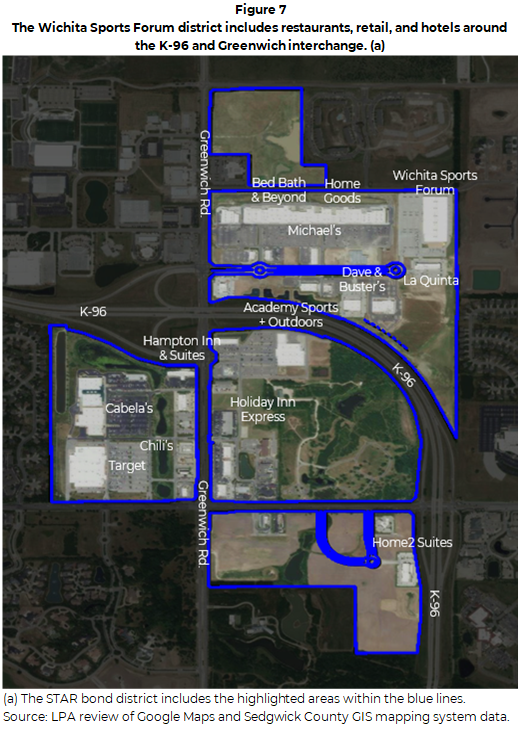

- Some of the businesses in the district also existed before STAR bonds. The Sports Forum district is highly developed, as Figure 7 shows. Many of its businesses existed before its bonds, including big box retailers like Target. That means the state would’ve gained some of the sales tax revenue even without STAR bond financing.

Our results are only estimates and would change based on different assumptions.

- Conducting this break-even analysis required us to predict what the 3 districts we reviewed might have looked like if STAR bonds hadn’t existed. It also required that we predict the choices people would make under these alternate scenarios. Any such assumptions are necessarily uncertain.

- We used economic research and our professional judgment to make reasonable assumptions. Using different assumptions would yield different outcomes. But they would also reflect different understandings of how people might behave.

- For example, we assumed only spending from out-of-state tourists represents new economic activity and tax revenue for Kansas. This may overestimate the state’s benefit because some out-of-state tourists would’ve visited Kansas even without the 3 attractions, for things like weddings or business.

- We did not include Kansan visitors as new spending. This may underestimate the state’s benefit because some local visitors may not have spent money in Kansas without the 3 attractions.

- We assumed only development that happened because of STAR bonds represents new tax revenue for Kansas.

- For Hutchinson and Wichita, we assumed all development that occurred after the creation of the STAR bond district happened because of STAR bonds. This may overestimate the state’s benefit because some of the development may have happened anyway.

- For Overland Park, we assumed none of the development happened because of STAR bonds. In other words, we assumed the Prairiefire area would have developed anyway, just later than it did with STAR bonds. This may underestimate the state’s benefit.

- Because our estimates are based on assumptions, readers should not focus on the estimated year projects may break even. They should instead view our results as an indication of whether these districts’ STAR bonds are good state investments.

For these 3 projects, using STAR bonds shifted significant private and local government costs to the state.

- We interviewed stakeholders from the Hutchinson Underground Salt Museum, Overland Park Prairiefire, and Wichita Sports Forum districts to understand their views on STAR bonds. We talked to developers, a former Kansas legislator, and current and former city and Chamber of Commerce officials.

- These interviews suggest these stakeholders focused at least partially on using STAR bonds to finance local amenities that couldn’t attract enough private funding.

- The Sports Forum developer told us that attraction wouldn’t have been financially feasible without STAR bonds. He said it wouldn’t have generated enough revenue on its own to cover its costs. Further, Wichita officials said Cabela’s expressed interest in opening a store in the K-96 and Greenwich area. But the company required a full highway interchange. City officials saw STAR bonds as a way to help finance the interchange for Cabela’s, in addition to helping finance the Sports Forum. Using STAR bonds shifted significant private and local government costs to the state.

- The Prairiefire Museum developer told us he couldn’t have built the museum without STAR bonds. He said its cost exceeded the district’s projected rent revenue. He’d tried unsuccessfully to raise private funds before turning to STAR bonds. Doing so shifted much of the district’s costs to the state.

- A former Reno County Chamber of Commerce official said the Underground Salt Museum may have been viable without STAR bonds. But the Reno County Historical Society had exhausted the available private funding. He said the museum opened when it did because STAR bonds shifted much of its costs to the state.

Conclusion

The STAR bonds financing program is a major economic development tool for Kansas and has provided more than $1 billion in financing for development and redevelopment projects since it began. And although STAR bond projects likely benefit their local communities (e.g. through job creation and local tourism), most don’t draw a lot of out-of-state tourists to Kansas. That significantly limits their ability to generate new revenues for the state. Local tourist attractions clearly have value, but legislators will have to consider the extent to which they’re willing to have the state finance these projects through STAR bonds.

Recommendations

- The Department of Commerce should use STAR bond districts’ visitation data to evaluate whether the STAR bonds financing program is meeting its goals and shape future decisions about whether to approve proposed attractions.

- The Department of Commerce agrees that better visitor tracking capability and data is a key component of assessing the effectiveness of STAR bond projects. This type of data will be a factor in evaluating requests for STAR bond financing. We look forward to working with vendors engaged through the current RFP process to establish effective and reliable visitor data.

- The Kansas Legislature should consider amending statute to clarify the STAR bonds financing program’s goals. This might include specific benchmarks for program success. Or it might include broadening its purpose to support using it for primarily local amenities.

Agency Response

On March 24, 2021, we provided the draft report to the Departments of Commerce and Revenue. We also provided it to the cities of Hutchinson, Overland Park, and Wichita. Commerce, Overland Park, and Wichita officials provided feedback. We made both minor and major changes based on this feedback. This includes changes to some of our findings and conclusions.

We provided a final draft report to the same agencies and cities for final review on July 12, 2021. Commerce and Overland Park chose to respond to the audit. Their responses are below. In their responses, they disagreed with the scope of our work and some of the assumptions we used. This disagreement reflects our remaining differences after the changes we made based on their initial feedback. We reviewed their concerns but chose not to make additional changes for the reasons described below.

- Commerce contends our evaluation should have considered other aspects of legislative intent, such as “general and economic welfare.” We agree these other aspects could be useful to evaluate. But because we had limited time, we chose to focus on tourism because that’s what sets STAR bonds apart from other economic development incentives.

- Commerce contends StreetLight data aren’t reliable to estimate visitation. We acknowledge StreetLight’s data are imperfect and can’t be used to determine exact visitor numbers. But we conducted data reliability and concluded the data provide reasonable estimates. We’re also confident they accurately show the proportions of visitors who came from outside Kansas and over 100 miles away based on our review of StreetLight’s methodology and conversations with StreetLight officials. Finally, Commerce didn’t suggest alternatives to StreetLight beyond the attractions’ incomplete, self-reported information.

- Commerce contends our break-even analyses should have included the Village West district. We excluded this district from our break-even analysis because it isn’t generally representative of the program. We also limited our break-even assumptions and conclusions to the 3 STAR bond districts we reviewed, not the program’s overall fiscal effects.

- Commerce and Overland Park disagree with some of our break-even analysis assumptions, such as what activity generates new state spending or may have occurred without STAR bonds. We stand by our assumptions and methods for two main reasons. First, we think our assumptions are reasonable because they’re based on economic research and are tailored to our understanding of each individual district we reviewed. Second, although Commerce and Overland Park question those assumptions and methodologies, they don’t offer alternative solutions. We agree different analysts may have used different assumptions, which likely would’ve yielded different results.

Department of Commerce Response

STAR Bonds are a very important economic development tool and deserve objective, careful and thorough review and analysis. The Department of Commerce (Commerce) appreciates LPA’s professionalism, thoroughness and willingness to engage in discussion during this STAR Bond audit. While acknowledging both the need and importance of this review by LPA, Commerce is concerned that this audit:

- fails to consider the full scope of legislative intent when evaluating STAR Bonds;

- fails to review the most successful STAR Bond projects; including Village West –which alone remits more sales tax to the State General Fund (SGF) than the amount of sales tax “foregone” by the state and applied to debt service for all other STAR Bond projects combined;

- uses a series of flawed assumptions and methodologies.

While we appreciate LPA’s willingness to engage and discuss these issues, the audit’s assumptions, flawed methodologies and limited scope of review resulted in the audit missing an opportunity to provide a more comprehensive review of the program.

Commerce believes we must look at each issue raised by LPA, explain our concerns, and discuss why a different approach is needed if we are going to truly understand the value of STAR Bonds to the state.

LEGISLATIVE INTENT AND VISITATION

LPA FINDING – Only 3 of the 16 STAR Bond attractions we reviewed drew enough visitors from far enough away to meet Commerce’s tourism-related program goals.

Commerce agrees with LPA that tourism is an important component of STAR Bond projects. However, Commerce also contends the “general and economic welfare” of the state is a critical statutory goal of the program and was generally overlooked.

LPA overemphasizes and limits its focus to the relatively narrow tourism-related goals of STAR Bonds.

K.S.A. 12-17,160 states the purpose of this act is “to promote, stimulate and develop the general and economic welfare of the State of Kansas, including Kansas communities.” The Legislature clearly intended to promote both the “general” as well as the “economic” welfare of the state. LPA places disproportionate weight on certain goals while not giving much attention to other statutory goals. For example, LPA doesn’t fully discuss the general welfare and economic welfare of Kansas and how these projects provide the quality of life, sense of place, cultural and public benefits envisioned by the Legislature. Rather, LPA focuses on a narrow interpretation of legislative intent and statutory goals.

LPA focuses predominately on its own notion of “economic welfare” and assigns too much weight to certain visitation guidelines in reaching its conclusion that only a limited number of projects have met legislative intent. The analysis is limited to only one of the metrics used by Commerce to review and analyze STAR Bond projects. Rather than provide an accurate and comprehensive perspective of how Commerce evaluates projects, LPA focuses on certain visitation metrics and doesn’t fully address legislative intent and other statutory goals. For example, LPA doesn’t develop the fact Commerce has promulgated regulations that provide criteria to assist Commerce in reviewing and analyzing STAR Bond projects. LPA failed to even reference those criteria in its report. K.A.R. 110- 9-6 provides a list of 17 criteria used by Commerce to review projects including:

The following criteria shall be utilized by the secretary to determine whether a proposed project constitutes a major commercial entertainment and tourism area:

a. Visitation, which shall include the following:

- out-of-state visitation;

- visitation drawn from more than 100 miles distant from the community where the proposed project would be located; and

- the total annual visitation.

The regulations provide formal guidance to cities and developers as to the visitation attributes Commerce considers when evaluating potential projects. However, visitation is only one criteria used to evaluate projects and the other criteria aren’t adequately considered by LPA.

Moreover, ignoring the practical differences between Atchison and Wichita, LPA lumps together all STAR Bond projects in its interpretation of statutory goals. Notwithstanding that the Legislature established separate and, in some instances, lesser standards for projects in non-metro areas, LPA appears to view each project through the same lens.

For example, the Legislature approved the Kansas Speedway in Wyandotte County and Heartland Park in Topeka fully aware they were not year-round visitor draws. Those facilities also serve as venues for local events to cover costs. However, even though it is clear the STAR Bond program was intended for a variety of projects including projects that were built for certain types of events, LPA primarily relied on a year-round tourism perspective in its findings. Failure to fully discuss the full context for these projects creates a flawed basis for analysis by LPA. (K.S.A. 12-17,162).

While robustly analyzing and discussing certain tourism-related attributes of STAR Bond projects, LPA failed to adequately evaluate the job creation, quality of life and the general public welfare goals and benefits of the program. If the intended goal of STAR Bonds is that these projects should draw visitors from across Kansas and from out-of-state, then each of the projects reviewed by LPA has met statutory intent. This is established by Figure 2 on page 9 of the report. The over emphasis by LPA on the aspirational visitation goals, as compared to the legal requirements of the Act, both short-changes Commerce’s review process as well as the many benefits these projects have on the quality of life in Kansas.

It is unclear why the projects selected for review excluded the Village West projects which have been tremendously successful. In order to present a fair and balanced perspective on STAR Bonds, Village West provides over $40 million in sales tax to the state general fund every year; has created several billion dollars of private investment; and created tens of thousands of jobs. Village West’s record of improving both the economy and the general welfare of Wyandotte County and the state as a whole is beyond dispute. In fact, the Village West project returns more state sales tax to the SGF than the amount of state sales tax “foregone” by the state and applied to debt service for all other STAR Bond projects across the state!

Flawed Methodology

To estimate visitation numbers LPA used Streetlight, a program built to track transportation patterns. Streetlight only works if a person has their cell phone location services turned on. Various estimates show this means anywhere from 10-20 percent of the adult population are not counted. The number expands when you consider children who typically do not carry a phone. Therefore, children who may visit an attraction with their parent or on a school field trip are not counted by Streetlight. This leads to drastic differences in the number Streetlight claims compared to the number that is representative of actual visitors.

Streetlight, and consequently LPA, cannot provide a reliable number of the people it can’t account for in each specific STAR Bond project, let alone their location of origin. In other words, they have no estimate of how many people are being missed. Even Streetlight, in its own webinar discussing the product, states the limitations in trying to track individuals and the need to utilize subjective means to address the shortfall in specific data. While LPA, to its credit, references this flaw in tracking visitation, Commerce is concerned the visitation numbers will be taken out of context.

Notably, the visitation numbers cited by LPA vary significantly from those reported by the actual attractions. For example, the Manhattan Flint Hills Discovery Center reported over 70,000 visitors in 2019 and LPA reports approximately 30,000. Similar significant variances exist for Wichita Sports Forum and other STAR Bond attractions. These statistically significant variances in visitor data aren’t fully explained by Streetlight or LPA.

All Projects Meet Statutory Criteria for Eligibility

The Legislature has approved each category and type of eligible STAR Bond project. This specifically includes museums, which were so important to the Legislature it allowed STAR Bonds to be used for vertical construction costs at these attractions which provide quality of life and general public benefit. Commerce has at all times operated the program consistently with the Act. Each of the STAR Bond projects is unique in its own way and contributes to the economic vitality and quality of life in that community and across the state and region.

Almost as an aside, LPA theorizes that the local benefits produced by these projects are inconsistent with the intent of STAR Bonds. Again, this conclusion is at odds with the stated intent of promoting the general welfare of the state, even while LPA acknowledges projects provide new amenities, create local jobs and additional tax revenue for local governments. Most surprisingly, the report goes on to say some of these projects don’t produce new economic activity.

A clear fundamental misunderstanding from LPA is that local success does not equate to statewide success. State investment in our local communities, leading to more vibrant communities, is exactly what we want from a results perspective. Having local attractions, job creation, housing, etc., all lead to successful cities, which in turn lead to a successful state.

ERRONEOUS ASSUMPTIONS AND NARROW METHODOLOGY

LPA FINDING – We estimate it will take decades for the state to recoup the sales tax revenue it gave up for three STAR Bond districts we evaluated.

LPA’s determinations on how to evaluate the STAR Bond program are arbitrary and may lead to erroneous conclusions about the program. Among these flawed metrics are those around how to measure economic activity. While initially characterizing its scope as covering “fiscal impact” LPA later narrows this to consideration of sales tax revenues only and ignores the significant additional economic impacts created by STAR Bonds.

Rather than measure true economic activity, LPA chose to use a “break even” concept more commonly used for other purposes. Additionally, LPA relies on several unsubstantiated assumptions in its “break even” analysis. These critical assumptions include that only out-of- state visitors create new economic activity in Kansas; that much of the development around the STAR Bond attractions would have happened anyway; and that the STAR Bond attraction played little or sometimes no role in that development and economic activity.

The “break even” methodology is not found in the Act, not found in legislative intent and not found in any program materials. The “break even” analysis is based on only sales tax revenues rather than general economic activity, and consequently is very limited due to the flawed assumptions noted above. Based on that limited construct, LPA then offers significantly variable “projections” as to when these projects will “break even”. For example, the Hutchinson Salt Museum, will “break even” somewhere between 43 and 118 years. For Overland Park the spread is over 50 years! Relying on data supporting a potential variance of such magnitude brings into question the conclusions.

Notwithstanding LPA’s extremely narrow perspective of considering only sales tax revenues, from a higher-level perspective, the STAR Bond program is a net positive sales tax generator. The Village West project, which LPA chose not to study, returns more sales tax to the state than the state “forgoes” on STAR Bonds for every other project on an annual basis. Further, STAR Bond Districts have created tens of thousands of jobs, millions of dollars in state withholding taxes, increased property taxes and a plethora of other positive economic impacts.

Starting at pgs. 22-23, LPA seems to employ an arbitrary “test” for reviewing STAR Bond projects. While initially focusing on the tourism related aspects of the program, LPA then segues to an apparent “but for” test to consider whether development would have occurred in some of these areas regardless of STAR Bonds. This completely misses the point about the general purposes of STAR Bonds to create attractions and destinations. Among the most misleading of those assumptions is that much of the economic activity and development in certain STAR Bond project districts would have happened without the STAR Bond project. LPA contends many of the visitors to STAR Bond districts are merely shifting existing economic activity from one part of Kansas to another. The assumption is that much of the economic activity created by Kansas visitors to STAR Bond projects is merely shifted impact that would have occurred anyway elsewhere in the state. Extrapolating on this perspective, would the greenfields and brownfields of western Wyandotte County still have been developed; still be generating tens of millions of dollars of sales, property and payroll taxes for the state; still have created tens of thousands of jobs; and all of the other economic activity without STAR Bonds? Taken to the extreme, this assumption could result in a finding the $40 million plus in state sales tax being returned to the state each year by the Village West project isn’t “real” economic activity because it would have happened somewhere in Kansas regardless of STAR Bonds.

Also important is an understanding of how STAR Bonds really work and what state sales taxes are pledged to a project. Under the STAR Bond Act, the state forgoes future sales tax revenues in order to assist the financing of the attraction. To be clear, sales tax revenues pledged to projects are not sales tax revenues the state was collecting prior to the time the project comes into service. It is a legal requirement that only incremental sales tax growth is used to fund STAR Bond projects. (K.S.A. 12-17, 169)

STAR Bonds are funded solely by the sales tax growth each project creates. Unless one assumes that much of the economic growth generated by STAR Bond projects would have happened anyway (as LPA apparently does) then the actual fiscal impact of STAR Bonds leans more toward neutral as each project relies on new revenues from its own STAR Bond project district to pay debt service on the STAR Bonds. No project has defaulted on its bonds and the vast majority will pay off bonds prior to the end of the 20-year term. The sooner a project pays off its bonds, the sooner the state begins receiving new sales tax revenues it wasn’t receiving prior to the project.

LPA’s assertion that only out of state tax dollars should be factored into its analysis and that any current Kansas dollars spent within project districts should not be included in this analysis is incorrect. The state forgoes sales tax revenues that would not have existed in exchange for attraction development that creates major capital investment and income to the state over a long period of time. Additionally, LPA limits its “fiscal impact” analysis as if the only benefit to the state is through sales tax. This is another inaccurate assumption. STAR Bonds bring MAJOR capital investment that keeps our contractors and construction workers employed, creates thousands of full-time and part-time jobs, all of which contribute to the local economy. That capital investment also increases property tax revenue. LPA simply chose not to measure that impact.

Another major flaw in the LPA report is the erroneous assumption that all Kansans would have spent their tax dollars in the state, regardless of the STAR Bond attraction. This is not an accurate statement for multiple reasons. This tends to disregard the unique circumstances of the Greater Kansas City region, as people in Johnson and Wyandotte counties don’t simply stay in the state. For example, if people are interested in visiting the zoo, they have multiple options for both in-state and out of state zoos. Trying to frame tourism in this regard shows disregard of the industry, how it functions and how individuals frame their decision making. And finally, this assumption by LPA disregards the tremendous growth and economic opportunity created by youth traveling sports tournaments that aren’t dependent on where the participants live and provide tremendous economic impact.

Overland Park

Introducing an entirely new standard for STAR Bond projects, LPA contends this District would have developed regardless of STAR Bonds. Notwithstanding that this standard is nowhere to be found in the Act, LPA treats this contention as if it were an accepted barometer for analyzing a STAR Bond project. The conclusion seems to imply that STAR Bond projects, such as museums, are unnecessary if the area surrounding the attraction would have developed eventually regardless of the project. This is a wholly fabricated standard to which LPA holds this STAR Bond project and it ignores the cultural and public benefits of these projects.

Wichita Sports Forum

In yet another example of LPA potentially failing to accurately report the number of annual visitors, LPA finds the Wichita-based Wichita Sports Forum gets about half the visitors reported by the attraction. LPA reports 300,000 visitors and the attraction reports 600,000. In general, LPA’s visitor estimates vary drastically from those reported by the project operators. (Kansas Department of Commerce Annual STAR Bond Report for 2019)

LPA also states that since there was retail business in the K-96 Wichita district prior to the STAR Bond project, the state would have “gained some of the sales tax revenue even without STAR Bond financing”. However, the state does receive every dollar of sales tax revenue present at the time the district was created. By law, STAR Bond projects are funded only with incremental increases in sales taxes in districts with pre-existing retail.

LPA FINDING – These three districts seemed to use STAR Bonds to finance local amenities that didn’t attract enough private funding.

LPA also believes it noteworthy that these projects wouldn’t have been financially feasible if not for STAR Bonds. Albeit for the wrong reason, LPA is completely accurate with that finding. In fact, public financial support is a necessary component of the financial structure of every STAR Bond project. By definition, these projects would not have occurred but for STAR Bonds. Public financial support for these projects is the very genesis of the STAR Bond program. For example, western Wyandotte County was a greenfield/brownfield until STAR Bonds were used to absolutely transform the area and benefit the entire state. The Legislature limits state investment to less than 50% of a STAR Bond project and that percentage is typically much less. Consequently, these projects leverage large amounts of private capital. Each and every STAR Bond project, including Overland Park, Wichita Sports Forum and the Hutchinson Salt Museum, would not have happened without STAR Bonds. Each of the attractions included with those projects was authorized by the Act and meets the statutory intent.

SB 124

So where does that leave us? SB 124, which passed the Legislature and was signed into law by Governor Kelly on April 15, 2021, comprehensively addresses data and transparency needs related to STAR Bonds. Commerce is working with the Department of Administration on an RFP for vendors to provide feasibility studies, including visitor tracking. Projects are now also required to provide return on investment and economic impact projections. These reforms of the STAR Bond program will provide more scientifically-sound, reliable data needed by developers, local governments, Commerce and the Legislature to evaluate the performance of STAR Bond projects.

We believe SB 124 will provide meaningful reforms to the program based on what we have learned since the inception of STAR Bonds and make STAR Bonds an even more effective tool for growing the state and its communities. We believe this is shown in the 131 votes this bill received in both chambers this year.

We thank LPA for their time and work on this audit.

Sincerely,

David C. Toland

Lt. Governor and Secretary

City of Overland Park Response

Thank you for the opportunity to provide comments, corrections and clarifications to the performance audit titled, “STAR Bonds Financing Program.” The City appreciates the legislative post audit staff’s effort creating this audit report. However, the City believes some of the report’s assumptions are problematic and therefore its conclusions could be misleading. The City would like the Committee to consider the following points when it reviews the report:

- The report should not exclude the benefit of property taxes to the state. On page 13 the report states, “Our analysis excludes income and property tax revenues because they’re minimal for the state compared to these districts’ bonds” For example, the state’s share of these areas’ property taxes is about 1%.” At Prairiefire, the total 2020 mill levy was 112.766, of which 21.5 mills are remitted to the State (20 mills levied pursuant to K.S.A. 72-5142, the 1 mill levied pursuant to K.S.A. 76- 6b01, and the .5 mill levied pursuant to K.S.A. 76-6b04). This means the state’s share of Prairiefire’s property taxes is 19.07%, not “about 1%.” Article 6 of the Kansas Constitution, imposes a duty on the legislature to “make suitable provision for finance of the educational interests of the state.” Kan. Const. art. 6, § 6 (b). As explained in Gannon v. State, 402 P.3d 513 (2017), the property taxes remitted to the state are used by the state to meet its Constitutional obligation. Because that Constitutional obligation would remain regardless of whether the aforementioned property taxes were levied or not, we think the benefit of property taxes generated by STAR bond districts to the state should be included in the report. By excluding the benefits of property taxes based on the assumption that these taxes are “minimal for the state,” the report underestimates the state benefit of the Prairiefire STAR bond district.

- Although the report assumes that Prairiefire would have developed into a sales-tax generating development without STAR bond financing, it is not clear how much of the development would have been retail. The report notes several times that the Prairiefire district likely would have developed without STAR bond financing, which is probably true. However, the report seems to assume for the purposes of its cost-benefit/break-even analysis that the Prairiefire district would have developed into a project that produced comparable sales taxes, which is far from certain. For example, the current developer of the Prairiefire district purchased the property in 2007, one year before his initial request to the Overland Park City Council for STAR bond financing in order to finance construction of a mixed-use development. However, the previous owner owned the property while it was zoned for office, which of course would not have generated any sales taxes, but potentially could have generated income taxes (which the current development also generates). Therefore, it is questionable that, just because the district was likely to develop, it would have gained most of the sales tax revenue in the district even without STAR bond financing. This assumption cannot be verified and has a significant impact on the report’s “break-even” analysis on page 13, the underlying justification for excluding sales taxes generated by Kansans from the report’s “benefit” calculation, and other conclusions and assumptions throughout the report.

- The report does not appear to provide any basis for assuming Kansas City metro area Missouri residents would travel to Kansas regardless of whether STAR bond attractions were built or not. Both Prairiefire and the Village West attractions have met the Department of Commerce’s benchmarks for out-of-state visitors. However, page 11 of the report concludes that Kansas City-area STAR bond attractions don’t provide statewide economic benefits because visitors from the Missouri side of the metro area may have spent money at other Kansas retailers if the STAR bond attraction had not been built. We are not aware of any data or studies used in the basis for this assumption, and believe the report is undervaluing the impact that Kansas attractions have in attracting Missouri residents to the Kansas side of the metro area. Similarly, the report does not take into account that STAR bond attractions on the Kansas side of the metro area may cause Kansans to generate sales taxes in Kansas that they would otherwise possibly generate in Missouri. The assumption used in the study only holds true if the major attractions (like STAR bond attractions) in the Kansas City metro area are on both the Kansas and the Missouri side. A more realistic approach may be to allocate a reasonable percentage of lost revenue, rather than completely exclude sales taxes generated by Kansans from the analysis.

Sincerely,

Bill Ebel

City Manager

Appendix A – Cited References

This appendix lists the major publications we relied on for this report.

- A Spatial Extension to a Framework for Assessing Direct Economic Impacts of Tourist Events (January, 2012). Timothy J. Tyrrell and Robert J. Johnston.

- Mental Accounting Matters (July, 1999). Richard H. Thaler.

Appendix B – Break-Even Methodology

This appendix outlines our methodology for calculating the STAR bonds financing program’s fiscal impact. For this analysis, we evaluated 3 typical districts. These include the Hutchinson Underground Salt Museum, Overland Park Prairiefire, and Wichita Sports Forum districts.

We used tax revenue data to determine how much these districts generate in taxes each year.

- We gathered these districts’ sales tax revenue data from the Kansas Department of Revenue. We also used Kansas State Treasurer data to determine how much of their bonds had already been repaid.

- We used these data to project these 3 districts’ future tax revenue. Our method differed slightly for each district depending on its actual revenue generation.

- Since they developed recently, we estimated upper and lower bounds for Overland Park and Wichita. Our lower bounds assume these districts will remain at their current levels of development. But inflation will increase the revenue they generate. We used the Consumer Price Index for past years’ inflation rates. And we used the Social Security Administration’s assumption of 2.4% future inflation.

- For Overland Park’s upper bound, we assumed about 30% additional development in the district. We based this on our estimation of the size of the district’s undeveloped area. Overland Park officials said this area is under development.

- For Wichita’s upper bound, we assumed logarithmic future growth. This would reflect the district continuing to develop indefinitely at its observed rate. It would also help account for attractions planned to be built in this district.

- For Hutchinson’s estimate, we assumed only linear future growth. We didn’t create upper and lower bounds for Hutchinson. This would reflect the district continuing to develop indefinitely at its observed rate. We think it’s existed long enough for its actual development to predict its future reasonably accurately.

We compared our tax revenue estimates to these districts’ bond amounts to determine how long it’ll take to retire their bonds.

- Hutchinson retired its STAR bond in 2013. But as of February 2021, Overland Park and Wichita’s bonds are not yet repaid. Statute (K.S.A. 12-17,164(g)) requires repayment of these districts’ bonds within 20 years. But we assume these cities would repay them sooner if possible. This would save them interest.

- We used our future tax projections to estimate when Overland Park and Wichita will retire their bonds.

- This is when the state will start collecting its full share of the taxes these districts generate. It’s when the state starts gaining revenue from spending in the districts.

- We compared our projections to these districts’ outstanding bonds, including interest. We also accounted for revenue already collected and waiting to go to the bondholders.

- We assume Overland Park will stop repaying Prairiefire’s bonds in 2032, when they’re scheduled to be retired. This may be overly optimistic because Prairiefire isn’t generating enough tax revenue to make its bond payments. But our analysis gave the district the benefit of the doubt.

- We estimate the Wichita Sports Forum district will generate enough revenue to repay its bonds early. It may be able to do so in 2025 or 2027.

Our state cost estimates reflect the revenue the state is giving up during the districts’ bond repayment periods.

- During bond repayment, the state gives up at least some of the revenue it would otherwise collect from these districts. Generally, this includes the new revenue the districts generate during the repayment period. For Hutchinson and Wichita, this also includes lost revenue from the businesses that pre-existed the STAR bond district.

- But some of these districts’ new development would’ve happened without STAR bonds. This development didn’t need STAR bonds. The state didn’t need to give up tax revenue to help finance something that would’ve happened anyway. So, the state isn’t gaining new revenue from this kind of development that it wouldn’t have gotten otherwise. This tax revenue isn’t a program-related benefit for the state.

- Our method for estimating these districts’ costs to the state differed slightly for each district. We based it on each district’s pre-existing development. And we considered how these districts might’ve developed without STAR bonds. Whenever possible, we underestimated the cost to the state to give the program the benefit of the doubt.

- For Hutchinson, we assume only pre-existing development would’ve existed without STAR bonds. Because Hutchinson created its district prior to 2007, it didn’t include a baseline. All existing revenue from the district went toward retiring its bond during its repayment period, so the state stopped getting revenue it had previously received. We used the taxes this development generated in 2007, adjusted for inflation. We estimate the state lost about $4 million during 2007-2013.

- For Wichita, we assume only pre-existing development would’ve existed without STAR bonds. The state collects a baseline tax revenue amount from this district to reflect this development. But it’s not adjusted for inflation. As prices go up over time, the amount the state gets stays the same. So, its value erodes over time, costing the state during the bond repayment period. We estimate the state will lose about $4-$6 million during 2014-2027.

- For Overland Park, we assume something like the actual development would’ve happened without STAR bonds. Overland Park stakeholders told us the area likely would’ve developed anyway. They didn’t know if that development would generate sales tax revenues like Prairiefire currently does, but we assumed it would. We think it’s likely the district would include similar restaurant and retail development (and similar tax revenues) because it’s in Overland Park’s 135th Street corridor. Prairiefire developed in 2015. So, we used 2021 and 2025 in our estimates of this district’s development without STAR bonds. We assumed a development trajectory like the district’s actual development, adjusted for inflation. We removed the Prairiefire Museum’s estimated revenue, assuming it wouldn’t have existed without STAR bonds. We estimate the state will have foregone about $18-$29 million during 2012-2032.

Our state benefit estimates reflect out-of-state visitors’ spending, in alignment with the program’s goal of stimulating the Kansas economy through tourism.

- After STAR bond repayment, the state begins collecting its full share of the tax revenue districts generate. But only out-of-state visitors bring new money to the state. Kansans who visit STAR bond districts are likely shifting existing spending to a new area. This doesn’t reflect new economic activity or tax revenue for the state.

- So, our estimates of the districts’ benefits to the state reflect only out-of-state visitors. Whenever possible, we overestimated the benefit to the state to give the program the benefit of the doubt.

- We estimated upper and lower bounds for each district. We based them on StreetLight visitation data for 2018-2019. We assume these years are generally representative of others. These data showed us how many of each district’s visitors came from outside Kansas. We applied upper and lower bound percentages to the districts’ tax revenue based on these data.

- The lower bound percentage reflects out-of-state visitors to each district’s tourist attraction. We assume the attractions drew out-of-state visitors who otherwise wouldn’t have visited Kansas. This overestimates the state’s benefit from STAR bonds, though. Some of these visitors likely came to Kansas for other reasons, such as business or a family event. They would’ve visited the state even if the attraction hadn’t been built.

- The upper bound percentage reflects out-of-state visitors to the entire district. We limited this estimate to what we assume wouldn’t have been built without STAR bonds. This also overestimates the state’s benefit from STAR bonds. Again, some of these visitors likely came to Kansas for things other than the district. They likely would’ve visited even if the district hadn’t existed. And some of the development we attribute to the program probably would’ve happened anyway.

- We didn’t treat visitors from the Missouri side of the Kansas City metro area differently from other out-of-state visitors. In reality, we think these visitors may have spent money at other Kansas retailers if the Kansas City-area STAR bond attractions they visited hadn’t been built. This would mean their spending may not be new economic activity and revenue for the state. But to give the program the benefit of the doubt, we didn’t include this assumption in our analysis. This likely overestimates the benefit to the state.

- We used these upper and lower bounds to calculate the new Kansas sales and use tax revenue each district generated or will generate. We calculated this for the first year after its bonds are repaid. Based on this analysis, we estimate:

- Hutchinson generated between about $8,000 and $30,000 in 2014.

- Overland Park will generate between about $150,000 and $1 million in 2033.

- Wichita will generate between about $70,000 and $1 million in 2026.

- We assume these years are generally representative of others. We adjusted these values for inflation going forward from these years.

- Our state benefit calculations excluded property tax revenues. That’s because these are minimal for the state and likely would’ve existed without STAR bonds.

- Property taxes generally benefit local governments and school districts instead of the state. The state primarily relies on income and sales taxes for revenue. But it gets a small portion in property taxes through a statutory 1.5 mill levy for two state building funds. Even though property taxes for schools are assessed through a statewide 20 mill levy, the resulting property taxes generally return to local school districts rather than stay with the state. As such, we didn’t include property taxes in our estimates.

- Including property tax revenues would minimally affect our calculations because much of it couldn’t be attributed to STAR bonds. Any development that might have happened in these 3 districts without STAR bonds would also be subject to property tax. For example, we assume something like the actual Prairiefire development would’ve happened without STAR bonds. If so, this area would’ve generated property tax revenues even without the program.

- Finally, our state benefit calculations exclude income tax revenues, too. That’s because the annual amounts we estimated these 3 districts generated were minimal in the years we reviewed compared to their bond amounts. We estimated Hutchinson generated about $700,000 per year, but this district had significant pre-existing development. So, much of this isn’t attributable to STAR bonds. We estimated that Wichita and Overland Park each generated less than $150,000 each year.

- We compared each district’s total costs and annual benefits to the state to determine their break-even points. We projected our calculations into the future until the state’s costs are fully recovered for each district.